Drawings On A Balance Sheet - Drawings in accounting are when money is taken out of the business for personal use for a sole trader or partnership withdrawal of owner’s. In accounting, assets such as cash or goods which are withdrawn from a business by the owner(s) for their personal.

Drawings in accounting are when money is taken out of the business for personal use for a sole trader or partnership withdrawal of owner’s. In accounting, assets such as cash or goods which are withdrawn from a business by the owner(s) for their personal.

Drawings in accounting are when money is taken out of the business for personal use for a sole trader or partnership withdrawal of owner’s. In accounting, assets such as cash or goods which are withdrawn from a business by the owner(s) for their personal.

The taxonomic structure of the balance sheet Download Scientific Diagram

In accounting, assets such as cash or goods which are withdrawn from a business by the owner(s) for their personal. Drawings in accounting are when money is taken out of the business for personal use for a sole trader or partnership withdrawal of owner’s.

image

In accounting, assets such as cash or goods which are withdrawn from a business by the owner(s) for their personal. Drawings in accounting are when money is taken out of the business for personal use for a sole trader or partnership withdrawal of owner’s.

Balance Sheet Example For Students at Lori Bell blog

In accounting, assets such as cash or goods which are withdrawn from a business by the owner(s) for their personal. Drawings in accounting are when money is taken out of the business for personal use for a sole trader or partnership withdrawal of owner’s.

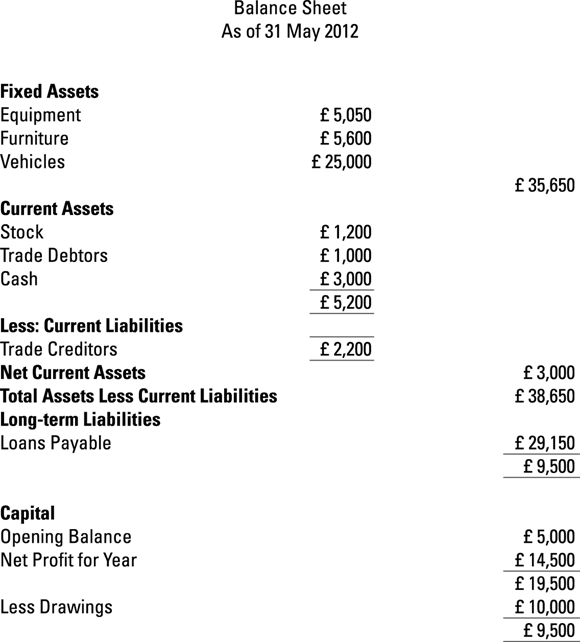

Drawing up P&L and Balance Sheet YouTube

Drawings in accounting are when money is taken out of the business for personal use for a sole trader or partnership withdrawal of owner’s. In accounting, assets such as cash or goods which are withdrawn from a business by the owner(s) for their personal.

