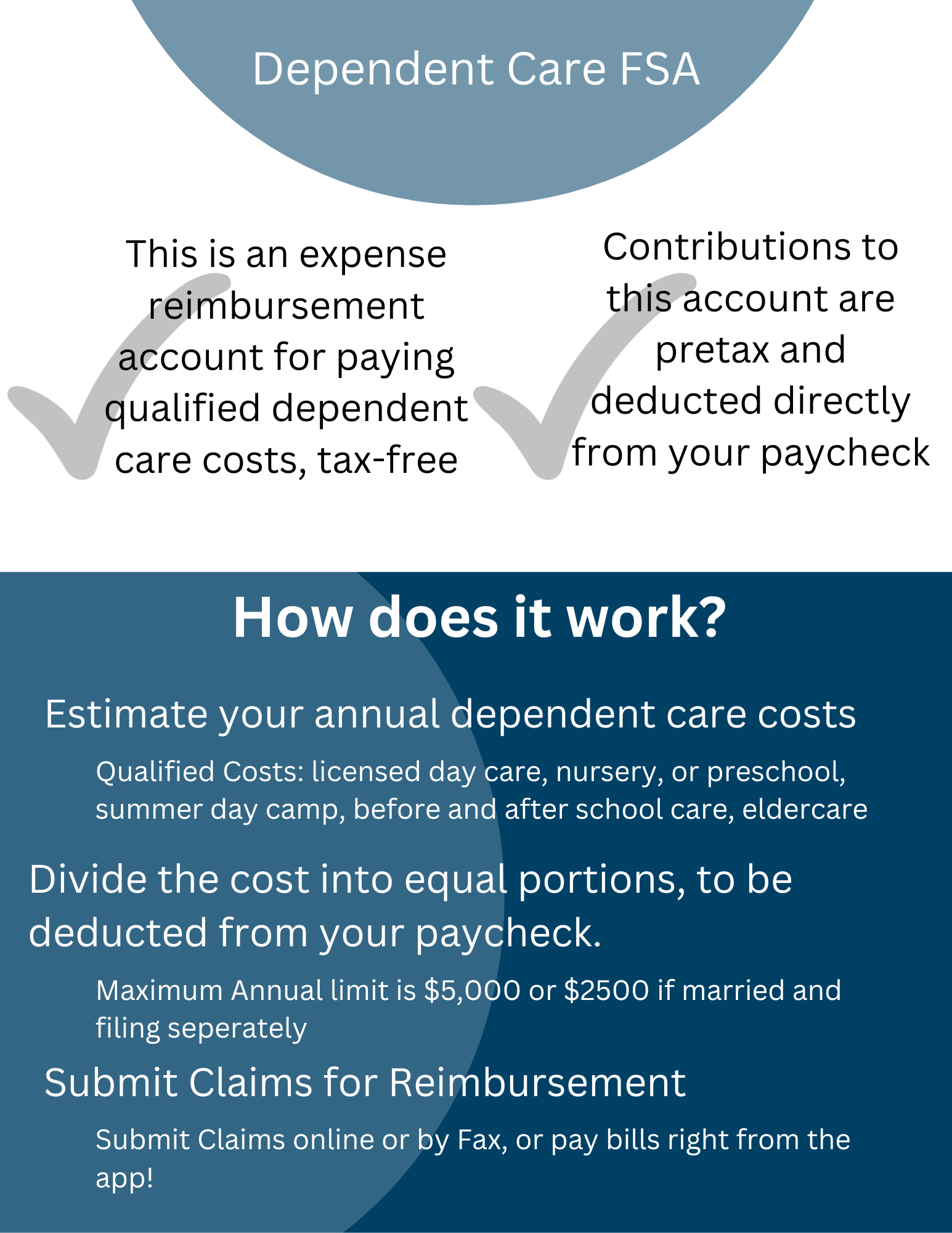

Are Dependent Care Fsa Funds Available Immediately - You don’t have to pay federal, state or payroll taxes on the money. This is an important difference between a. Dependent care fsa claims cannot be reimbursed until after the last day of service listed. You enroll in or renew your enrollment in your dependent care fsa through fsafeds during open season each year. For example, if you submit a claim that includes an. Dcfsa (dependent care fsa) because dcfsa funds accrue across each payroll, funds will be available either when contribution files are sent,. The amount of your pay that goes into a dependent care fsa will not count as taxable income, so you will have immediate tax. Your employer deducts this amount from each paycheck, before taxes. The total funds you contribute annually are not immediately available at the beginning of the plan year.

