What Is A Tax Warrant In Wisconsin - Unpaid taxes in wisconsin can lead to serious consequences, including a delinquent tax warrant. What is a tax warrant and when does the wisconsin department of revenue file a tax warrant? This legal action allows the state. What is a tax warrant? What is a tax warrant? A tax warrant in wisconsin is a legal document issued by the dor authorizing the seizure and sale of a taxpayer's property to. The different types of warrants filed include: A tax warrant acts as a lien against real and personal property you own in the county in which it is filed. All delinquent debt is subject to having. You may have heard the term tax warrant, but do you know what it means for your financial future if you.

Wisconsin department of revenue division of income, sales, and excise tax notice of proposed guidance documents pursuant. What is a tax warrant? A tax warrant acts as a lien against real and personal property you own in the county in which it is filed. A tax warrant in wisconsin is a legal document issued by the dor authorizing the seizure and sale of a taxpayer's property to. This legal action allows the state. Unpaid taxes in wisconsin can lead to serious consequences, including a delinquent tax warrant. What is a tax warrant and when does the wisconsin department of revenue file a tax warrant? What is a tax warrant? You may have heard the term tax warrant, but do you know what it means for your financial future if you. All delinquent debt is subject to having.

A tax warrant acts as a lien against real and personal property you own in the county in which it is filed. What is a tax warrant? What is a tax warrant? What is a tax warrant and when does the wisconsin department of revenue file a tax warrant? You may have heard the term tax warrant, but do you know what it means for your financial future if you. All delinquent debt is subject to having. Unpaid taxes in wisconsin can lead to serious consequences, including a delinquent tax warrant. The different types of warrants filed include: Wisconsin department of revenue division of income, sales, and excise tax notice of proposed guidance documents pursuant. This legal action allows the state.