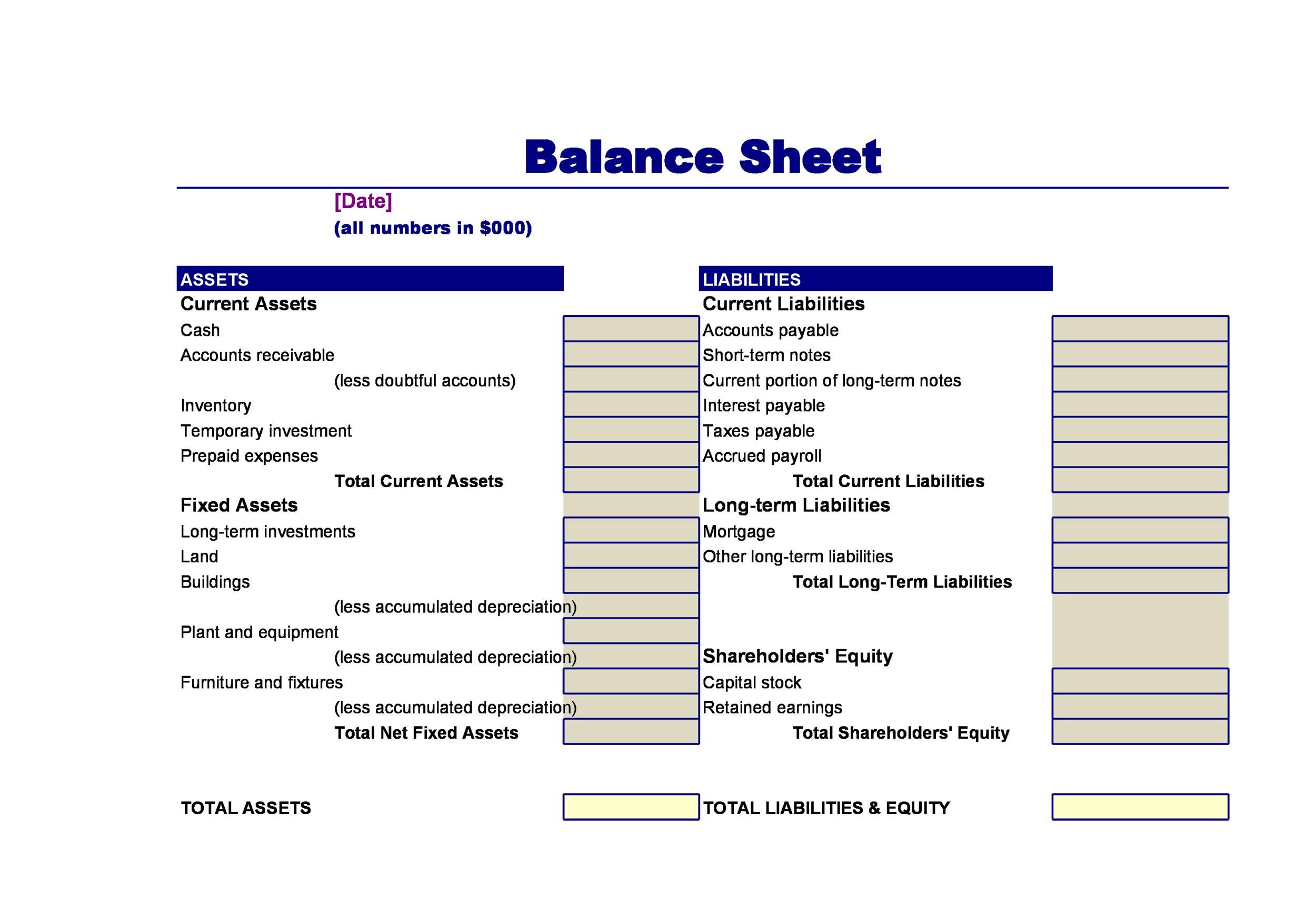

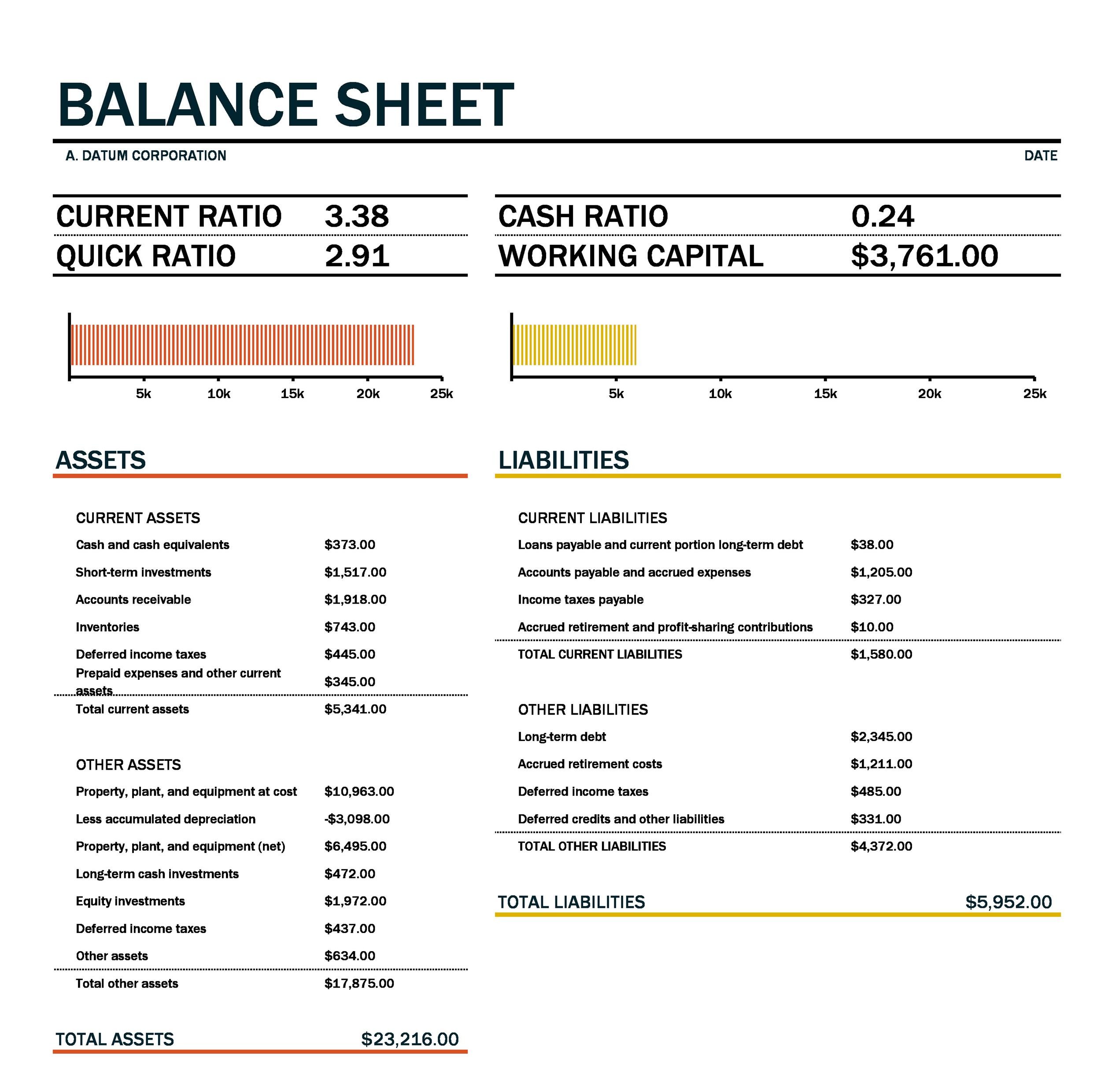

38 Free Balance Sheet Templates & Examples Template Lab

Drawings in accounting are when money is taken out of the business for personal use for a sole trader or partnership withdrawal of owner’s. In accounting, assets such as cash or goods which are withdrawn from a business by the owner(s) for their personal.

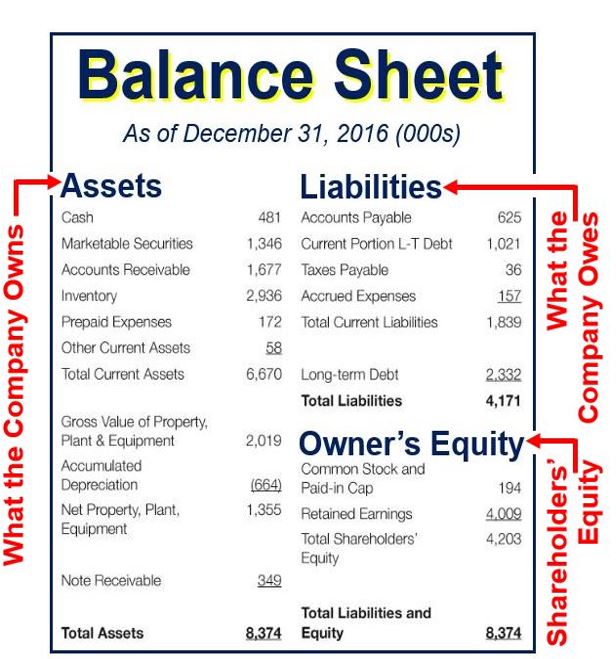

How to Read a Balance Sheet Bench Accounting

In accounting, assets such as cash or goods which are withdrawn from a business by the owner(s) for their personal. Drawings in accounting are when money is taken out of the business for personal use for a sole trader or partnership withdrawal of owner’s.

Balance Sheet Business Literacy Institute Financial Intelligence

In accounting, assets such as cash or goods which are withdrawn from a business by the owner(s) for their personal. Drawings in accounting are when money is taken out of the business for personal use for a sole trader or partnership withdrawal of owner’s.

38 Free Balance Sheet Templates & Examples ᐅ TemplateLab

In accounting, assets such as cash or goods which are withdrawn from a business by the owner(s) for their personal. Drawings in accounting are when money is taken out of the business for personal use for a sole trader or partnership withdrawal of owner’s.

