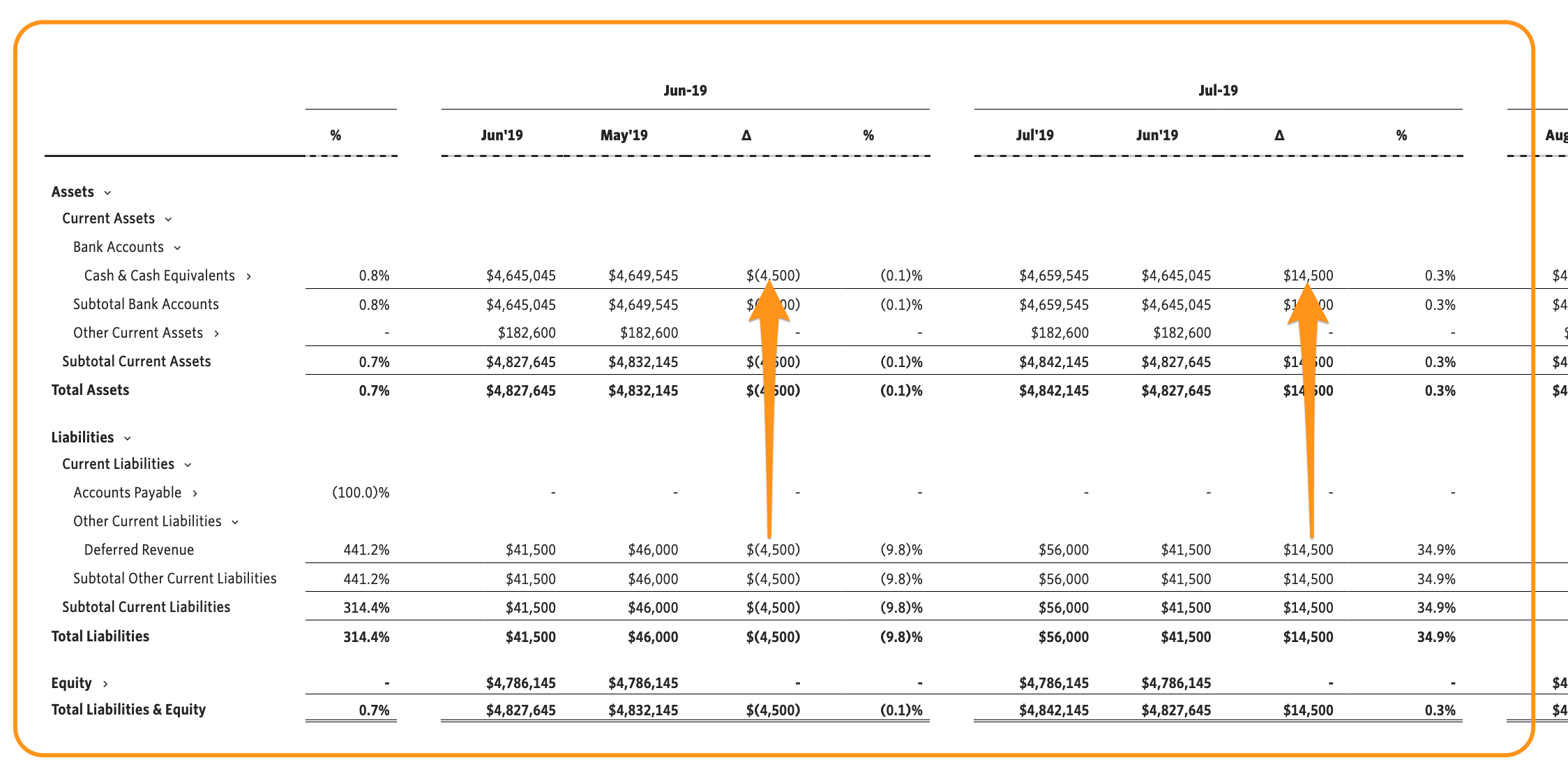

Deferred Revenue Balance Sheet - Current liabilities are expected to be repaid within one year unlike long term liabilities which are. When a customer prepays for goods or services, the business must record the receipt of cash as deferred revenue on the balance sheet and only recognize the revenue on the income. Proper accounting for deferred revenue helps. Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until the product or service is delivered. You record deferred revenue as a short term or current liability on the balance sheet. Deferred revenue is an advance payment received for goods or services to be delivered in the future, recorded as a liability until earned. Deferred revenue (also called unearned revenue) is generated when a company receives payment for goods and/or services that have not been delivered or.