You don’t have to pay federal, state or payroll taxes on the money. Dependent care fsa claims cannot be reimbursed until after the last day of service listed. This is an important difference between a. You enroll in or renew your enrollment in your dependent care fsa through fsafeds during open season each year. The total funds you contribute annually are not immediately available at the beginning of the plan year. The amount of your pay that goes into a dependent care fsa will not count as taxable income, so you will have immediate tax. For example, if you submit a claim that includes an. Dcfsa (dependent care fsa) because dcfsa funds accrue across each payroll, funds will be available either when contribution files are sent,. Your employer deducts this amount from each paycheck, before taxes.

You enroll in or renew your enrollment in your dependent care fsa through fsafeds during open season each year. The amount of your pay that goes into a dependent care fsa will not count as taxable income, so you will have immediate tax. Dependent care fsa claims cannot be reimbursed until after the last day of service listed. The total funds you contribute annually are not immediately available at the beginning of the plan year. For example, if you submit a claim that includes an. You don’t have to pay federal, state or payroll taxes on the money. This is an important difference between a. Dcfsa (dependent care fsa) because dcfsa funds accrue across each payroll, funds will be available either when contribution files are sent,. Your employer deducts this amount from each paycheck, before taxes.

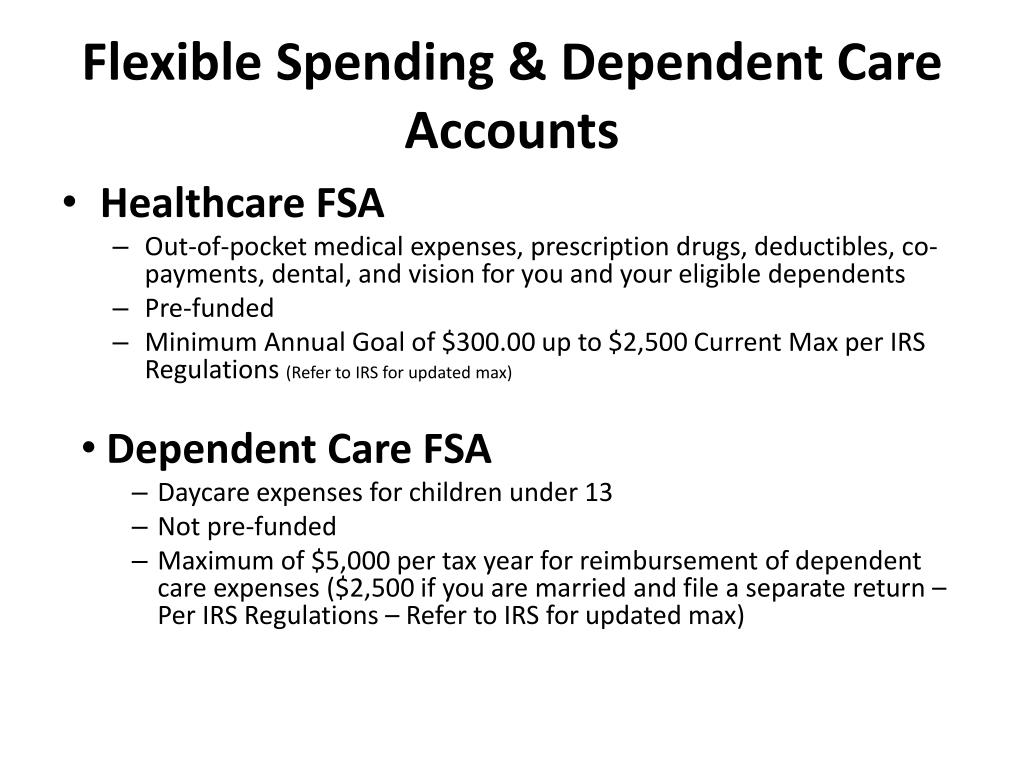

2018 Open Enrollment Benefits PRESENTATION ppt download

For example, if you submit a claim that includes an. Dcfsa (dependent care fsa) because dcfsa funds accrue across each payroll, funds will be available either when contribution files are sent,. Dependent care fsa claims cannot be reimbursed until after the last day of service listed. The amount of your pay that goes into a dependent care fsa will not.

Pin on Personal Finance

For example, if you submit a claim that includes an. The amount of your pay that goes into a dependent care fsa will not count as taxable income, so you will have immediate tax. You don’t have to pay federal, state or payroll taxes on the money. This is an important difference between a. You enroll in or renew your.