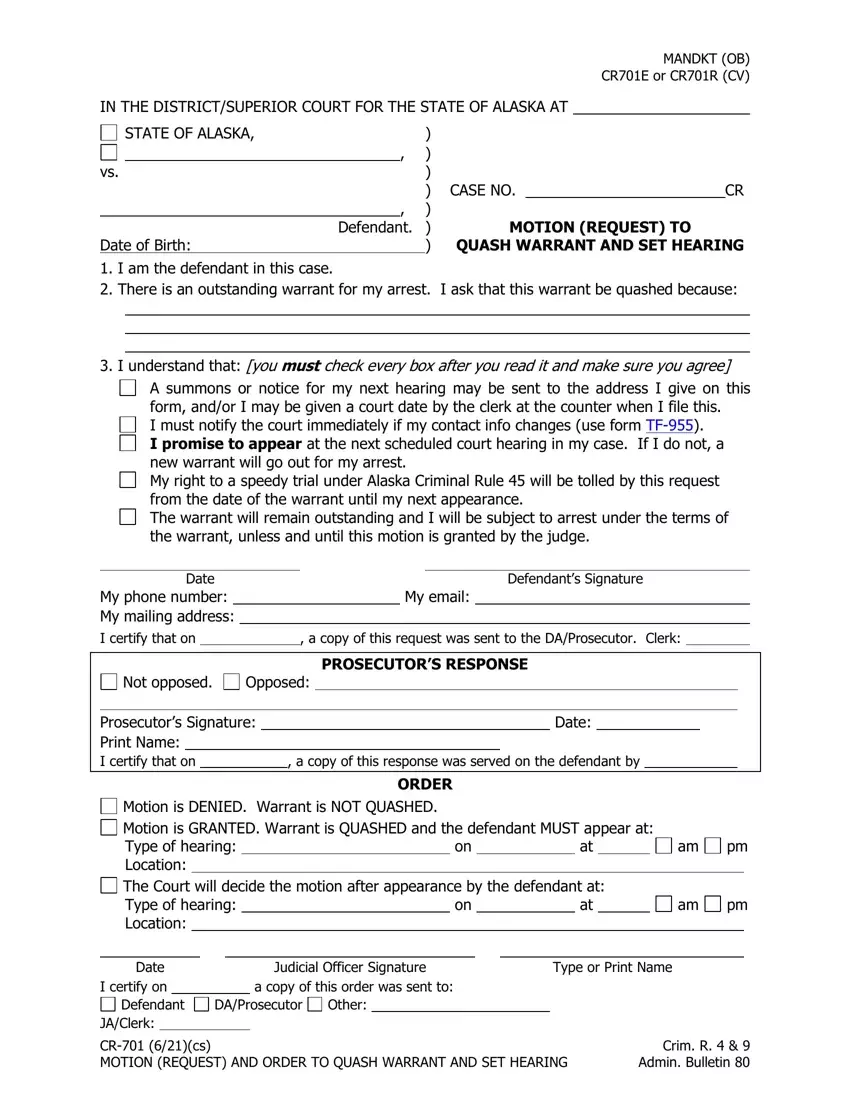

Wisconsin Warrant Template Fill Out And Sign Printabl vrogue.co

You may have heard the term tax warrant, but do you know what it means for your financial future if you. All delinquent debt is subject to having. Unpaid taxes in wisconsin can lead to serious consequences, including a delinquent tax warrant. The different types of warrants filed include: Wisconsin department of revenue division of income, sales, and excise tax.

