Examples Of Liabilities In Balance Sheet - Liabilities are settled over time through the transfer of economic benefits including money, goods, or services. On the balance sheet, the liabilities. T he assets and liabilities are separated into two. On the right side, the balance sheet outlines the company’s liabilities and shareholders’ equity. What are the different types of liabilities on the balance sheet? Most businesses will organize the liabilities on their balance sheet under two separate headings:

T he assets and liabilities are separated into two. On the right side, the balance sheet outlines the company’s liabilities and shareholders’ equity. What are the different types of liabilities on the balance sheet? Most businesses will organize the liabilities on their balance sheet under two separate headings: Liabilities are settled over time through the transfer of economic benefits including money, goods, or services. On the balance sheet, the liabilities.

Most businesses will organize the liabilities on their balance sheet under two separate headings: Liabilities are settled over time through the transfer of economic benefits including money, goods, or services. What are the different types of liabilities on the balance sheet? On the balance sheet, the liabilities. On the right side, the balance sheet outlines the company’s liabilities and shareholders’ equity. T he assets and liabilities are separated into two.

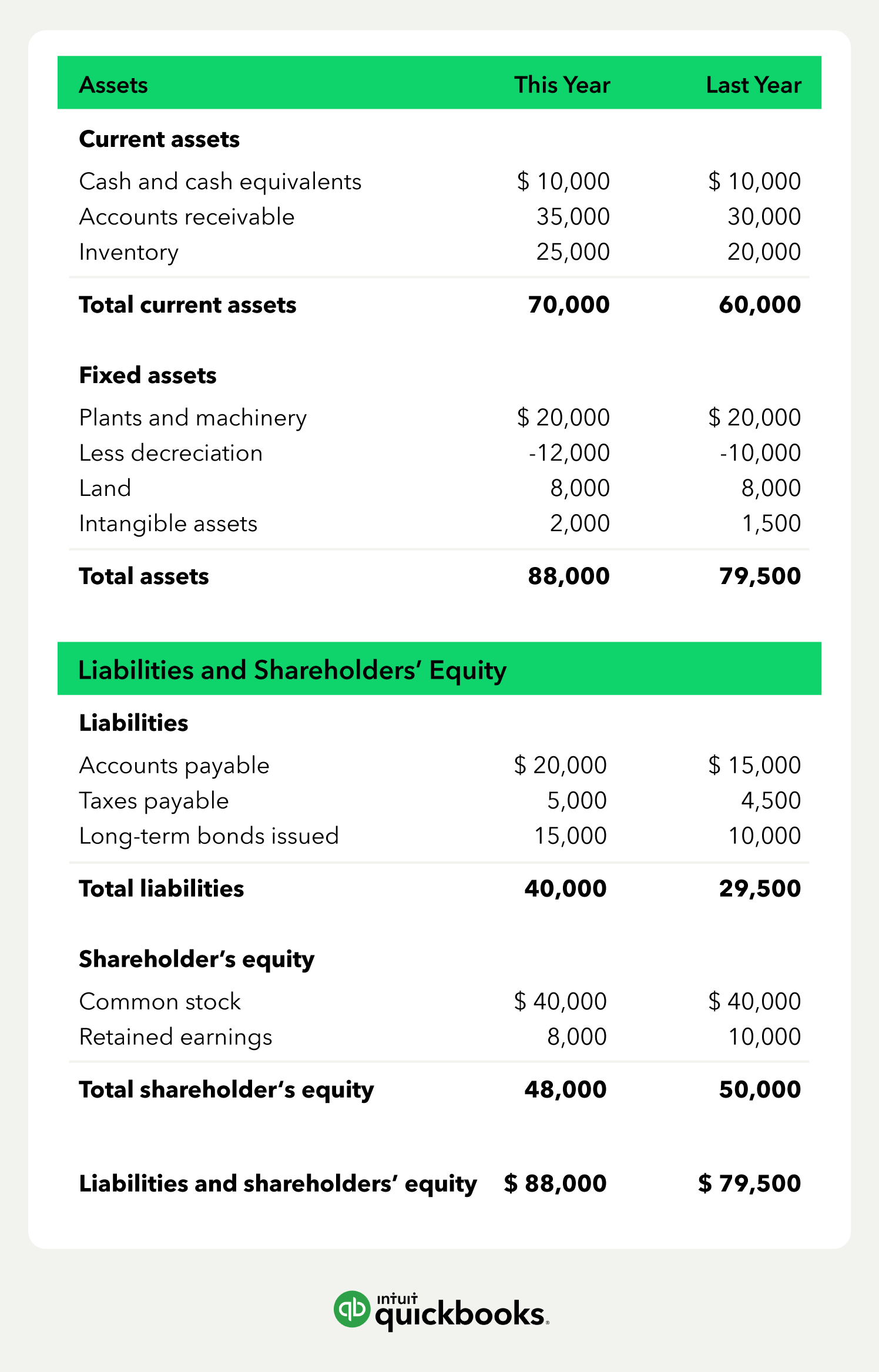

How to Read & Prepare a Balance Sheet QuickBooks

What are the different types of liabilities on the balance sheet? Liabilities are settled over time through the transfer of economic benefits including money, goods, or services. Most businesses will organize the liabilities on their balance sheet under two separate headings: On the balance sheet, the liabilities. T he assets and liabilities are separated into two.