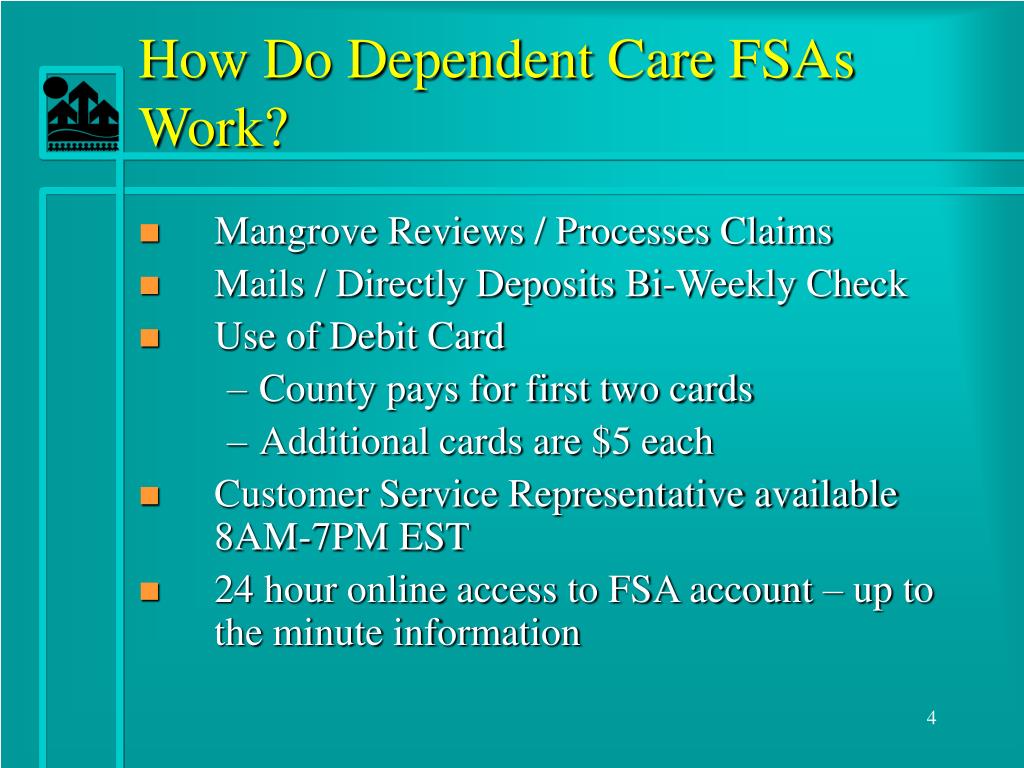

PPT Flexible Spending Accounts to Include Dependent Care PowerPoint

You enroll in or renew your enrollment in your dependent care fsa through fsafeds during open season each year. This is an important difference between a. The amount of your pay that goes into a dependent care fsa will not count as taxable income, so you will have immediate tax. Dependent care fsa claims cannot be reimbursed until after the.

PPT to NEO A&M College PowerPoint Presentation, free download

You enroll in or renew your enrollment in your dependent care fsa through fsafeds during open season each year. The total funds you contribute annually are not immediately available at the beginning of the plan year. Dcfsa (dependent care fsa) because dcfsa funds accrue across each payroll, funds will be available either when contribution files are sent,. You don’t have.

