How Are Donations Recorded On A Balance Sheet - Accurate recording of donations is essential for preparing financial statements, such as the balance. Revenue is not reported on the balance sheet. Make 2 entries to record the transaction—debit an asset account, then credit. Where do donations go on a balance sheet? Contributions are recognized in the period that the simultaneous transfer of benefit occurs.

Make 2 entries to record the transaction—debit an asset account, then credit. Where do donations go on a balance sheet? Revenue is not reported on the balance sheet. Accurate recording of donations is essential for preparing financial statements, such as the balance. Contributions are recognized in the period that the simultaneous transfer of benefit occurs.

Make 2 entries to record the transaction—debit an asset account, then credit. Contributions are recognized in the period that the simultaneous transfer of benefit occurs. Revenue is not reported on the balance sheet. Accurate recording of donations is essential for preparing financial statements, such as the balance. Where do donations go on a balance sheet?

Statement of Financial Position Reading a Nonprofit Balance Sheet

Contributions are recognized in the period that the simultaneous transfer of benefit occurs. Make 2 entries to record the transaction—debit an asset account, then credit. Where do donations go on a balance sheet? Revenue is not reported on the balance sheet. Accurate recording of donations is essential for preparing financial statements, such as the balance.

How to Prepare Charitable Trust Balance Sheet Format in Excel

Revenue is not reported on the balance sheet. Make 2 entries to record the transaction—debit an asset account, then credit. Accurate recording of donations is essential for preparing financial statements, such as the balance. Where do donations go on a balance sheet? Contributions are recognized in the period that the simultaneous transfer of benefit occurs.

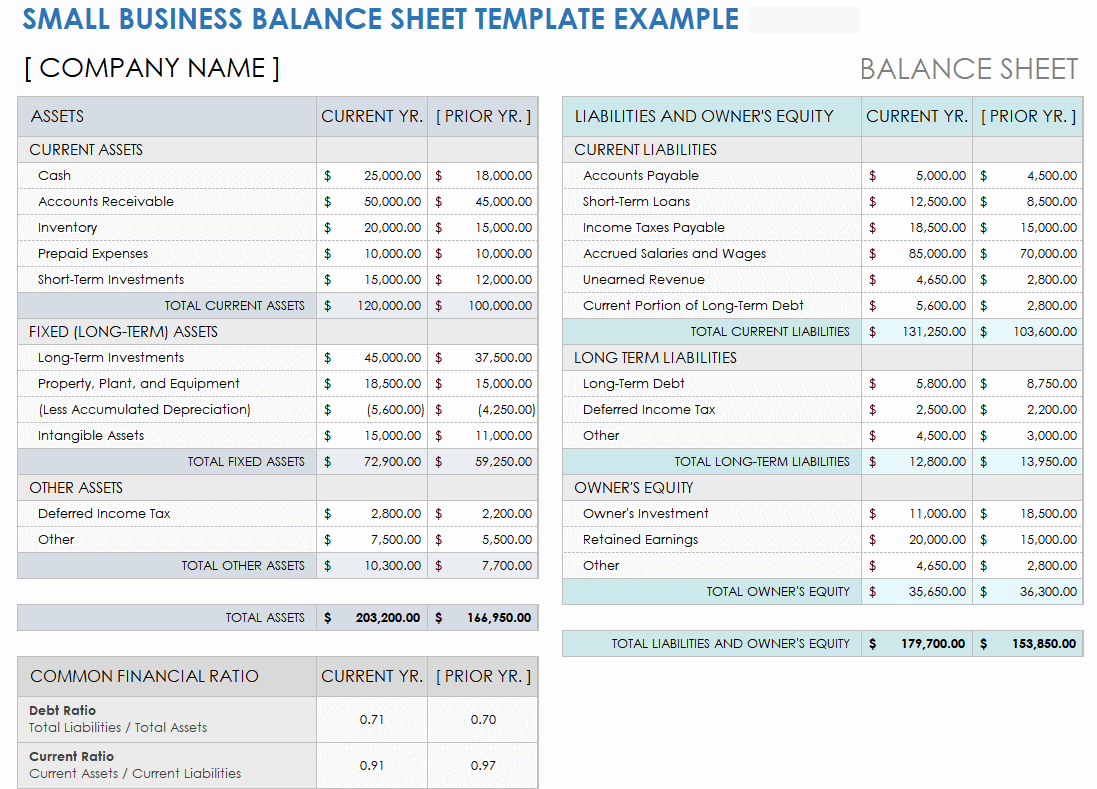

Free Small Business Balance Sheet Templates Smartsheet

Where do donations go on a balance sheet? Contributions are recognized in the period that the simultaneous transfer of benefit occurs. Revenue is not reported on the balance sheet. Make 2 entries to record the transaction—debit an asset account, then credit. Accurate recording of donations is essential for preparing financial statements, such as the balance.