Best Warranty Liabilities On Balance Sheet And Statement Example

Liabilities are settled over time through the transfer of economic benefits including money, goods, or services. What are the different types of liabilities on the balance sheet? On the balance sheet, the liabilities. T he assets and liabilities are separated into two. On the right side, the balance sheet outlines the company’s liabilities and shareholders’ equity.

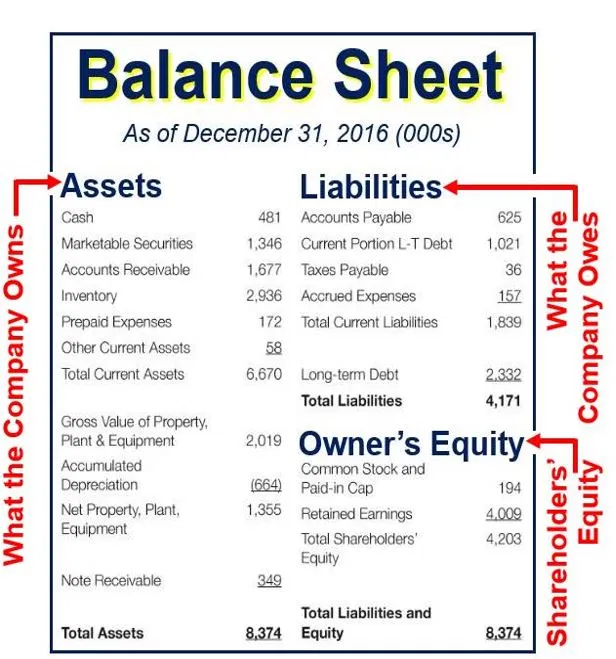

Balance Sheets 101 Understanding Assets, Liabilities and Equity HBX

Liabilities are settled over time through the transfer of economic benefits including money, goods, or services. On the right side, the balance sheet outlines the company’s liabilities and shareholders’ equity. T he assets and liabilities are separated into two. Most businesses will organize the liabilities on their balance sheet under two separate headings: What are the different types of liabilities.

Best Warranty Liabilities On Balance Sheet And Statement Example

What are the different types of liabilities on the balance sheet? On the balance sheet, the liabilities. On the right side, the balance sheet outlines the company’s liabilities and shareholders’ equity. Most businesses will organize the liabilities on their balance sheet under two separate headings: T he assets and liabilities are separated into two.