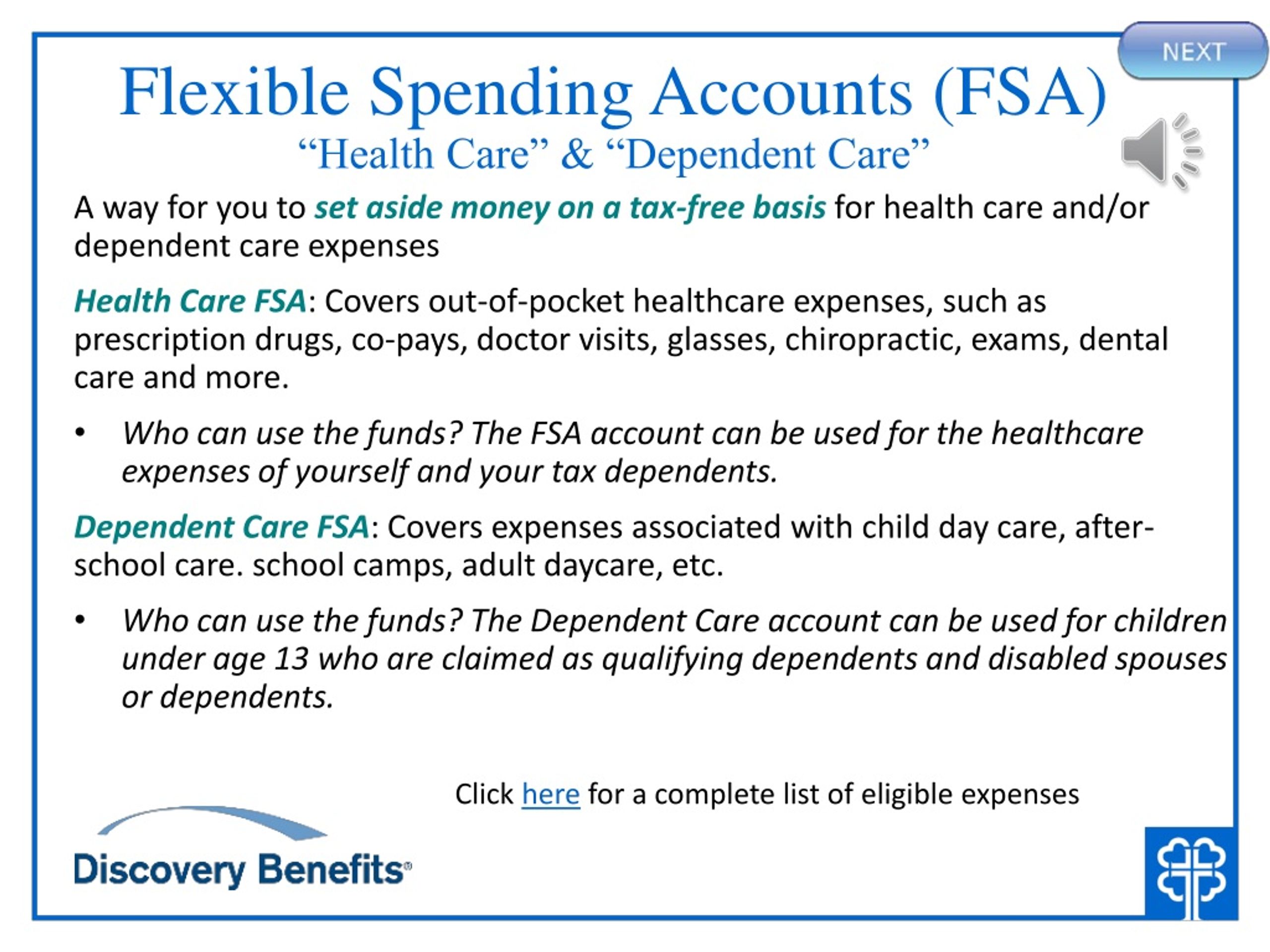

PPT Flexible Spending Accounts (FSA) “Health Care” & “Dependent Care

Dependent care fsa claims cannot be reimbursed until after the last day of service listed. For example, if you submit a claim that includes an. Your employer deducts this amount from each paycheck, before taxes. Dcfsa (dependent care fsa) because dcfsa funds accrue across each payroll, funds will be available either when contribution files are sent,. The total funds you.

