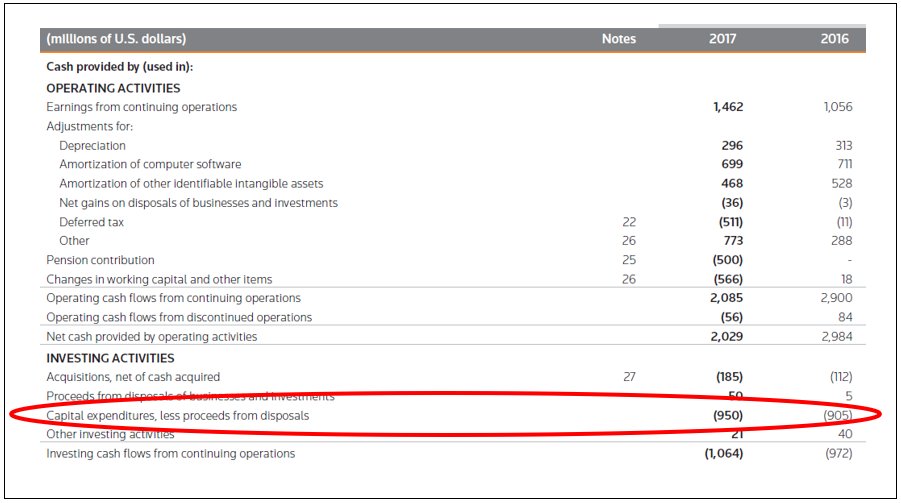

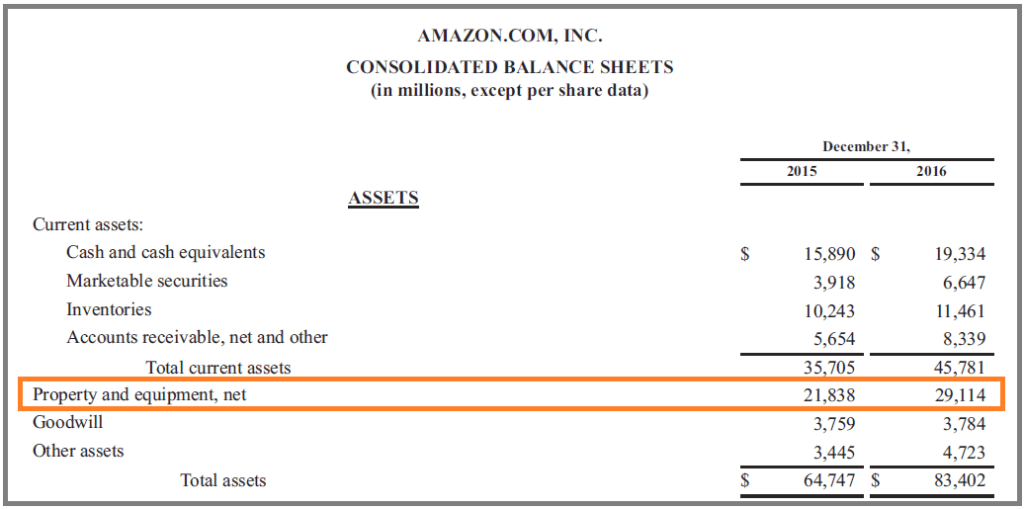

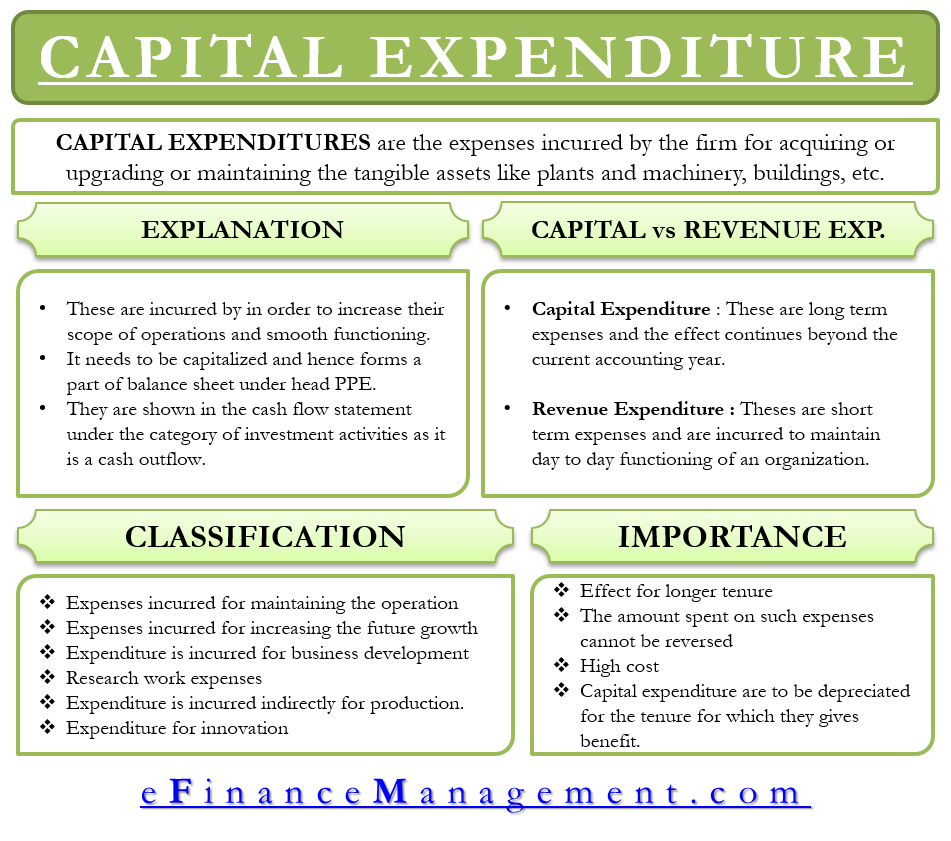

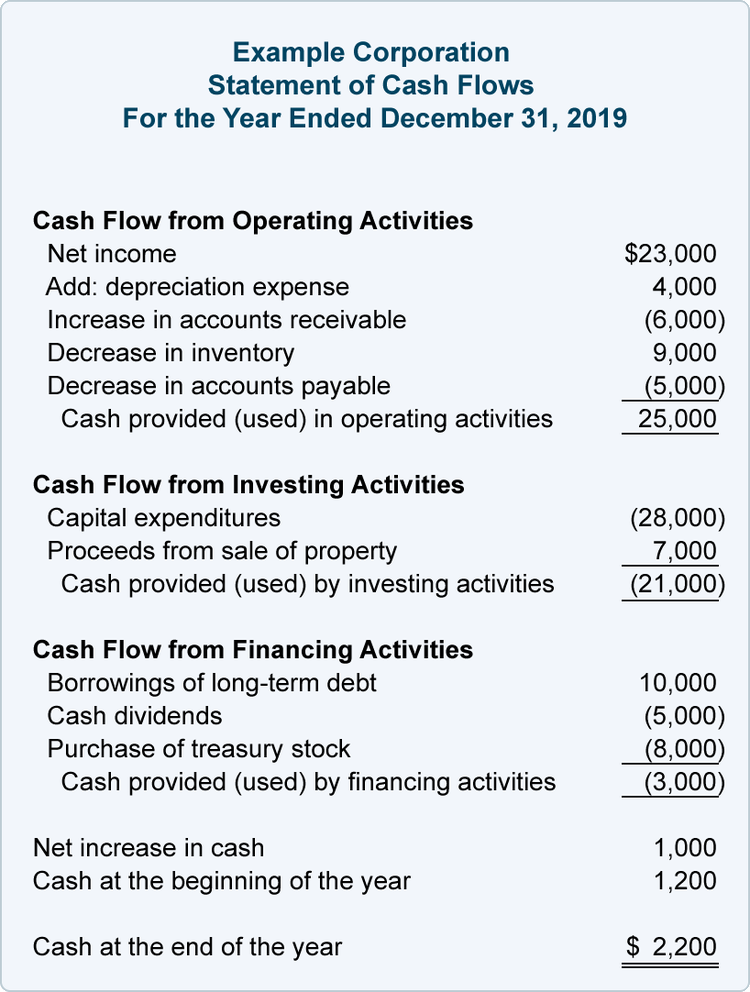

What Is Capital Expenditure In Balance Sheet - Capital expenditure is a critical concept in accounting that affects a company’s balance sheet, income statement, and cash. The capital expenditure (capex) of a company in a given period can be determined by tracking the changes in the company’s fixed. Capital expenditures are recorded on cash flow statements under investing activities and on the balance sheet, usually under. What is a capital expenditure (capex)?

