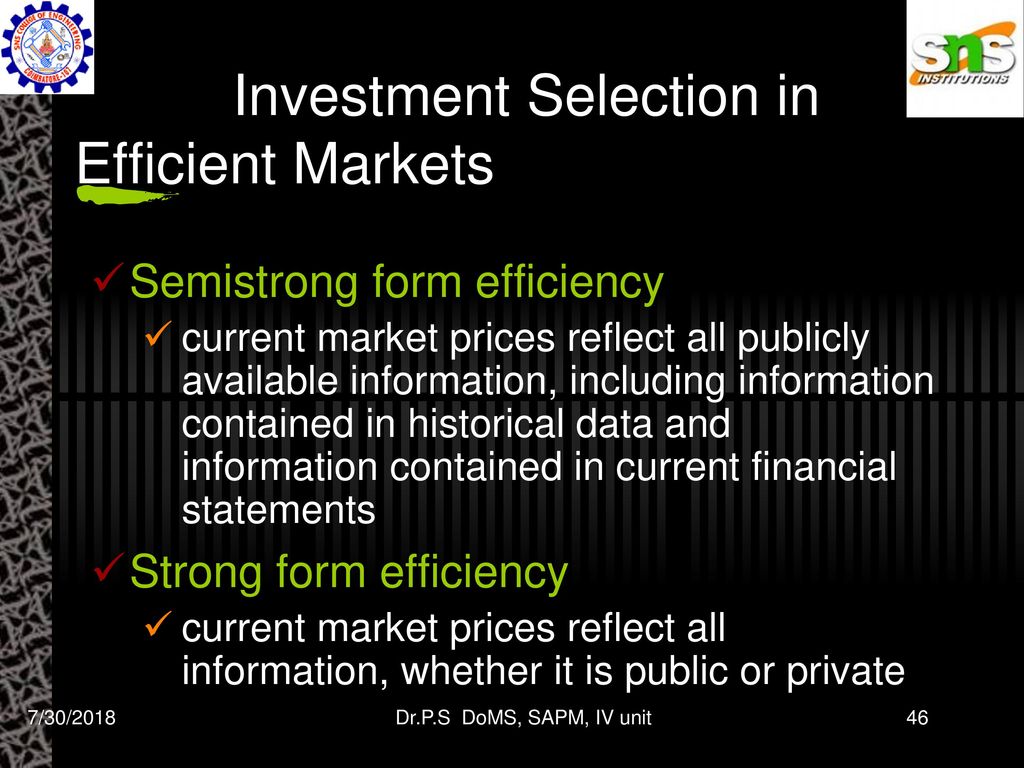

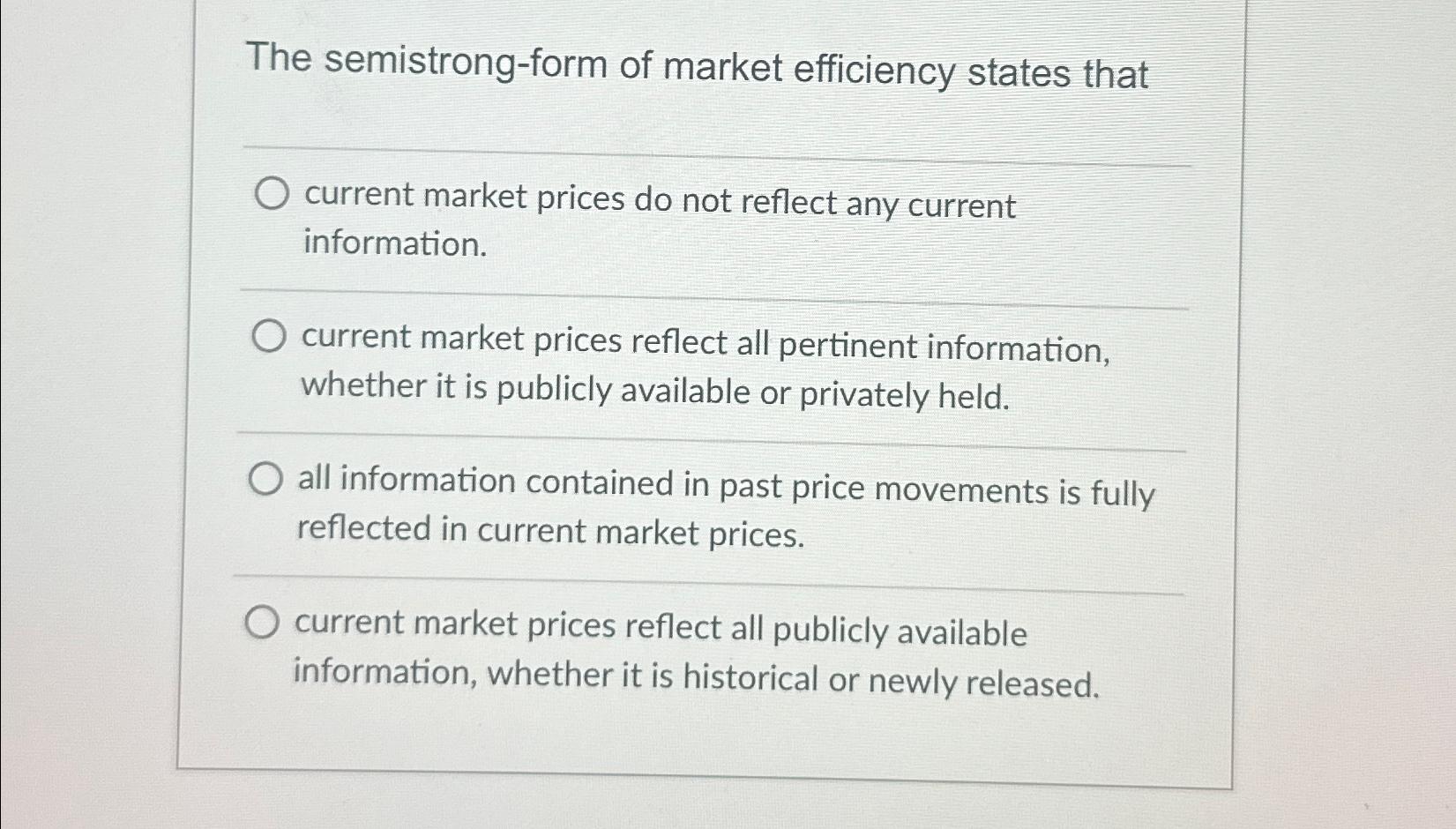

Current Market Prices Reflect All Relevant Publicly Available Information - Current market prices reflect all information contained in past price movements. Finacial theorists have identify three levels of. The question of whether current market prices reflect all relevant publicly available information is a core consideration in. The strong form of the emh holds that current market prices reflect all information (whether publicly available or privately held) that can be. Half of the homes are listed below. The efficient market hypothesis (emh) is an investment theory that states asset prices fully reflect all relevant and available. This is the middle price for all homes actively listed in an area broken out by the number of bedrooms. If the markets are efficient, they will react rapidly as new relevant information becomes available.

This is the middle price for all homes actively listed in an area broken out by the number of bedrooms. The question of whether current market prices reflect all relevant publicly available information is a core consideration in. The strong form of the emh holds that current market prices reflect all information (whether publicly available or privately held) that can be. Finacial theorists have identify three levels of. Current market prices reflect all information contained in past price movements. If the markets are efficient, they will react rapidly as new relevant information becomes available. The efficient market hypothesis (emh) is an investment theory that states asset prices fully reflect all relevant and available. Half of the homes are listed below.

The strong form of the emh holds that current market prices reflect all information (whether publicly available or privately held) that can be. The question of whether current market prices reflect all relevant publicly available information is a core consideration in. This is the middle price for all homes actively listed in an area broken out by the number of bedrooms. The efficient market hypothesis (emh) is an investment theory that states asset prices fully reflect all relevant and available. If the markets are efficient, they will react rapidly as new relevant information becomes available. Half of the homes are listed below. Current market prices reflect all information contained in past price movements. Finacial theorists have identify three levels of.

