Prepaid Insurance On A Balance Sheet - Learn how to accurately record, adjust, and reconcile prepaid insurance in accounting to ensure financial statements. When the company makes an advance payment for insurance, it can make prepaid insurance journal entry by debiting prepaid insurance. Prepaid insurance is the insurance premium paid by a company in an accounting period that didn’t expire in the same accounting. Prepaid expenses are future expenses that are paid in advance and hence recognized initially as an asset. As the benefits of the expenses are. Under generally accepted accounting principles (gaap), businesses must recognize prepaid insurance as a current asset.

Prepaid insurance is the insurance premium paid by a company in an accounting period that didn’t expire in the same accounting. Prepaid expenses are future expenses that are paid in advance and hence recognized initially as an asset. Under generally accepted accounting principles (gaap), businesses must recognize prepaid insurance as a current asset. Learn how to accurately record, adjust, and reconcile prepaid insurance in accounting to ensure financial statements. As the benefits of the expenses are. When the company makes an advance payment for insurance, it can make prepaid insurance journal entry by debiting prepaid insurance.

Prepaid expenses are future expenses that are paid in advance and hence recognized initially as an asset. As the benefits of the expenses are. Under generally accepted accounting principles (gaap), businesses must recognize prepaid insurance as a current asset. When the company makes an advance payment for insurance, it can make prepaid insurance journal entry by debiting prepaid insurance. Prepaid insurance is the insurance premium paid by a company in an accounting period that didn’t expire in the same accounting. Learn how to accurately record, adjust, and reconcile prepaid insurance in accounting to ensure financial statements.

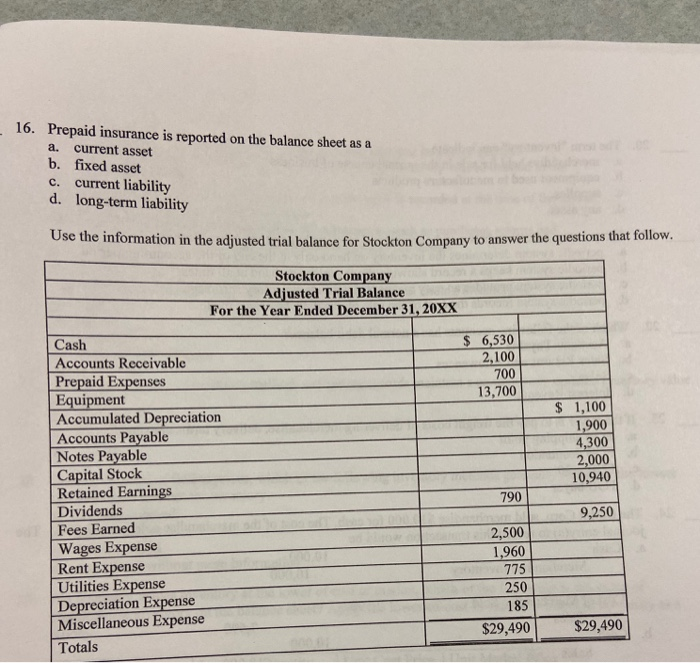

What is prepaid insurance on a balance sheet? Leia aqui Is prepaid

Under generally accepted accounting principles (gaap), businesses must recognize prepaid insurance as a current asset. As the benefits of the expenses are. Prepaid expenses are future expenses that are paid in advance and hence recognized initially as an asset. Learn how to accurately record, adjust, and reconcile prepaid insurance in accounting to ensure financial statements. When the company makes an.

