Interest Expense In Balance Sheet - Interest expense is documented in the financial records when a company incurs costs related to borrowing money. Interest expense represents the total cost of the interest, whereas interest payable is the account that records the unpaid balance of interest.

Interest expense is documented in the financial records when a company incurs costs related to borrowing money. Interest expense represents the total cost of the interest, whereas interest payable is the account that records the unpaid balance of interest.

Interest expense represents the total cost of the interest, whereas interest payable is the account that records the unpaid balance of interest. Interest expense is documented in the financial records when a company incurs costs related to borrowing money.

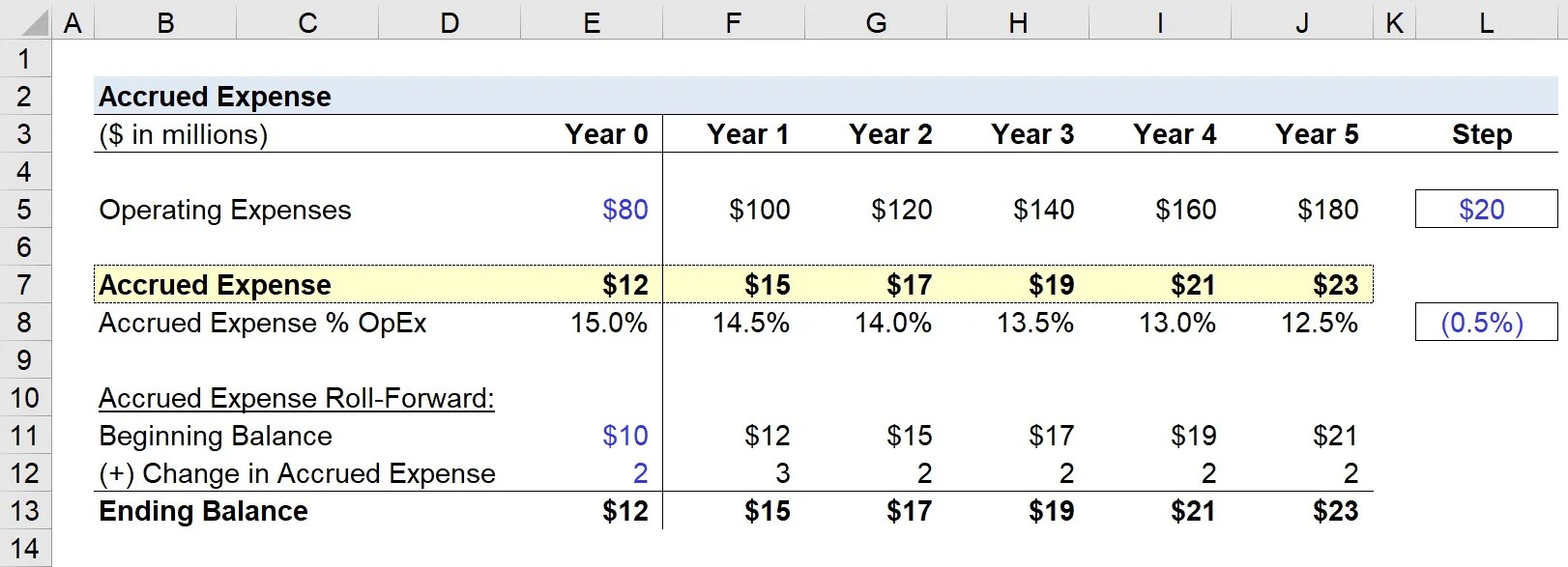

Where Is Interest Expense On Balance Sheet LiveWell

Interest expense represents the total cost of the interest, whereas interest payable is the account that records the unpaid balance of interest. Interest expense is documented in the financial records when a company incurs costs related to borrowing money.

Where Is Interest Expense On Balance Sheet LiveWell

Interest expense represents the total cost of the interest, whereas interest payable is the account that records the unpaid balance of interest. Interest expense is documented in the financial records when a company incurs costs related to borrowing money.

Where Is Interest Expense On Balance Sheet LiveWell

Interest expense represents the total cost of the interest, whereas interest payable is the account that records the unpaid balance of interest. Interest expense is documented in the financial records when a company incurs costs related to borrowing money.