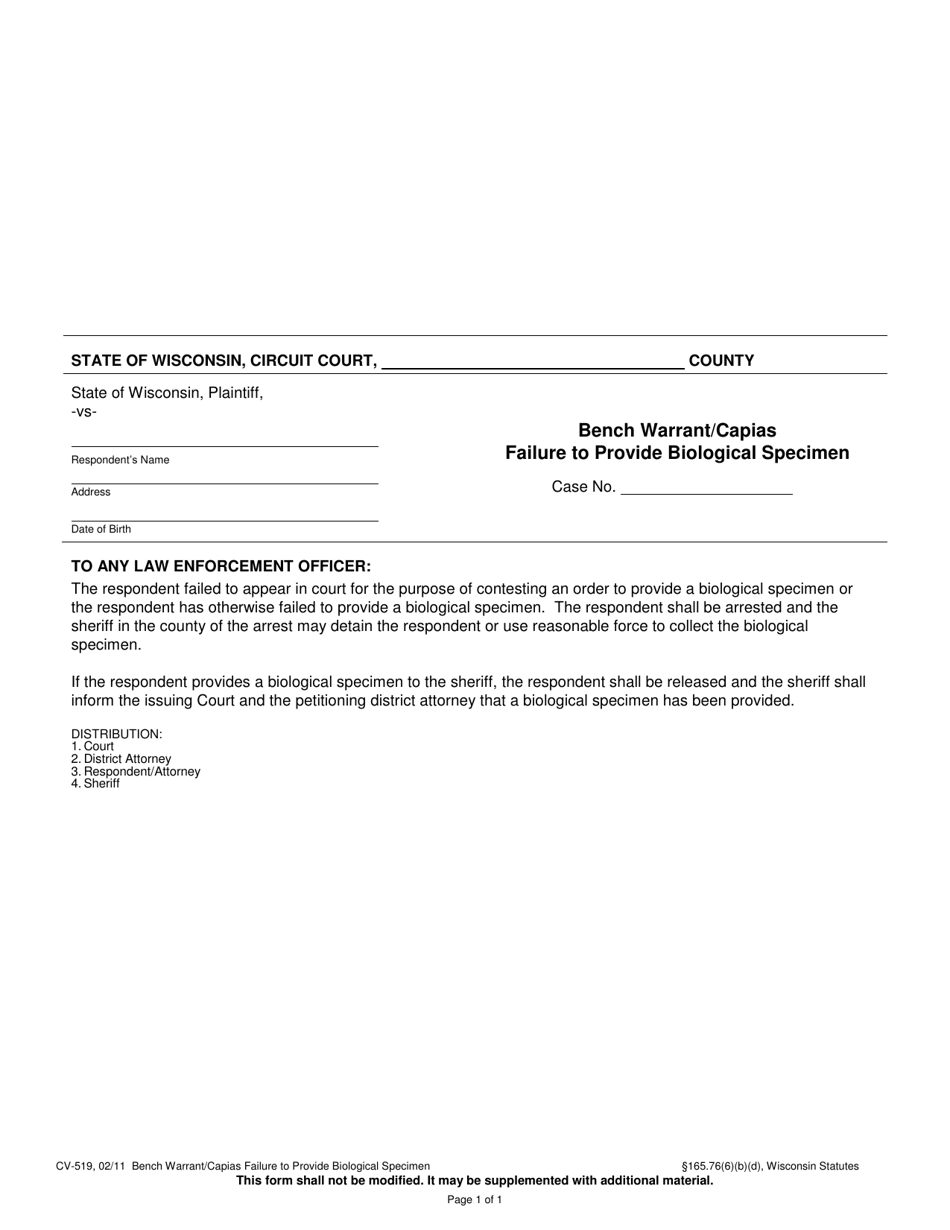

Form CV519 Fill Out, Sign Online and Download Printable PDF

What is a tax warrant and when does the wisconsin department of revenue file a tax warrant? What is a tax warrant? You may have heard the term tax warrant, but do you know what it means for your financial future if you. A tax warrant acts as a lien against real and personal property you own in the county.

Tax Warrants — DeKalb County Sheriff's Office

Unpaid taxes in wisconsin can lead to serious consequences, including a delinquent tax warrant. The different types of warrants filed include: What is a tax warrant? A tax warrant acts as a lien against real and personal property you own in the county in which it is filed. This legal action allows the state.