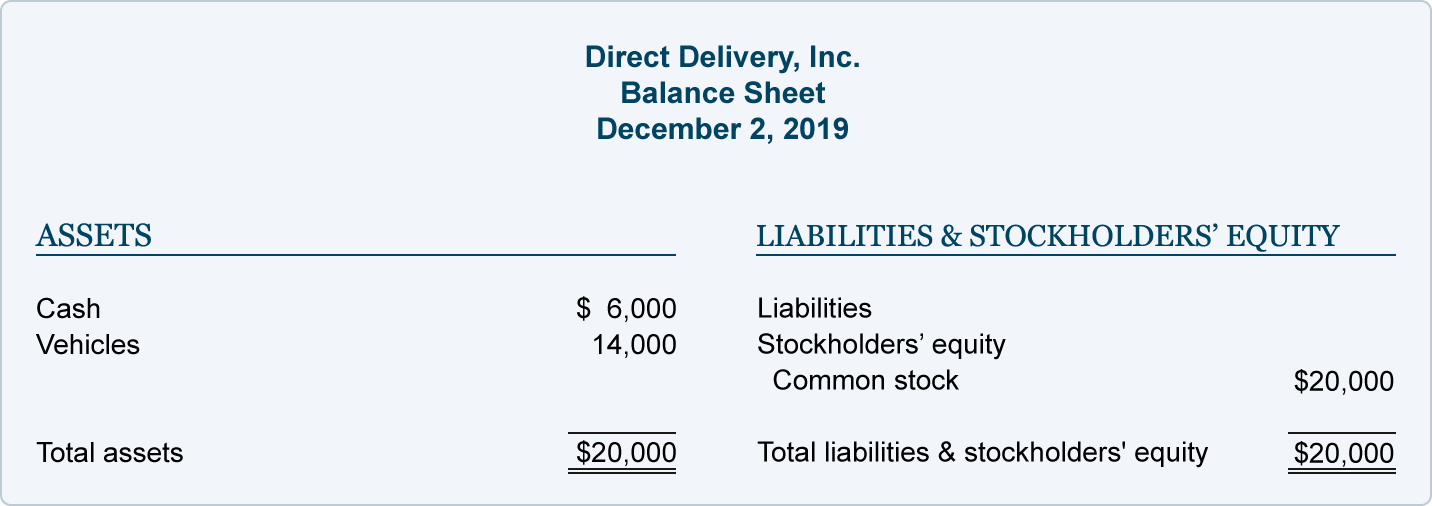

Solved Please help complete balance sheet. Prepaid insurance

Prepaid insurance is the insurance premium paid by a company in an accounting period that didn’t expire in the same accounting. Learn how to accurately record, adjust, and reconcile prepaid insurance in accounting to ensure financial statements. As the benefits of the expenses are. When the company makes an advance payment for insurance, it can make prepaid insurance journal entry.

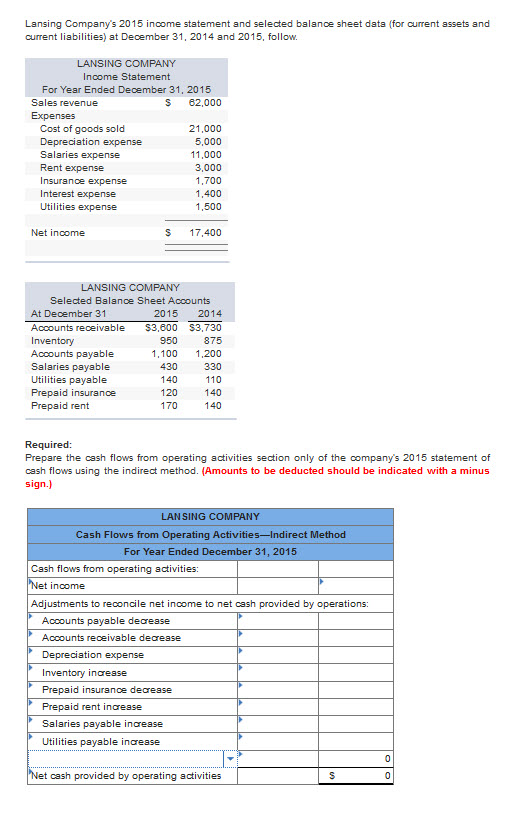

Balance sheet prepaid insurance veryrb

When the company makes an advance payment for insurance, it can make prepaid insurance journal entry by debiting prepaid insurance. Under generally accepted accounting principles (gaap), businesses must recognize prepaid insurance as a current asset. Prepaid expenses are future expenses that are paid in advance and hence recognized initially as an asset. As the benefits of the expenses are. Learn.