Is a snapshot of organizational assets and liabilities?

Contributions are recognized in the period that the simultaneous transfer of benefit occurs. Where do donations go on a balance sheet? Accurate recording of donations is essential for preparing financial statements, such as the balance. Revenue is not reported on the balance sheet. Make 2 entries to record the transaction—debit an asset account, then credit.

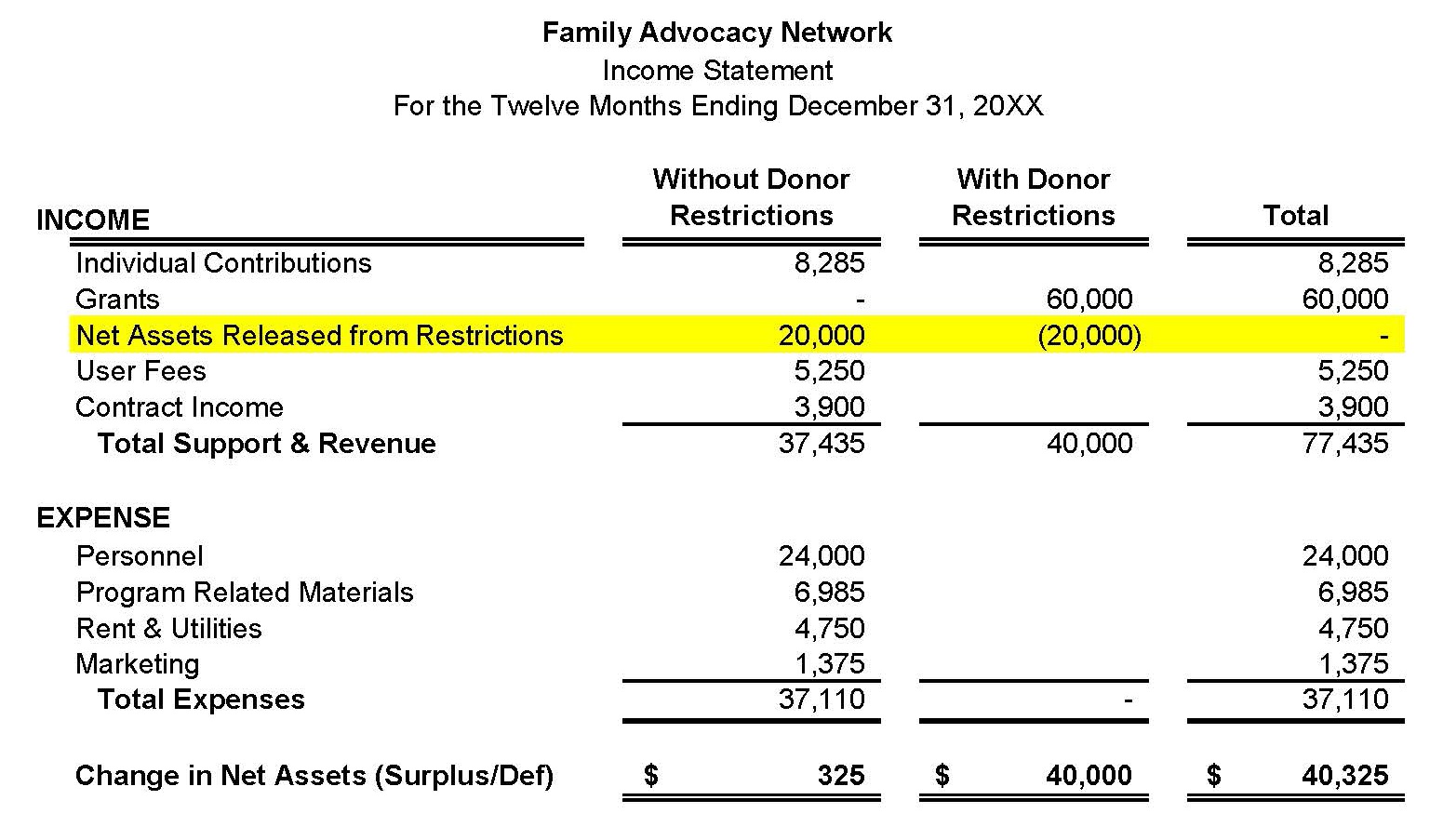

Managing Restricted Funds Propel

Make 2 entries to record the transaction—debit an asset account, then credit. Revenue is not reported on the balance sheet. Accurate recording of donations is essential for preparing financial statements, such as the balance. Contributions are recognized in the period that the simultaneous transfer of benefit occurs. Where do donations go on a balance sheet?