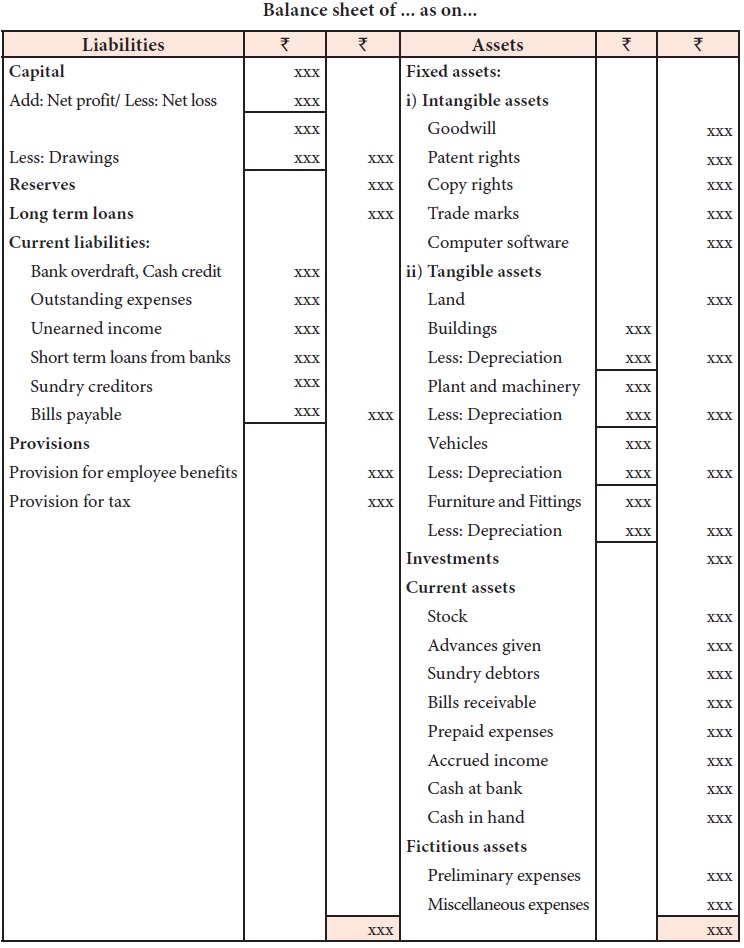

Balance sheet Need for preparing, Methods of drafting, Preparation

In accounting, assets such as cash or goods which are withdrawn from a business by the owner(s) for their personal. Drawings in accounting are when money is taken out of the business for personal use for a sole trader or partnership withdrawal of owner’s.

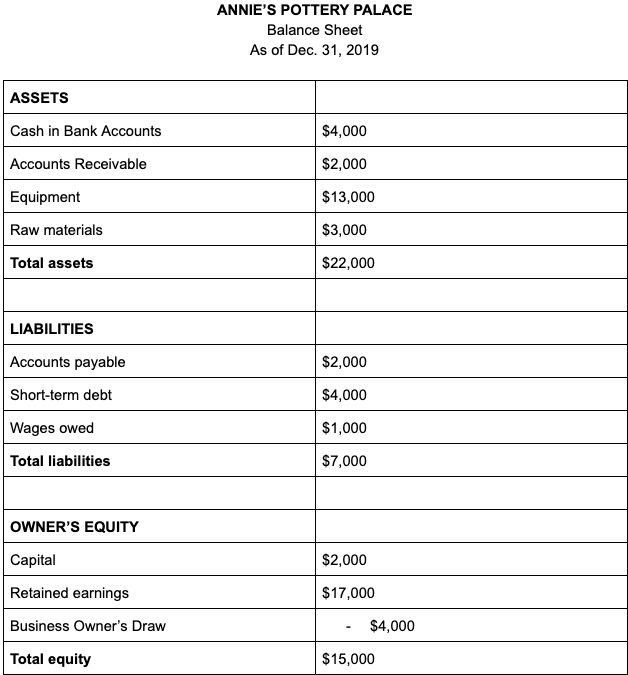

Expert Advice on How to Make a Balance Sheet for Accounting

Drawings in accounting are when money is taken out of the business for personal use for a sole trader or partnership withdrawal of owner’s. In accounting, assets such as cash or goods which are withdrawn from a business by the owner(s) for their personal.

In Accounting, Assets Such As Cash Or Goods Which Are Withdrawn From A Business By The Owner(S) For Their Personal.

Drawings in accounting are when money is taken out of the business for personal use for a sole trader or partnership withdrawal of owner’s.