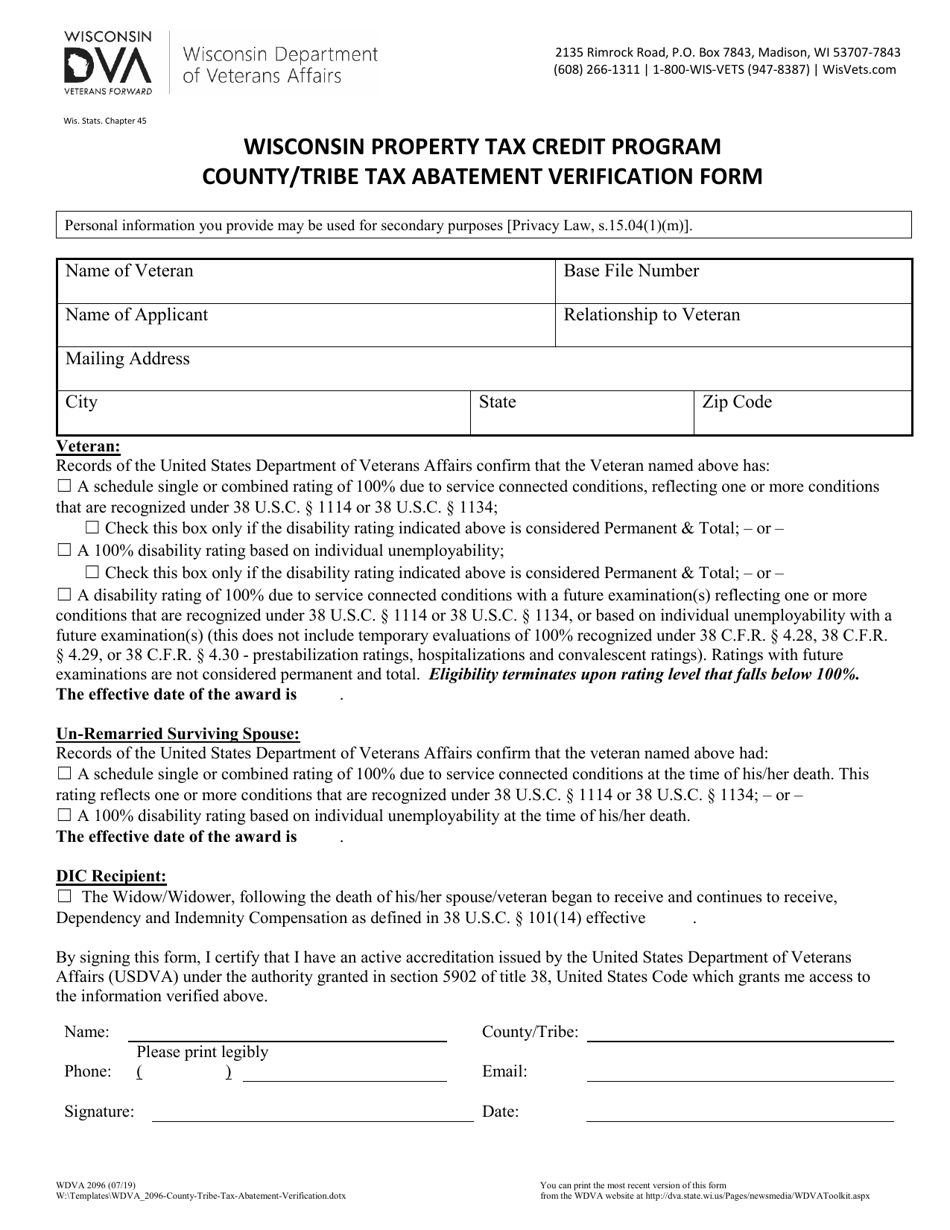

Form WDVA2096 Fill Out, Sign Online and Download Fillable PDF

This legal action allows the state. The different types of warrants filed include: A tax warrant acts as a lien against real and personal property you own in the county in which it is filed. What is a tax warrant? What is a tax warrant and when does the wisconsin department of revenue file a tax warrant?

Verify a Refund Check

What is a tax warrant? This legal action allows the state. A tax warrant in wisconsin is a legal document issued by the dor authorizing the seizure and sale of a taxpayer's property to. A tax warrant acts as a lien against real and personal property you own in the county in which it is filed. What is a tax.

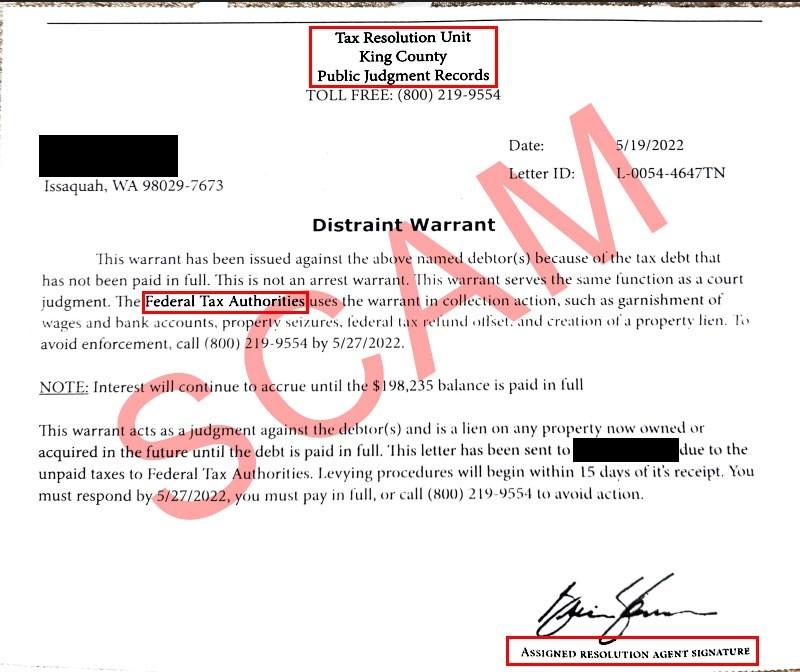

Judgement Records Search

Wisconsin department of revenue division of income, sales, and excise tax notice of proposed guidance documents pursuant. The different types of warrants filed include: What is a tax warrant? What is a tax warrant? A tax warrant in wisconsin is a legal document issued by the dor authorizing the seizure and sale of a taxpayer's property to.