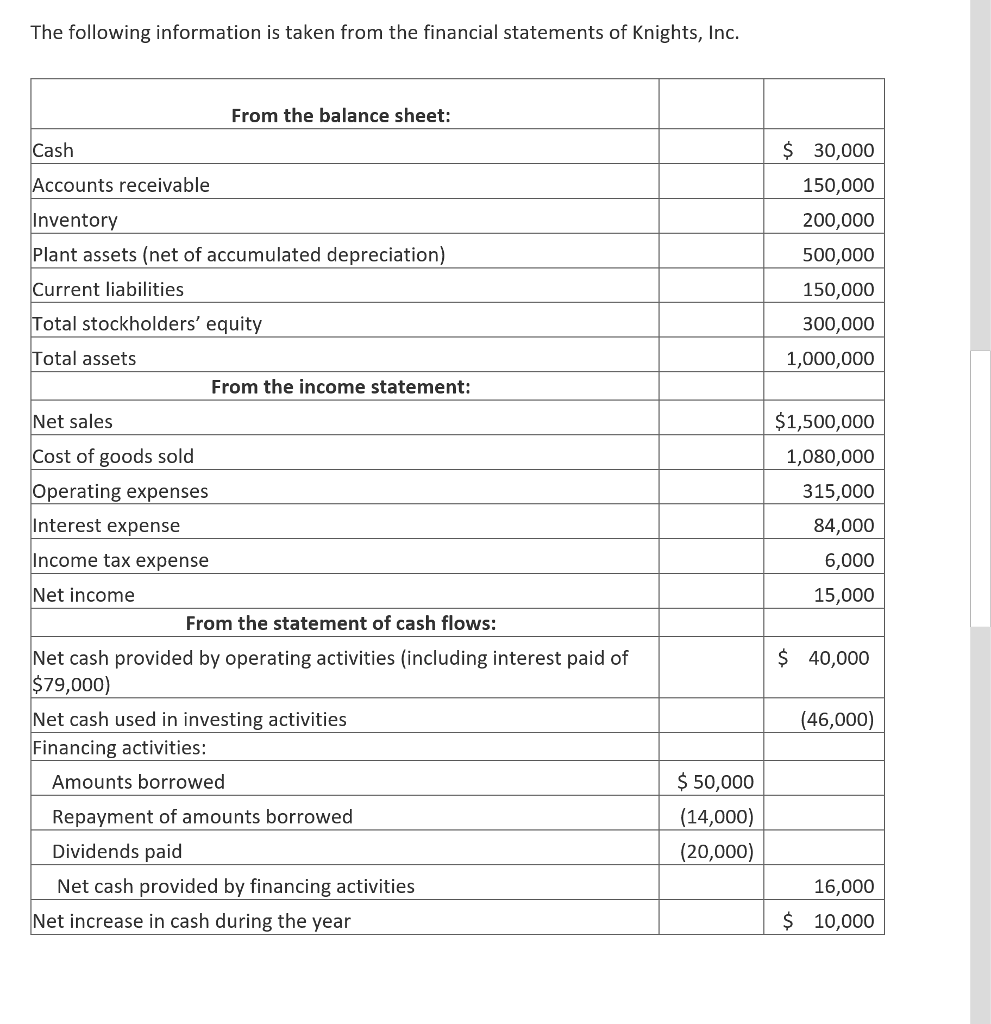

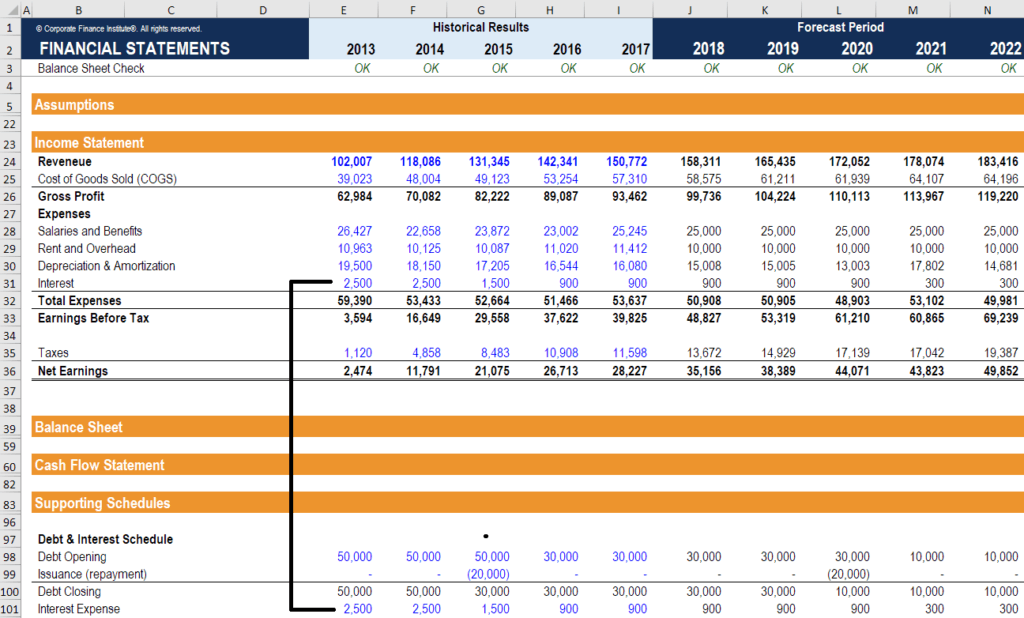

Interest Expense in a Monthly Financial Model (Cash Interest vs

Interest expense is documented in the financial records when a company incurs costs related to borrowing money. Interest expense represents the total cost of the interest, whereas interest payable is the account that records the unpaid balance of interest.

Solved Explain how the interest expense shown in the

Interest expense is documented in the financial records when a company incurs costs related to borrowing money. Interest expense represents the total cost of the interest, whereas interest payable is the account that records the unpaid balance of interest.

Interest Expense Term Glossary CSIMarket

Interest expense is documented in the financial records when a company incurs costs related to borrowing money. Interest expense represents the total cost of the interest, whereas interest payable is the account that records the unpaid balance of interest.

Interest Expense Calculate, Formula, How it Works

Interest expense is documented in the financial records when a company incurs costs related to borrowing money. Interest expense represents the total cost of the interest, whereas interest payable is the account that records the unpaid balance of interest.

Interest Expense in a Monthly Financial Model (Cash Interest vs

Interest expense is documented in the financial records when a company incurs costs related to borrowing money. Interest expense represents the total cost of the interest, whereas interest payable is the account that records the unpaid balance of interest.

Example Of Excel Expense Spreadsheet within Expenses Sheet Template

Interest expense represents the total cost of the interest, whereas interest payable is the account that records the unpaid balance of interest. Interest expense is documented in the financial records when a company incurs costs related to borrowing money.

Interest Expense in a Monthly Financial Model (Cash Interest vs

Interest expense is documented in the financial records when a company incurs costs related to borrowing money. Interest expense represents the total cost of the interest, whereas interest payable is the account that records the unpaid balance of interest.

Interest Expense Represents The Total Cost Of The Interest, Whereas Interest Payable Is The Account That Records The Unpaid Balance Of Interest.

Interest expense is documented in the financial records when a company incurs costs related to borrowing money.