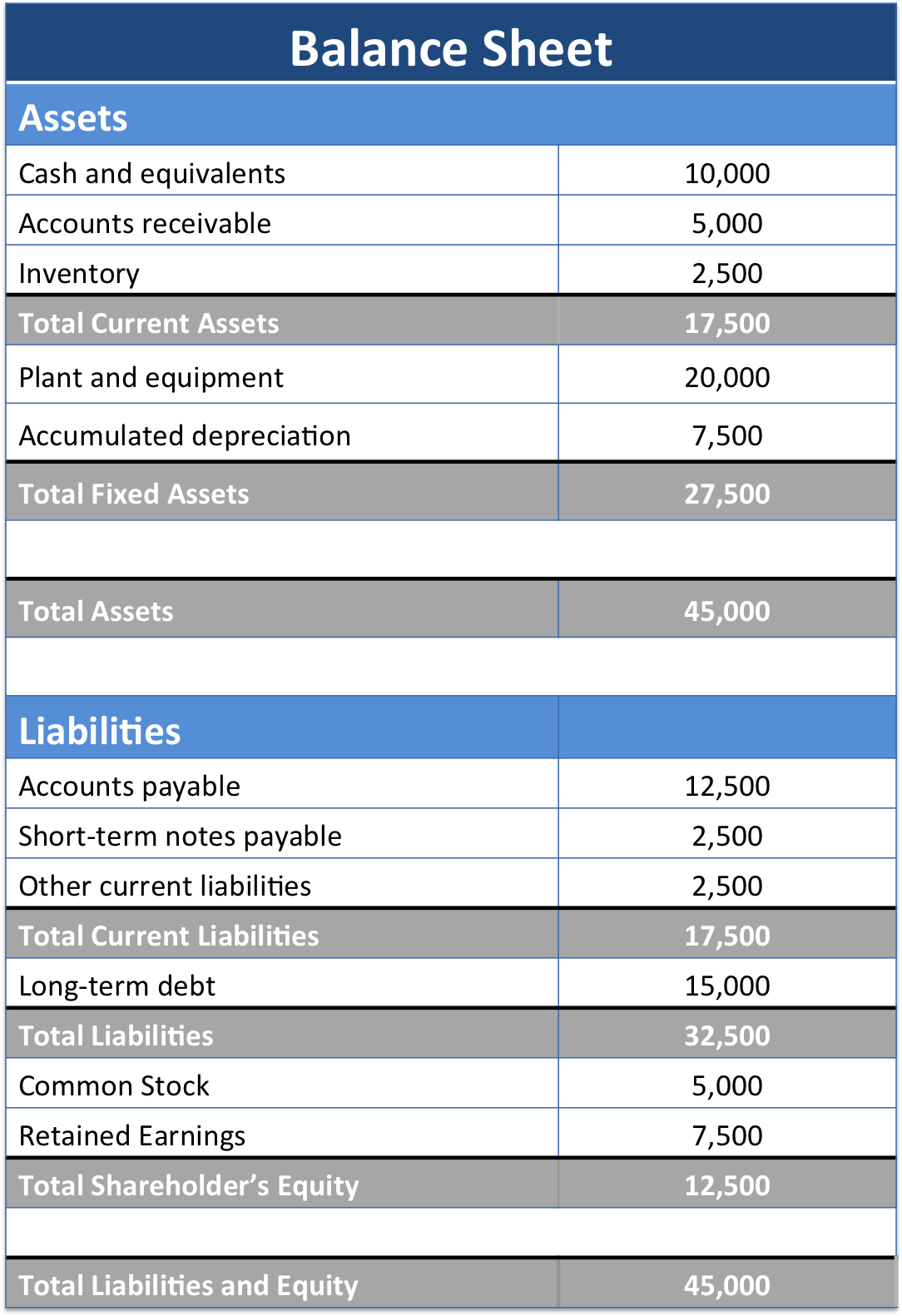

Balance sheet example track assets and liabilities

Most businesses will organize the liabilities on their balance sheet under two separate headings: What are the different types of liabilities on the balance sheet? On the balance sheet, the liabilities. T he assets and liabilities are separated into two. Liabilities are settled over time through the transfer of economic benefits including money, goods, or services.

Liabilities How to classify, Track and calculate liabilities?

What are the different types of liabilities on the balance sheet? On the balance sheet, the liabilities. T he assets and liabilities are separated into two. Liabilities are settled over time through the transfer of economic benefits including money, goods, or services. On the right side, the balance sheet outlines the company’s liabilities and shareholders’ equity.

Long Term Liabilities Balance Sheet

Most businesses will organize the liabilities on their balance sheet under two separate headings: What are the different types of liabilities on the balance sheet? T he assets and liabilities are separated into two. On the right side, the balance sheet outlines the company’s liabilities and shareholders’ equity. On the balance sheet, the liabilities.

Balance Sheet Example and Definition—What Is a Balance Sheet?

What are the different types of liabilities on the balance sheet? On the balance sheet, the liabilities. Liabilities are settled over time through the transfer of economic benefits including money, goods, or services. T he assets and liabilities are separated into two. On the right side, the balance sheet outlines the company’s liabilities and shareholders’ equity.

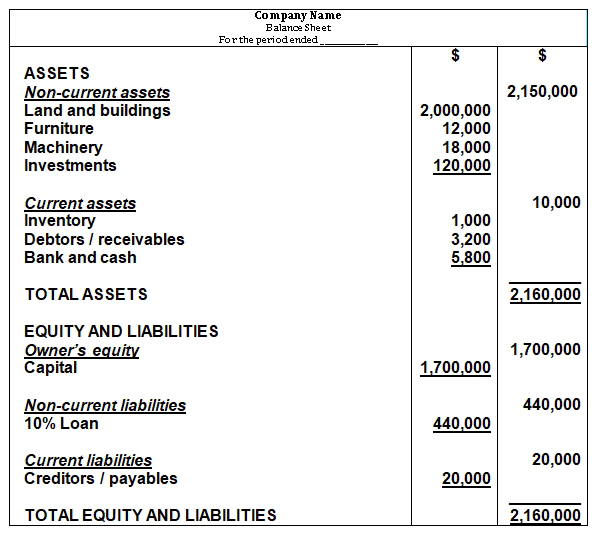

Balance Sheet Explained Structure, Assets, Liabilities with Examples

T he assets and liabilities are separated into two. On the right side, the balance sheet outlines the company’s liabilities and shareholders’ equity. What are the different types of liabilities on the balance sheet? Liabilities are settled over time through the transfer of economic benefits including money, goods, or services. Most businesses will organize the liabilities on their balance sheet.

How to Read a Balance Sheet (Free Download) Poindexter Blog

On the right side, the balance sheet outlines the company’s liabilities and shareholders’ equity. Most businesses will organize the liabilities on their balance sheet under two separate headings: T he assets and liabilities are separated into two. What are the different types of liabilities on the balance sheet? Liabilities are settled over time through the transfer of economic benefits including.

Most Businesses Will Organize The Liabilities On Their Balance Sheet Under Two Separate Headings:

Liabilities are settled over time through the transfer of economic benefits including money, goods, or services. On the balance sheet, the liabilities. What are the different types of liabilities on the balance sheet? T he assets and liabilities are separated into two.

/dotdash_Final_Liability_Definition_Aug_2020-01-5c53eb9b2a12410c92009f6525b70e7a.jpg)