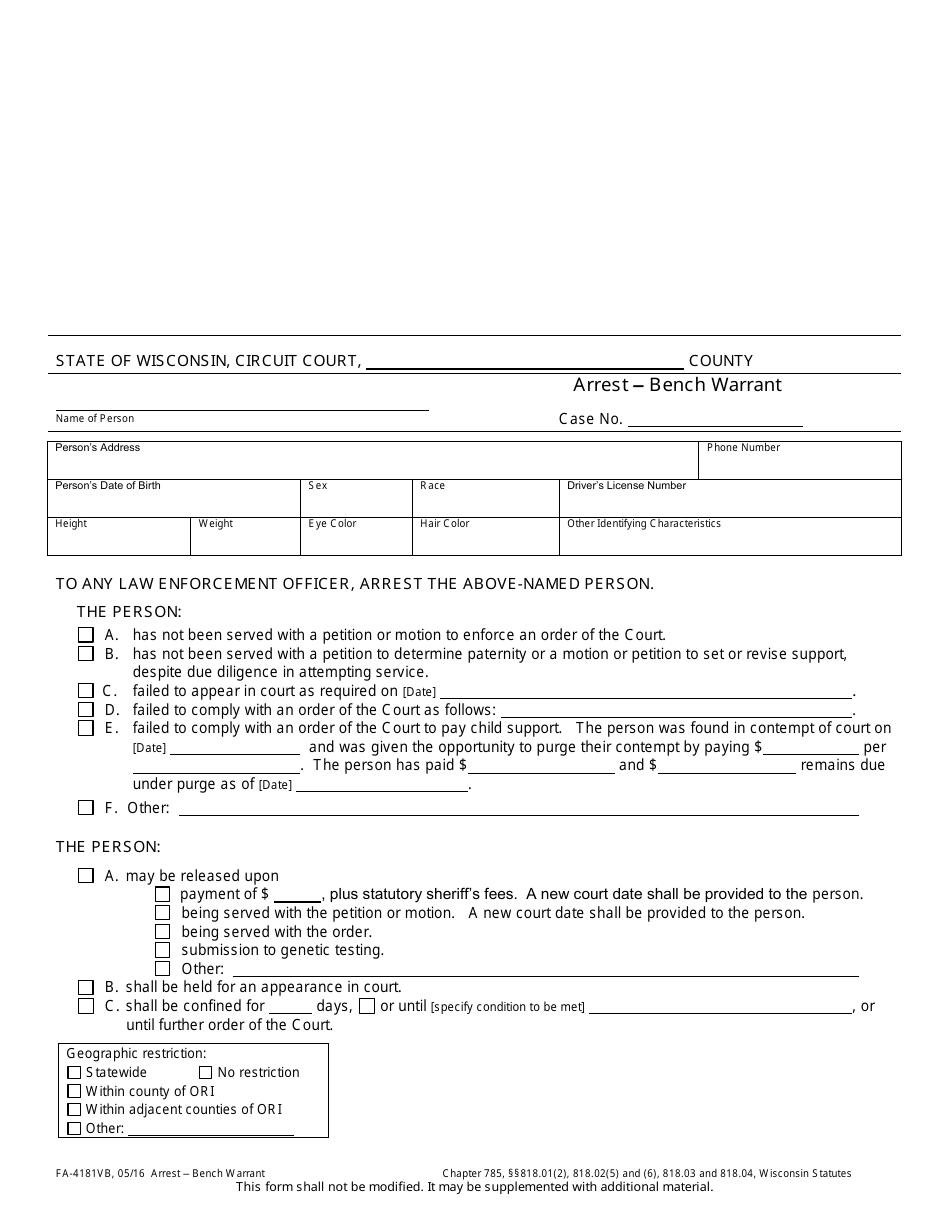

Form FA4181VB Fill Out, Sign Online and Download Printable PDF

You may have heard the term tax warrant, but do you know what it means for your financial future if you. What is a tax warrant and when does the wisconsin department of revenue file a tax warrant? What is a tax warrant? The different types of warrants filed include: What is a tax warrant?

Fake tax letter sent to Winnebago County residents, officials warn

The different types of warrants filed include: Unpaid taxes in wisconsin can lead to serious consequences, including a delinquent tax warrant. A tax warrant acts as a lien against real and personal property you own in the county in which it is filed. A tax warrant in wisconsin is a legal document issued by the dor authorizing the seizure and.

