Income Tax Payable Balance Sheet - The essential accounting for income taxes is to recognize tax liabilities for estimated income. See how income tax payable. How to account for income taxes. Learn how to determine the current taxes payable or refundable, deferred tax assets and liabilities, and rate reconciliation under fasb asc 740. Learn what income tax payable is, how it is calculated, and how it is presented in the balance sheet.

See how income tax payable. Learn what income tax payable is, how it is calculated, and how it is presented in the balance sheet. How to account for income taxes. Learn how to determine the current taxes payable or refundable, deferred tax assets and liabilities, and rate reconciliation under fasb asc 740. The essential accounting for income taxes is to recognize tax liabilities for estimated income.

See how income tax payable. The essential accounting for income taxes is to recognize tax liabilities for estimated income. Learn what income tax payable is, how it is calculated, and how it is presented in the balance sheet. How to account for income taxes. Learn how to determine the current taxes payable or refundable, deferred tax assets and liabilities, and rate reconciliation under fasb asc 740.

A Guide to Balance Sheets and Statements

See how income tax payable. How to account for income taxes. The essential accounting for income taxes is to recognize tax liabilities for estimated income. Learn how to determine the current taxes payable or refundable, deferred tax assets and liabilities, and rate reconciliation under fasb asc 740. Learn what income tax payable is, how it is calculated, and how it.

Here’s A Quick Way To Solve A Info About Statement Of Financial

See how income tax payable. Learn what income tax payable is, how it is calculated, and how it is presented in the balance sheet. The essential accounting for income taxes is to recognize tax liabilities for estimated income. Learn how to determine the current taxes payable or refundable, deferred tax assets and liabilities, and rate reconciliation under fasb asc 740..

38 Free Balance Sheet Templates & Examples ᐅ TemplateLab

The essential accounting for income taxes is to recognize tax liabilities for estimated income. See how income tax payable. How to account for income taxes. Learn how to determine the current taxes payable or refundable, deferred tax assets and liabilities, and rate reconciliation under fasb asc 740. Learn what income tax payable is, how it is calculated, and how it.

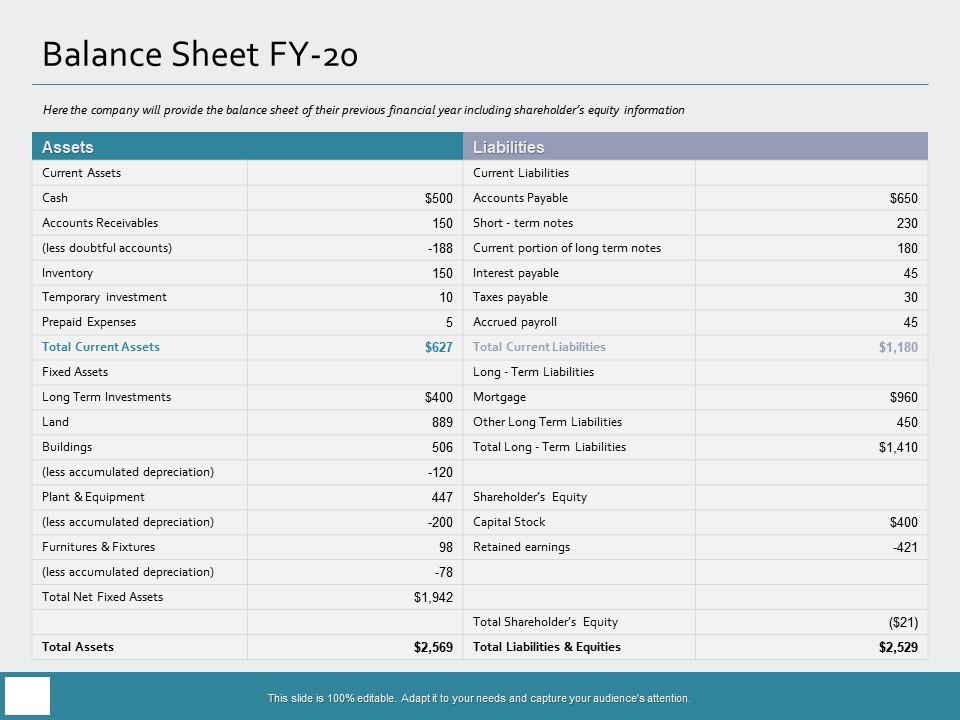

Balance Sheet FY 20 Taxes Payable Ppt Powerpoint Presentation Model

See how income tax payable. How to account for income taxes. The essential accounting for income taxes is to recognize tax liabilities for estimated income. Learn how to determine the current taxes payable or refundable, deferred tax assets and liabilities, and rate reconciliation under fasb asc 740. Learn what income tax payable is, how it is calculated, and how it.