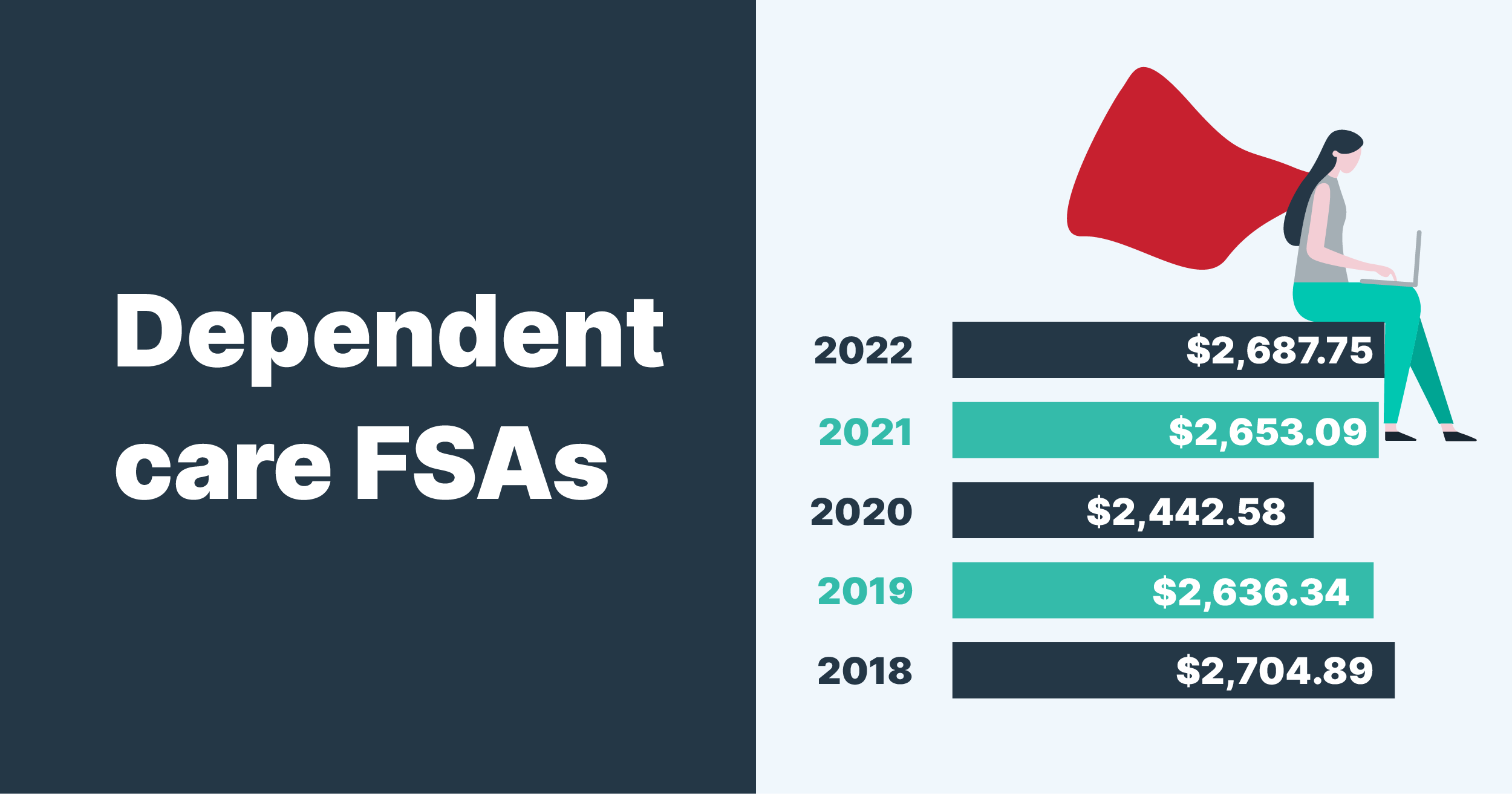

Dependent Care FSA

The total funds you contribute annually are not immediately available at the beginning of the plan year. Dcfsa (dependent care fsa) because dcfsa funds accrue across each payroll, funds will be available either when contribution files are sent,. You don’t have to pay federal, state or payroll taxes on the money. Dependent care fsa claims cannot be reimbursed until after.

What is a dependent care FSA? WEX Inc.

The total funds you contribute annually are not immediately available at the beginning of the plan year. For example, if you submit a claim that includes an. This is an important difference between a. You enroll in or renew your enrollment in your dependent care fsa through fsafeds during open season each year. Dcfsa (dependent care fsa) because dcfsa funds.

Sealaska Employee Benefits Benefit Year January 1, December 31, ppt

Dependent care fsa claims cannot be reimbursed until after the last day of service listed. The amount of your pay that goes into a dependent care fsa will not count as taxable income, so you will have immediate tax. You don’t have to pay federal, state or payroll taxes on the money. You enroll in or renew your enrollment in.

Dependent Care Flexible Spending Accounts Flex Made Easy

This is an important difference between a. For example, if you submit a claim that includes an. You enroll in or renew your enrollment in your dependent care fsa through fsafeds during open season each year. Dependent care fsa claims cannot be reimbursed until after the last day of service listed. Your employer deducts this amount from each paycheck, before.

Dependent Care Flexible Spending Account

Dependent care fsa claims cannot be reimbursed until after the last day of service listed. Your employer deducts this amount from each paycheck, before taxes. The amount of your pay that goes into a dependent care fsa will not count as taxable income, so you will have immediate tax. You enroll in or renew your enrollment in your dependent care.

This Is An Important Difference Between A.

For example, if you submit a claim that includes an. You don’t have to pay federal, state or payroll taxes on the money. You enroll in or renew your enrollment in your dependent care fsa through fsafeds during open season each year. Dependent care fsa claims cannot be reimbursed until after the last day of service listed.

Your Employer Deducts This Amount From Each Paycheck, Before Taxes.

The amount of your pay that goes into a dependent care fsa will not count as taxable income, so you will have immediate tax. The total funds you contribute annually are not immediately available at the beginning of the plan year. Dcfsa (dependent care fsa) because dcfsa funds accrue across each payroll, funds will be available either when contribution files are sent,.

.jpg)