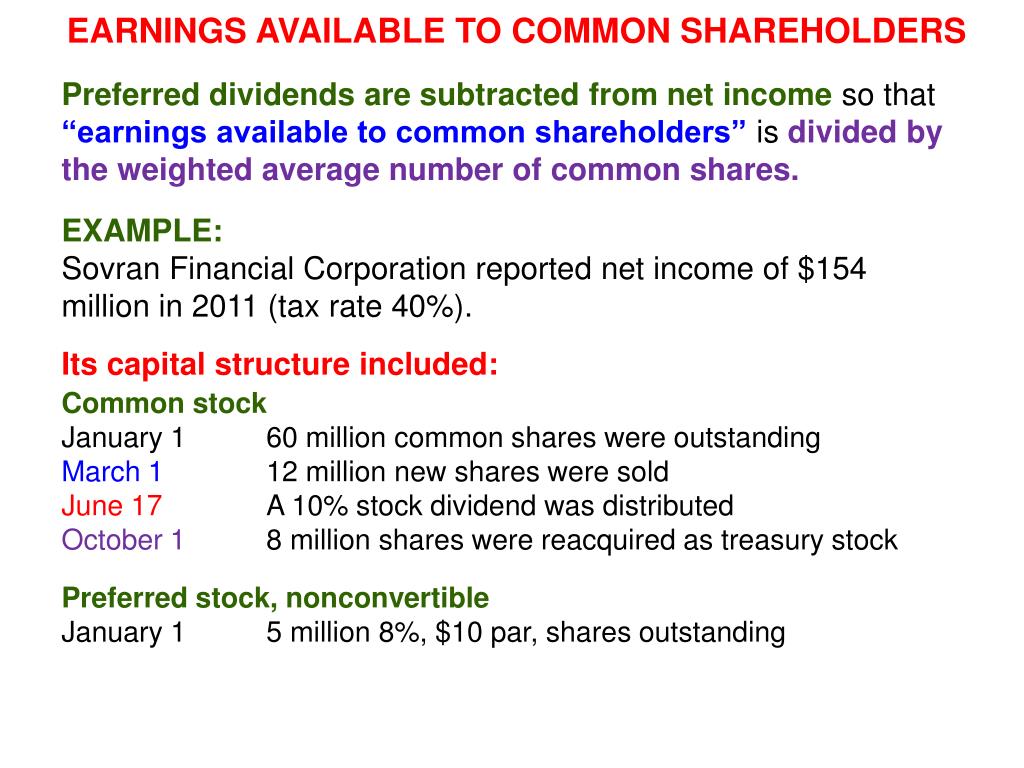

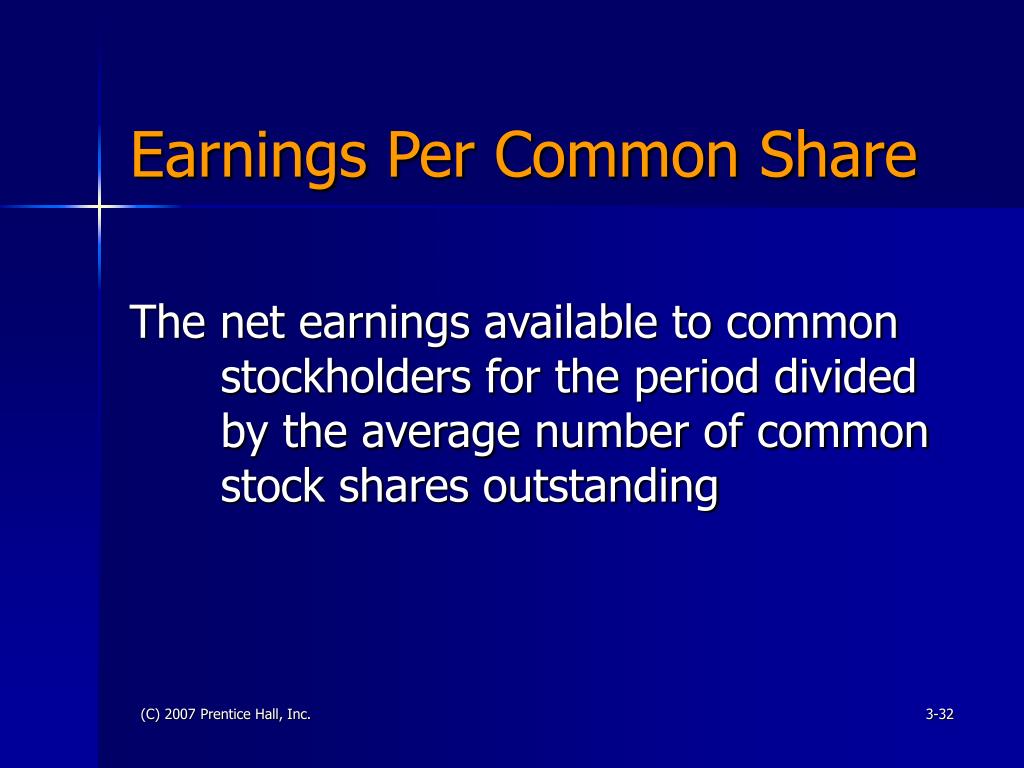

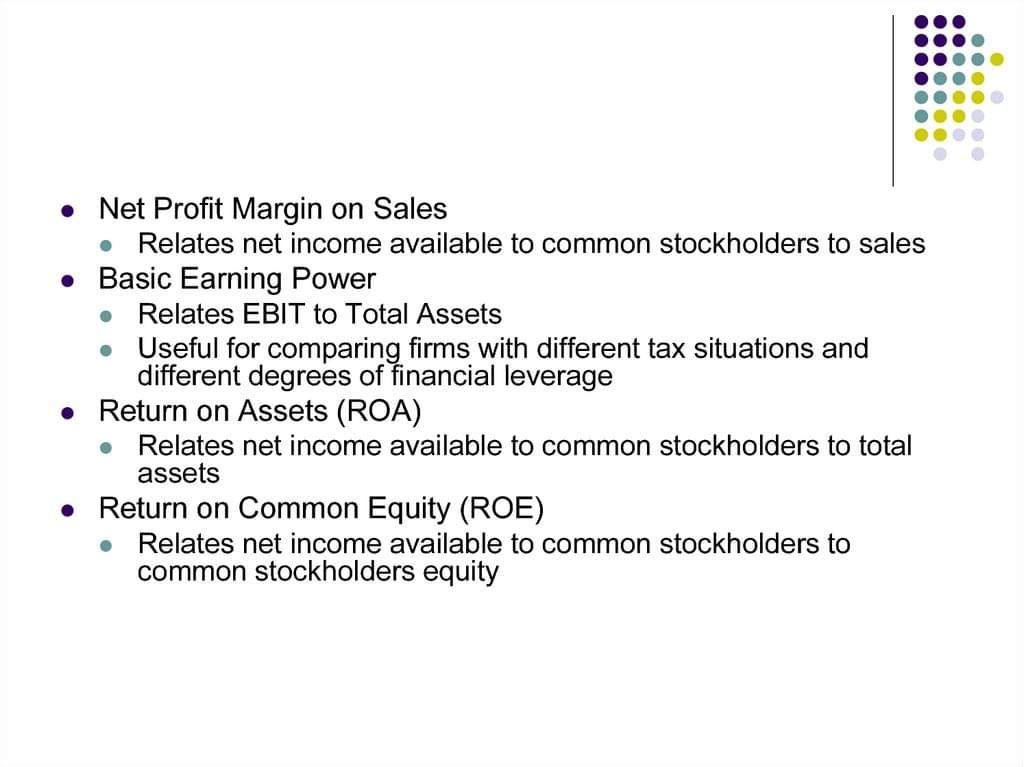

Earnings Available To Common Shareholders - The company's tax rate is 40%. At the beginning of the year, 200 million common. The retained earnings account on the corporate balance sheet is the source of earnings available for common stockholders. Factors in both cumulative & noncumulative dividends. Salt company reports net income of $360 million for 2017; Calculate earnings per share by subtracting preferred stock dividends from income.

Calculate earnings per share by subtracting preferred stock dividends from income. The company's tax rate is 40%. At the beginning of the year, 200 million common. The retained earnings account on the corporate balance sheet is the source of earnings available for common stockholders. Salt company reports net income of $360 million for 2017; Factors in both cumulative & noncumulative dividends.

Salt company reports net income of $360 million for 2017; The retained earnings account on the corporate balance sheet is the source of earnings available for common stockholders. Factors in both cumulative & noncumulative dividends. Calculate earnings per share by subtracting preferred stock dividends from income. At the beginning of the year, 200 million common. The company's tax rate is 40%.

Reporting and Analyzing Shareholders’ Equity ppt download

Salt company reports net income of $360 million for 2017; Calculate earnings per share by subtracting preferred stock dividends from income. The company's tax rate is 40%. Factors in both cumulative & noncumulative dividends. At the beginning of the year, 200 million common.

ShareBased Compensation and Earnings Per Share ppt download

The retained earnings account on the corporate balance sheet is the source of earnings available for common stockholders. Factors in both cumulative & noncumulative dividends. At the beginning of the year, 200 million common. The company's tax rate is 40%. Calculate earnings per share by subtracting preferred stock dividends from income.