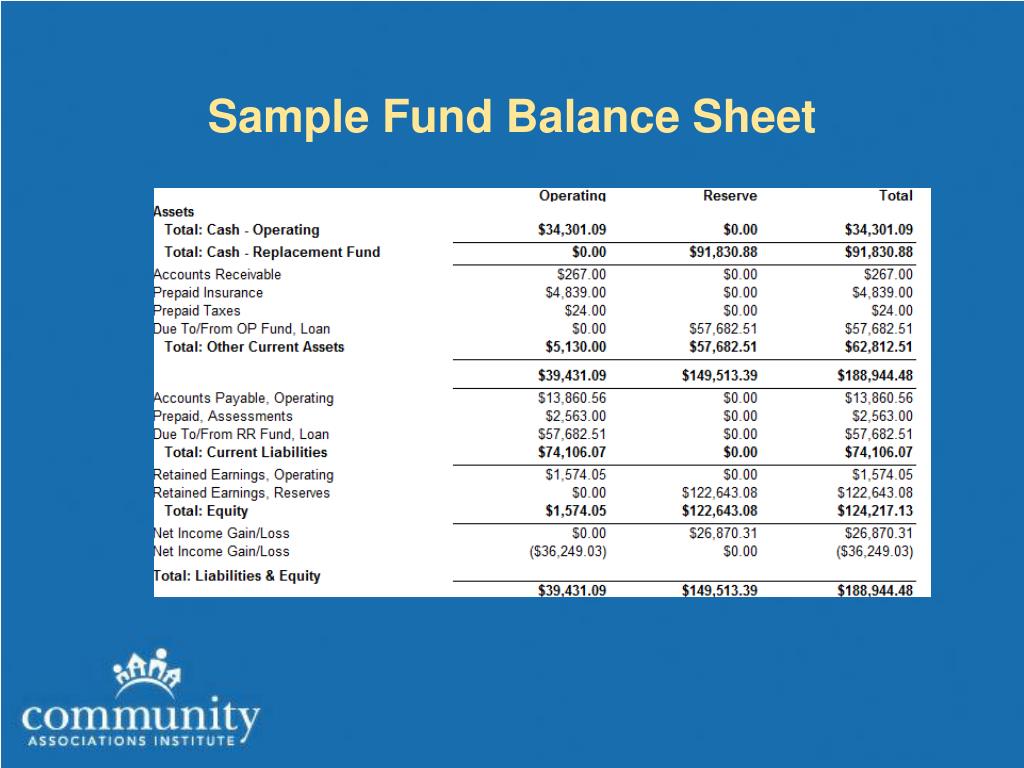

PPT Budgets & Reserve Contributions PowerPoint Presentation, free

Make 2 entries to record the transaction—debit an asset account, then credit. Contributions are recognized in the period that the simultaneous transfer of benefit occurs. Revenue is not reported on the balance sheet. Where do donations go on a balance sheet? Accurate recording of donations is essential for preparing financial statements, such as the balance.

A Detailed Guide on Nonprofit Balance Sheets [+Sample]

Contributions are recognized in the period that the simultaneous transfer of benefit occurs. Make 2 entries to record the transaction—debit an asset account, then credit. Accurate recording of donations is essential for preparing financial statements, such as the balance. Revenue is not reported on the balance sheet. Where do donations go on a balance sheet?

How Are Donations Recorded on a Balance Sheet Full Guide

Accurate recording of donations is essential for preparing financial statements, such as the balance. Where do donations go on a balance sheet? Make 2 entries to record the transaction—debit an asset account, then credit. Revenue is not reported on the balance sheet. Contributions are recognized in the period that the simultaneous transfer of benefit occurs.

Balance Sheet Template For Non Profit Organization

Make 2 entries to record the transaction—debit an asset account, then credit. Revenue is not reported on the balance sheet. Accurate recording of donations is essential for preparing financial statements, such as the balance. Contributions are recognized in the period that the simultaneous transfer of benefit occurs. Where do donations go on a balance sheet?

6+ Sample Donation Sheets Sample Templates

Where do donations go on a balance sheet? Contributions are recognized in the period that the simultaneous transfer of benefit occurs. Accurate recording of donations is essential for preparing financial statements, such as the balance. Revenue is not reported on the balance sheet. Make 2 entries to record the transaction—debit an asset account, then credit.

Revenue Is Not Reported On The Balance Sheet.

Where do donations go on a balance sheet? Make 2 entries to record the transaction—debit an asset account, then credit. Accurate recording of donations is essential for preparing financial statements, such as the balance. Contributions are recognized in the period that the simultaneous transfer of benefit occurs.

![A Detailed Guide on Nonprofit Balance Sheets [+Sample]](https://donorbox.org/nonprofit-blog/wp-content/uploads/2022/10/word-image-55267-3.png)