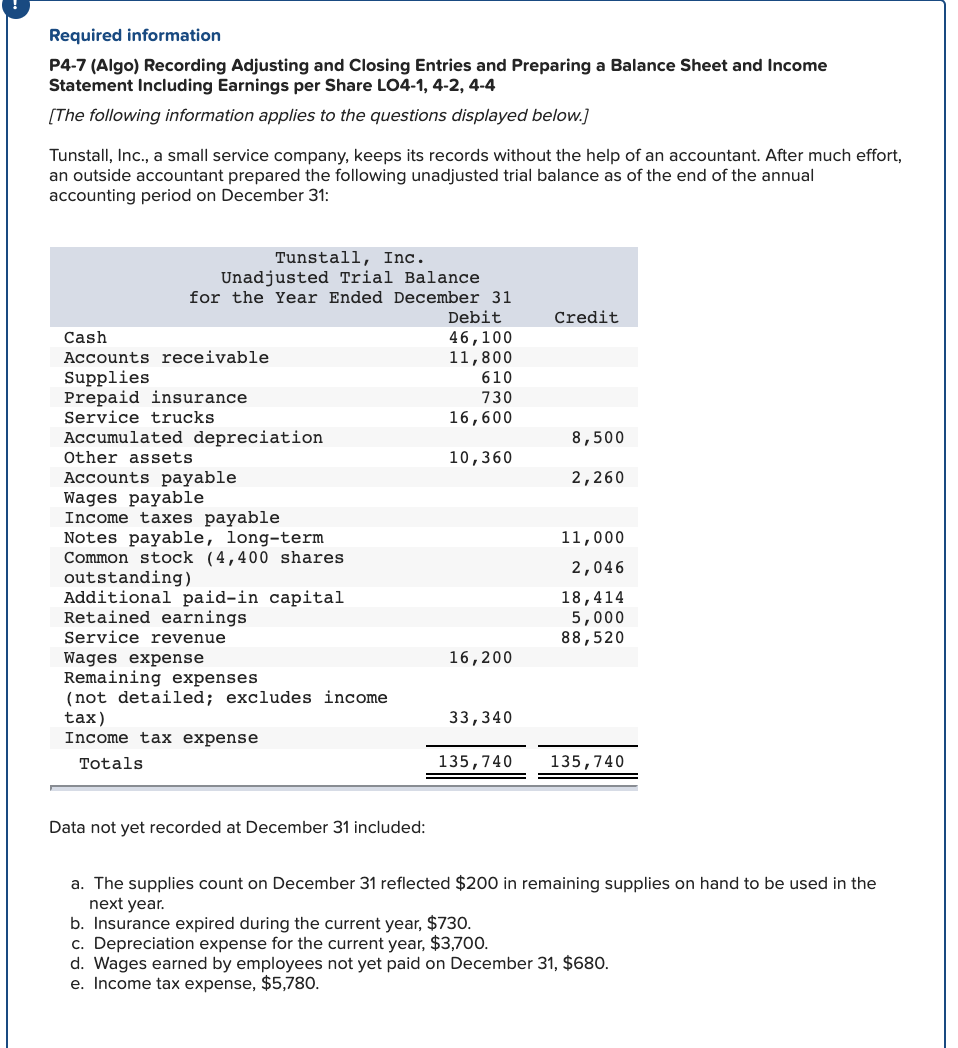

Help, cant balance sheet, see prepaid insurance and accumulated

Under generally accepted accounting principles (gaap), businesses must recognize prepaid insurance as a current asset. Prepaid expenses are future expenses that are paid in advance and hence recognized initially as an asset. Learn how to accurately record, adjust, and reconcile prepaid insurance in accounting to ensure financial statements. When the company makes an advance payment for insurance, it can make.

What Is Prepaid Insurance On A Balance Sheet? Cuztomize

Learn how to accurately record, adjust, and reconcile prepaid insurance in accounting to ensure financial statements. As the benefits of the expenses are. Prepaid insurance is the insurance premium paid by a company in an accounting period that didn’t expire in the same accounting. Prepaid expenses are future expenses that are paid in advance and hence recognized initially as an.