PPT Chapter 19 ShareBased Compensation ASC 718 (SFAS 123R

The retained earnings account on the corporate balance sheet is the source of earnings available for common stockholders. The company's tax rate is 40%. Salt company reports net income of $360 million for 2017; Calculate earnings per share by subtracting preferred stock dividends from income. Factors in both cumulative & noncumulative dividends.

What are Earnings Available for Common Stockholders? SuperfastCPA CPA

Calculate earnings per share by subtracting preferred stock dividends from income. Factors in both cumulative & noncumulative dividends. The retained earnings account on the corporate balance sheet is the source of earnings available for common stockholders. The company's tax rate is 40%. Salt company reports net income of $360 million for 2017;

PPT Statement and Statement of Stockholders’ Equity PowerPoint

The retained earnings account on the corporate balance sheet is the source of earnings available for common stockholders. Factors in both cumulative & noncumulative dividends. At the beginning of the year, 200 million common. Calculate earnings per share by subtracting preferred stock dividends from income. The company's tax rate is 40%.

Chapter 19 ShareBased Compensation ASC 718 (SFAS 123R) ppt download

The company's tax rate is 40%. Calculate earnings per share by subtracting preferred stock dividends from income. At the beginning of the year, 200 million common. Salt company reports net income of $360 million for 2017; The retained earnings account on the corporate balance sheet is the source of earnings available for common stockholders.

How to Find Net After Tax on a Balance Sheet AccountingCoaching

Salt company reports net income of $360 million for 2017; Calculate earnings per share by subtracting preferred stock dividends from income. The retained earnings account on the corporate balance sheet is the source of earnings available for common stockholders. The company's tax rate is 40%. At the beginning of the year, 200 million common.

Reporting and Analyzing Shareholders’ Equity ppt download

The company's tax rate is 40%. Salt company reports net income of $360 million for 2017; Factors in both cumulative & noncumulative dividends. At the beginning of the year, 200 million common. The retained earnings account on the corporate balance sheet is the source of earnings available for common stockholders.

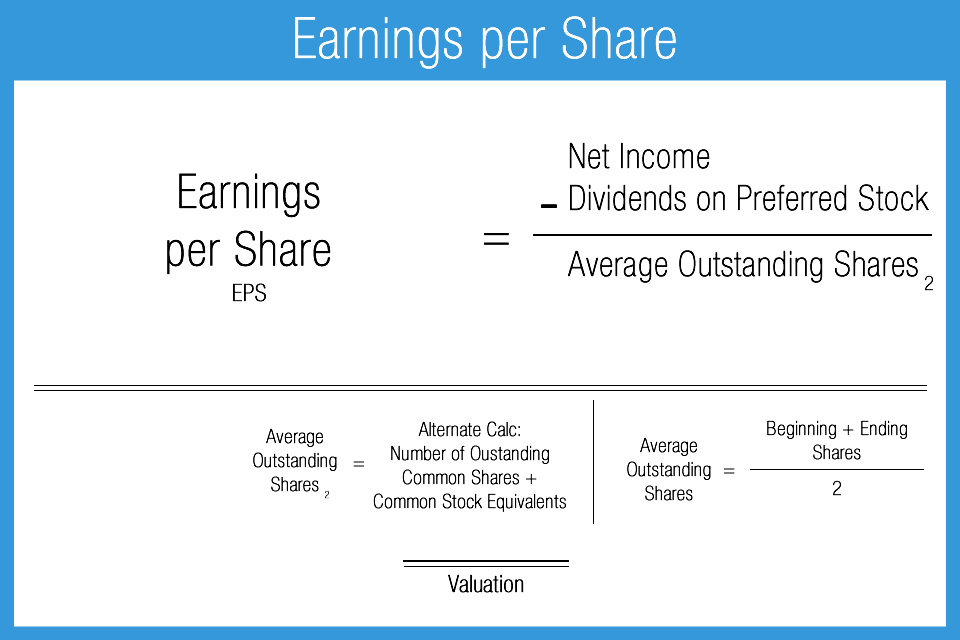

Earnings per Share Accounting Play

The retained earnings account on the corporate balance sheet is the source of earnings available for common stockholders. Salt company reports net income of $360 million for 2017; At the beginning of the year, 200 million common. Factors in both cumulative & noncumulative dividends. Calculate earnings per share by subtracting preferred stock dividends from income.

Module 9 Earnings per share ppt download

The retained earnings account on the corporate balance sheet is the source of earnings available for common stockholders. Salt company reports net income of $360 million for 2017; The company's tax rate is 40%. Factors in both cumulative & noncumulative dividends. At the beginning of the year, 200 million common.

The Retained Earnings Account On The Corporate Balance Sheet Is The Source Of Earnings Available For Common Stockholders.

Factors in both cumulative & noncumulative dividends. The company's tax rate is 40%. Salt company reports net income of $360 million for 2017; Calculate earnings per share by subtracting preferred stock dividends from income.