Market Efficiency and Behavioral Finance ppt download

The strong form of the emh holds that current market prices reflect all information (whether publicly available or privately held) that can be. The question of whether current market prices reflect all relevant publicly available information is a core consideration in. Half of the homes are listed below. This is the middle price for all homes actively listed in an.

1 Market Efficiency and Performance Evaluation Global Financial

Finacial theorists have identify three levels of. The efficient market hypothesis (emh) is an investment theory that states asset prices fully reflect all relevant and available. The strong form of the emh holds that current market prices reflect all information (whether publicly available or privately held) that can be. Half of the homes are listed below. This is the middle.

Chapter 7 Stocks and Stock Valuation. © 2013 Pearson Education, Inc

If the markets are efficient, they will react rapidly as new relevant information becomes available. This is the middle price for all homes actively listed in an area broken out by the number of bedrooms. The efficient market hypothesis (emh) is an investment theory that states asset prices fully reflect all relevant and available. The question of whether current market.

Chapter 10 Market Efficiency. ppt video online download

The efficient market hypothesis (emh) is an investment theory that states asset prices fully reflect all relevant and available. Half of the homes are listed below. The strong form of the emh holds that current market prices reflect all information (whether publicly available or privately held) that can be. The question of whether current market prices reflect all relevant publicly.

The Efficient Market Hypothesis ppt download

Current market prices reflect all information contained in past price movements. Half of the homes are listed below. The strong form of the emh holds that current market prices reflect all information (whether publicly available or privately held) that can be. This is the middle price for all homes actively listed in an area broken out by the number of.

Ch 5. Basic Stock Valuation. 1. Legal rights and privileges of common

The strong form of the emh holds that current market prices reflect all information (whether publicly available or privately held) that can be. Current market prices reflect all information contained in past price movements. Half of the homes are listed below. This is the middle price for all homes actively listed in an area broken out by the number of.

F Chapter 17 FUNDAMENTAL ANALYSIS vs TECHNICAL ANALYSIS 7/30/ ppt download

Current market prices reflect all information contained in past price movements. If the markets are efficient, they will react rapidly as new relevant information becomes available. The question of whether current market prices reflect all relevant publicly available information is a core consideration in. Half of the homes are listed below. This is the middle price for all homes actively.

Solved The semistrongform of market efficiency states

The strong form of the emh holds that current market prices reflect all information (whether publicly available or privately held) that can be. Finacial theorists have identify three levels of. This is the middle price for all homes actively listed in an area broken out by the number of bedrooms. If the markets are efficient, they will react rapidly as.

MARKET EFFICIENCY The concept of Market Efficiency ppt download

This is the middle price for all homes actively listed in an area broken out by the number of bedrooms. The strong form of the emh holds that current market prices reflect all information (whether publicly available or privately held) that can be. Half of the homes are listed below. The question of whether current market prices reflect all relevant.

MARKET EFFICIENCY The concept of Market Efficiency ppt download

The question of whether current market prices reflect all relevant publicly available information is a core consideration in. Finacial theorists have identify three levels of. The efficient market hypothesis (emh) is an investment theory that states asset prices fully reflect all relevant and available. If the markets are efficient, they will react rapidly as new relevant information becomes available. The.

Current Market Prices Reflect All Information Contained In Past Price Movements.

The efficient market hypothesis (emh) is an investment theory that states asset prices fully reflect all relevant and available. The question of whether current market prices reflect all relevant publicly available information is a core consideration in. Half of the homes are listed below. If the markets are efficient, they will react rapidly as new relevant information becomes available.

Finacial Theorists Have Identify Three Levels Of.

This is the middle price for all homes actively listed in an area broken out by the number of bedrooms. The strong form of the emh holds that current market prices reflect all information (whether publicly available or privately held) that can be.