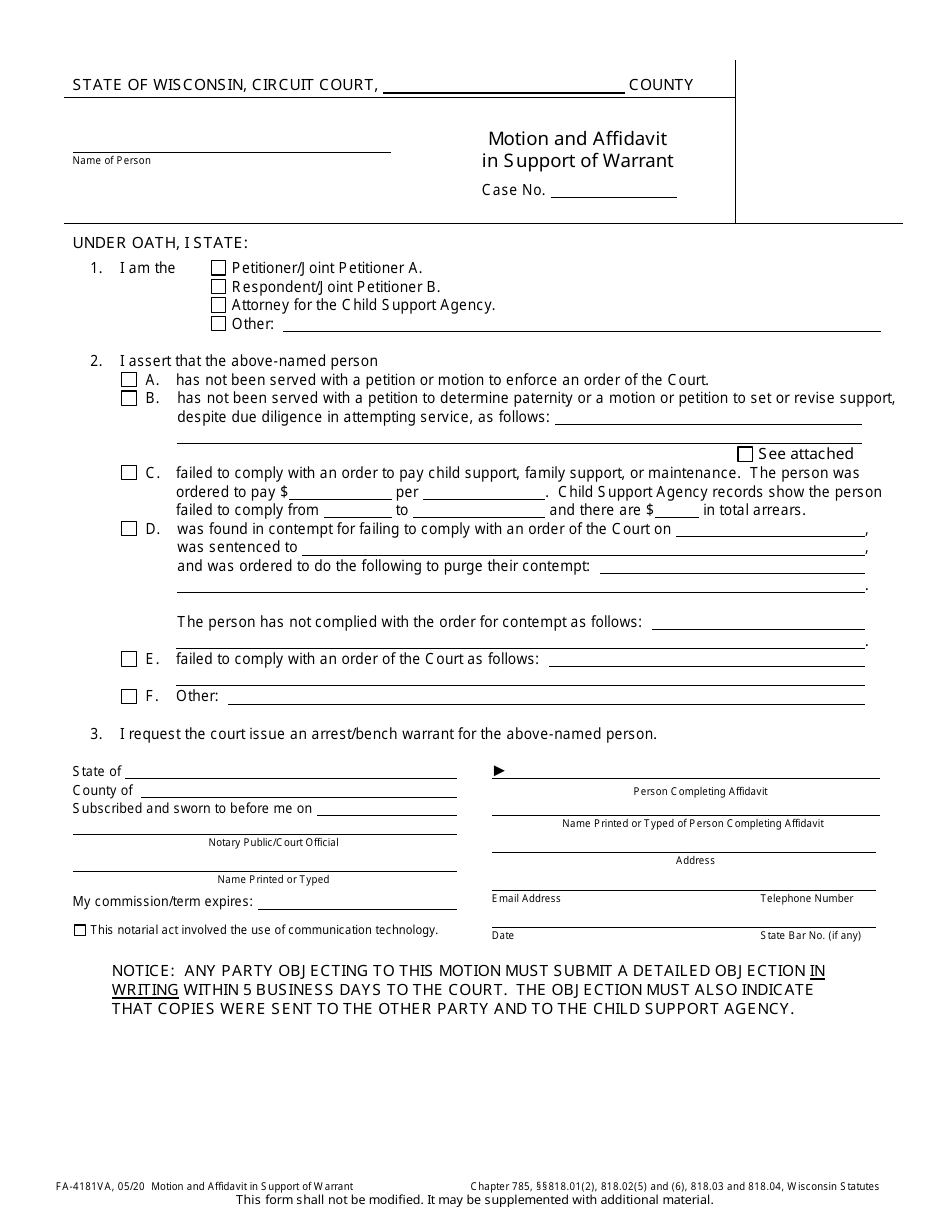

Form FA4181VA Fill Out, Sign Online and Download Printable PDF

This legal action allows the state. You may have heard the term tax warrant, but do you know what it means for your financial future if you. The different types of warrants filed include: Wisconsin department of revenue division of income, sales, and excise tax notice of proposed guidance documents pursuant. A tax warrant acts as a lien against real.

Warrant Taxpayer Taxes

A tax warrant acts as a lien against real and personal property you own in the county in which it is filed. What is a tax warrant and when does the wisconsin department of revenue file a tax warrant? What is a tax warrant? Unpaid taxes in wisconsin can lead to serious consequences, including a delinquent tax warrant. The different.

The Different Types Of Warrants Filed Include:

Unpaid taxes in wisconsin can lead to serious consequences, including a delinquent tax warrant. What is a tax warrant? All delinquent debt is subject to having. Wisconsin department of revenue division of income, sales, and excise tax notice of proposed guidance documents pursuant.

This Legal Action Allows The State.

A tax warrant acts as a lien against real and personal property you own in the county in which it is filed. What is a tax warrant? A tax warrant in wisconsin is a legal document issued by the dor authorizing the seizure and sale of a taxpayer's property to. What is a tax warrant and when does the wisconsin department of revenue file a tax warrant?