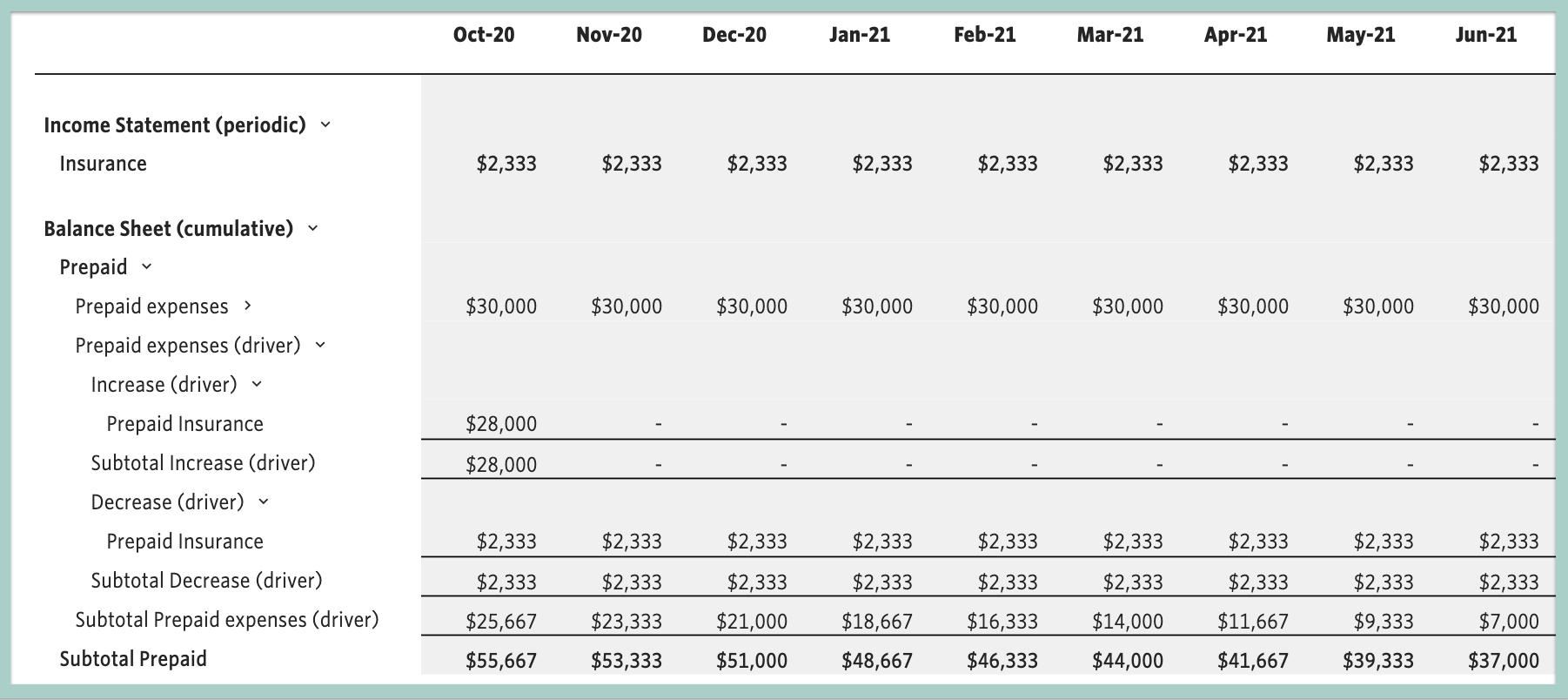

Step 20 Plan for Prepaid Insurance

Under generally accepted accounting principles (gaap), businesses must recognize prepaid insurance as a current asset. Learn how to accurately record, adjust, and reconcile prepaid insurance in accounting to ensure financial statements. As the benefits of the expenses are. When the company makes an advance payment for insurance, it can make prepaid insurance journal entry by debiting prepaid insurance. Prepaid insurance.

Prepaid Expenses on Balance Sheet Quant RL

When the company makes an advance payment for insurance, it can make prepaid insurance journal entry by debiting prepaid insurance. As the benefits of the expenses are. Learn how to accurately record, adjust, and reconcile prepaid insurance in accounting to ensure financial statements. Under generally accepted accounting principles (gaap), businesses must recognize prepaid insurance as a current asset. Prepaid insurance.

Prepaid Expenses In Balance Sheet Analysis Template Ipsas 20 Financial

Under generally accepted accounting principles (gaap), businesses must recognize prepaid insurance as a current asset. Prepaid expenses are future expenses that are paid in advance and hence recognized initially as an asset. Learn how to accurately record, adjust, and reconcile prepaid insurance in accounting to ensure financial statements. Prepaid insurance is the insurance premium paid by a company in an.

Understanding Prepaid Insurance In Statements Cuztomize

Learn how to accurately record, adjust, and reconcile prepaid insurance in accounting to ensure financial statements. Prepaid expenses are future expenses that are paid in advance and hence recognized initially as an asset. Under generally accepted accounting principles (gaap), businesses must recognize prepaid insurance as a current asset. As the benefits of the expenses are. Prepaid insurance is the insurance.

What Type of Account Is Prepaid Insurance on the Balance Sheet

Prepaid expenses are future expenses that are paid in advance and hence recognized initially as an asset. When the company makes an advance payment for insurance, it can make prepaid insurance journal entry by debiting prepaid insurance. Under generally accepted accounting principles (gaap), businesses must recognize prepaid insurance as a current asset. Prepaid insurance is the insurance premium paid by.

As The Benefits Of The Expenses Are.

Under generally accepted accounting principles (gaap), businesses must recognize prepaid insurance as a current asset. Prepaid expenses are future expenses that are paid in advance and hence recognized initially as an asset. When the company makes an advance payment for insurance, it can make prepaid insurance journal entry by debiting prepaid insurance. Prepaid insurance is the insurance premium paid by a company in an accounting period that didn’t expire in the same accounting.