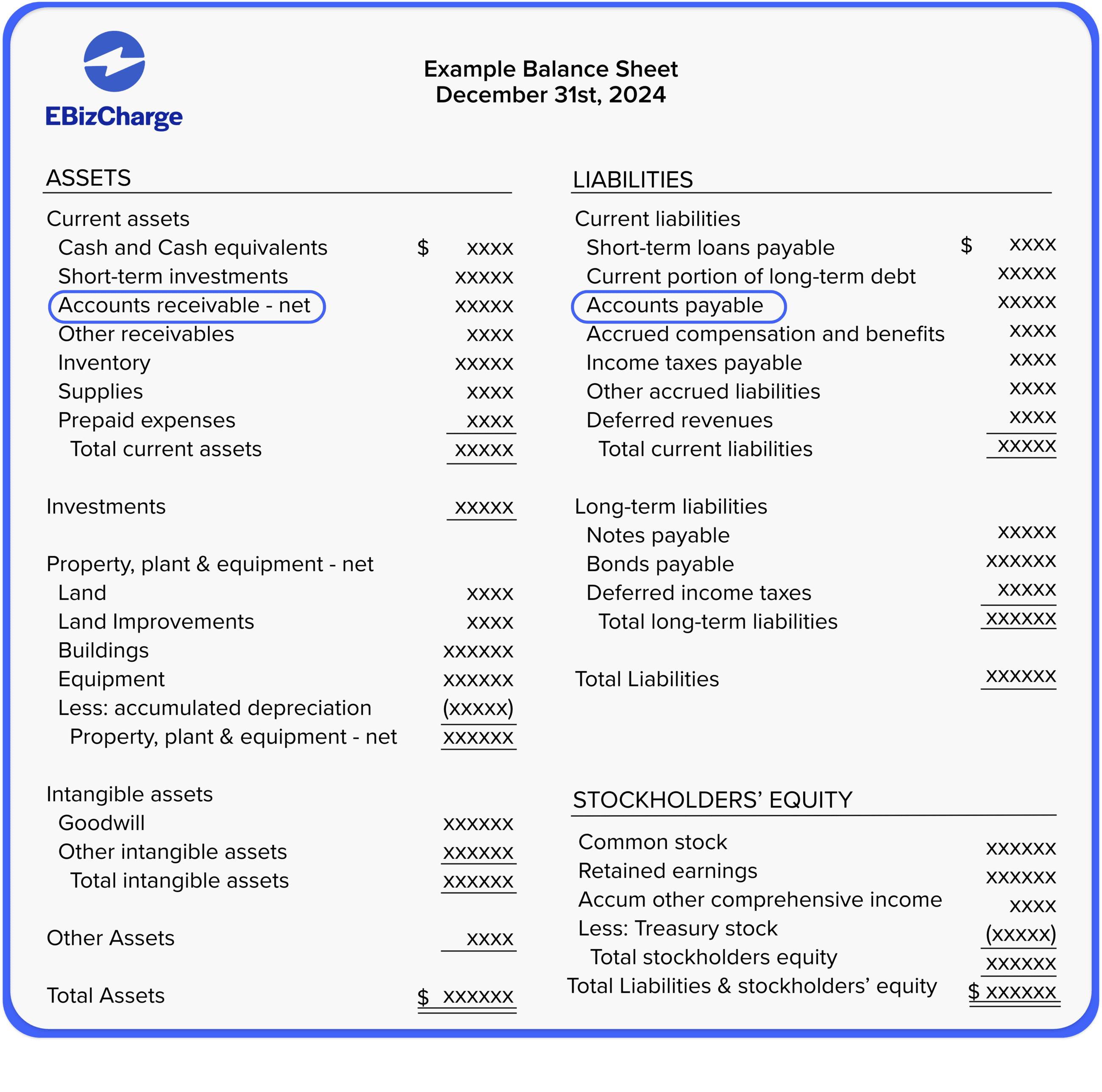

What are Accounts Receivable and Accounts Payable?

How to account for income taxes. Learn how to determine the current taxes payable or refundable, deferred tax assets and liabilities, and rate reconciliation under fasb asc 740. The essential accounting for income taxes is to recognize tax liabilities for estimated income. Learn what income tax payable is, how it is calculated, and how it is presented in the balance.