What is a capital expenditure (capex)? Capital expenditures are recorded on cash flow statements under investing activities and on the balance sheet, usually under. Capital expenditure is a critical concept in accounting that affects a company’s balance sheet, income statement, and cash. The capital expenditure (capex) of a company in a given period can be determined by tracking the changes in the company’s fixed.

The capital expenditure (capex) of a company in a given period can be determined by tracking the changes in the company’s fixed. What is a capital expenditure (capex)? Capital expenditure is a critical concept in accounting that affects a company’s balance sheet, income statement, and cash. Capital expenditures are recorded on cash flow statements under investing activities and on the balance sheet, usually under.

Capital Expenditure A Practical Guide YouTube

Capital expenditure is a critical concept in accounting that affects a company’s balance sheet, income statement, and cash. Capital expenditures are recorded on cash flow statements under investing activities and on the balance sheet, usually under. The capital expenditure (capex) of a company in a given period can be determined by tracking the changes in the company’s fixed. What is.

Capital Expenditures Definition, Overview And Examples with Capital

What is a capital expenditure (capex)? Capital expenditures are recorded on cash flow statements under investing activities and on the balance sheet, usually under. Capital expenditure is a critical concept in accounting that affects a company’s balance sheet, income statement, and cash. The capital expenditure (capex) of a company in a given period can be determined by tracking the changes.

Capital Expenditure Capex Meaning, Classification, Importance

Capital expenditure is a critical concept in accounting that affects a company’s balance sheet, income statement, and cash. The capital expenditure (capex) of a company in a given period can be determined by tracking the changes in the company’s fixed. What is a capital expenditure (capex)? Capital expenditures are recorded on cash flow statements under investing activities and on the.

CapEx What Is It and How Do You Calculate It?

What is a capital expenditure (capex)? Capital expenditures are recorded on cash flow statements under investing activities and on the balance sheet, usually under. Capital expenditure is a critical concept in accounting that affects a company’s balance sheet, income statement, and cash. The capital expenditure (capex) of a company in a given period can be determined by tracking the changes.

Capital Expenditure CapEx Definition Formula And Examples Form Used To

Capital expenditures are recorded on cash flow statements under investing activities and on the balance sheet, usually under. Capital expenditure is a critical concept in accounting that affects a company’s balance sheet, income statement, and cash. The capital expenditure (capex) of a company in a given period can be determined by tracking the changes in the company’s fixed. What is.

Capital Expenditure Template Excel

What is a capital expenditure (capex)? Capital expenditures are recorded on cash flow statements under investing activities and on the balance sheet, usually under. Capital expenditure is a critical concept in accounting that affects a company’s balance sheet, income statement, and cash. The capital expenditure (capex) of a company in a given period can be determined by tracking the changes.

Capital Expenditures Financial Modeling Institute

What is a capital expenditure (capex)? Capital expenditures are recorded on cash flow statements under investing activities and on the balance sheet, usually under. Capital expenditure is a critical concept in accounting that affects a company’s balance sheet, income statement, and cash. The capital expenditure (capex) of a company in a given period can be determined by tracking the changes.

Capital Expenditure (CAPEX) Definition, Example, Formula

The capital expenditure (capex) of a company in a given period can be determined by tracking the changes in the company’s fixed. Capital expenditures are recorded on cash flow statements under investing activities and on the balance sheet, usually under. What is a capital expenditure (capex)? Capital expenditure is a critical concept in accounting that affects a company’s balance sheet,.

Capital Expenditure Excel Template

Capital expenditure is a critical concept in accounting that affects a company’s balance sheet, income statement, and cash. Capital expenditures are recorded on cash flow statements under investing activities and on the balance sheet, usually under. What is a capital expenditure (capex)? The capital expenditure (capex) of a company in a given period can be determined by tracking the changes.

How to calculate capital expenditures using a company’s financial

The capital expenditure (capex) of a company in a given period can be determined by tracking the changes in the company’s fixed. What is a capital expenditure (capex)? Capital expenditure is a critical concept in accounting that affects a company’s balance sheet, income statement, and cash. Capital expenditures are recorded on cash flow statements under investing activities and on the.

What Is A Capital Expenditure (Capex)?

The capital expenditure (capex) of a company in a given period can be determined by tracking the changes in the company’s fixed. Capital expenditures are recorded on cash flow statements under investing activities and on the balance sheet, usually under. Capital expenditure is a critical concept in accounting that affects a company’s balance sheet, income statement, and cash.

:max_bytes(150000):strip_icc()/capitalexpenditure-b2aaeae25f3648f9929b8e86061eff63.png)