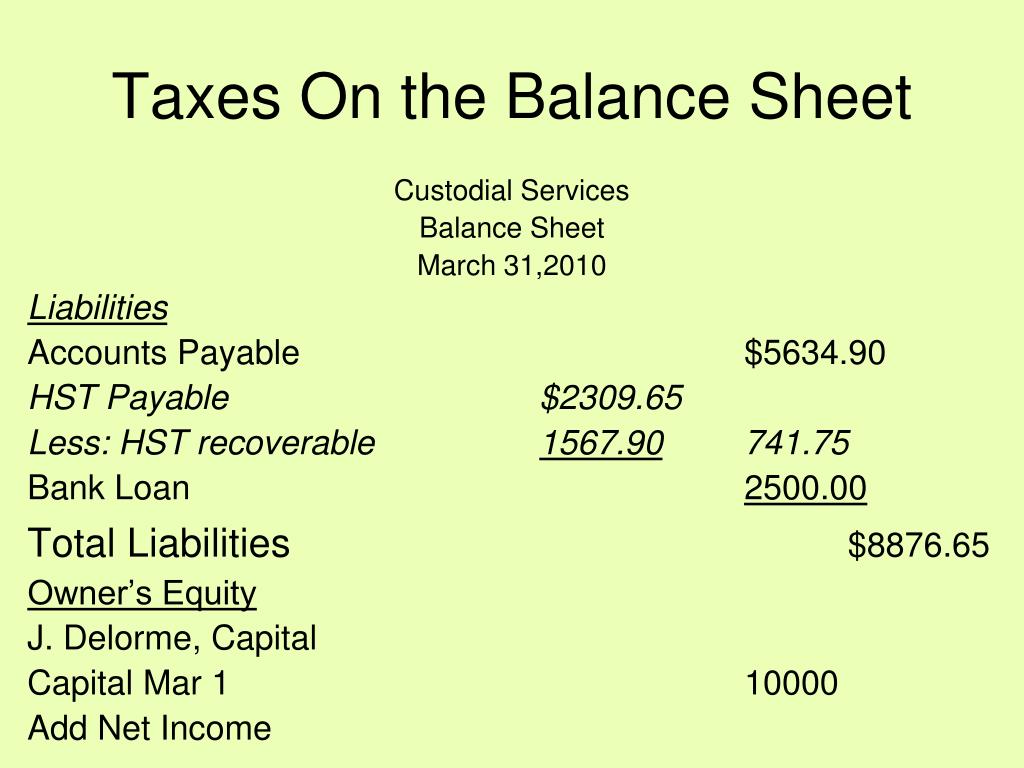

PPT Chapter 6 PowerPoint Presentation, free download ID6091035

Learn what income tax payable is, how it is calculated, and how it is presented in the balance sheet. The essential accounting for income taxes is to recognize tax liabilities for estimated income. See how income tax payable. Learn how to determine the current taxes payable or refundable, deferred tax assets and liabilities, and rate reconciliation under fasb asc 740..

How To Calculate Balance Sheet Net at Frank Leblanc blog

The essential accounting for income taxes is to recognize tax liabilities for estimated income. Learn what income tax payable is, how it is calculated, and how it is presented in the balance sheet. Learn how to determine the current taxes payable or refundable, deferred tax assets and liabilities, and rate reconciliation under fasb asc 740. See how income tax payable..

Taxes Payable on Balance Sheet Owing Taxes — 1099 Cafe

The essential accounting for income taxes is to recognize tax liabilities for estimated income. Learn what income tax payable is, how it is calculated, and how it is presented in the balance sheet. See how income tax payable. How to account for income taxes. Learn how to determine the current taxes payable or refundable, deferred tax assets and liabilities, and.

[Solved] . A comparative balance sheet and statement is shown

See how income tax payable. Learn what income tax payable is, how it is calculated, and how it is presented in the balance sheet. How to account for income taxes. Learn how to determine the current taxes payable or refundable, deferred tax assets and liabilities, and rate reconciliation under fasb asc 740. The essential accounting for income taxes is to.

What is accounts receivable? Definition and examples

How to account for income taxes. See how income tax payable. The essential accounting for income taxes is to recognize tax liabilities for estimated income. Learn how to determine the current taxes payable or refundable, deferred tax assets and liabilities, and rate reconciliation under fasb asc 740. Learn what income tax payable is, how it is calculated, and how it.

The Essential Accounting For Income Taxes Is To Recognize Tax Liabilities For Estimated Income.

Learn how to determine the current taxes payable or refundable, deferred tax assets and liabilities, and rate reconciliation under fasb asc 740. Learn what income tax payable is, how it is calculated, and how it is presented in the balance sheet. See how income tax payable. How to account for income taxes.