Deferred revenue (also called unearned revenue) is generated when a company receives payment for goods and/or services that have not been delivered or. Proper accounting for deferred revenue helps. Current liabilities are expected to be repaid within one year unlike long term liabilities which are. When a customer prepays for goods or services, the business must record the receipt of cash as deferred revenue on the balance sheet and only recognize the revenue on the income. You record deferred revenue as a short term or current liability on the balance sheet. Deferred revenue is an advance payment received for goods or services to be delivered in the future, recorded as a liability until earned. Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until the product or service is delivered.

Current liabilities are expected to be repaid within one year unlike long term liabilities which are. Deferred revenue is an advance payment received for goods or services to be delivered in the future, recorded as a liability until earned. When a customer prepays for goods or services, the business must record the receipt of cash as deferred revenue on the balance sheet and only recognize the revenue on the income. You record deferred revenue as a short term or current liability on the balance sheet. Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until the product or service is delivered. Deferred revenue (also called unearned revenue) is generated when a company receives payment for goods and/or services that have not been delivered or. Proper accounting for deferred revenue helps.

How To Record SaaS Deferred Revenue? FreeCashFlow.io

Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until the product or service is delivered. Deferred revenue (also called unearned revenue) is generated when a company receives payment for goods and/or services that have not been delivered or. When a customer prepays for goods or services, the.

Deferred Revenue Debit or Credit and its Flow Through the Financials

Proper accounting for deferred revenue helps. Deferred revenue (also called unearned revenue) is generated when a company receives payment for goods and/or services that have not been delivered or. When a customer prepays for goods or services, the business must record the receipt of cash as deferred revenue on the balance sheet and only recognize the revenue on the income..

What Is Deferred Revenue? Complete Guide Pareto Labs

Deferred revenue is an advance payment received for goods or services to be delivered in the future, recorded as a liability until earned. Current liabilities are expected to be repaid within one year unlike long term liabilities which are. Proper accounting for deferred revenue helps. Deferred revenue (also called unearned revenue) is generated when a company receives payment for goods.

What is Deferred Revenue? The Ultimate Guide (2022)

You record deferred revenue as a short term or current liability on the balance sheet. When a customer prepays for goods or services, the business must record the receipt of cash as deferred revenue on the balance sheet and only recognize the revenue on the income. Deferred revenue is an advance payment received for goods or services to be delivered.

Simple Deferred Revenue with Jirav Pro

Proper accounting for deferred revenue helps. Deferred revenue (also called unearned revenue) is generated when a company receives payment for goods and/or services that have not been delivered or. When a customer prepays for goods or services, the business must record the receipt of cash as deferred revenue on the balance sheet and only recognize the revenue on the income..

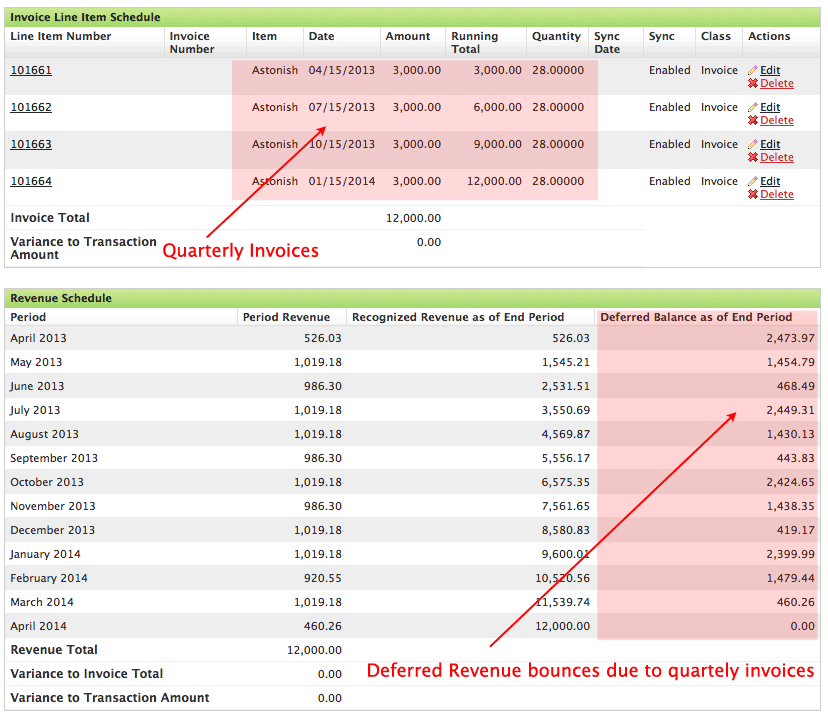

What is Deferred Revenue in a SaaS Business? SaaSOptics

Proper accounting for deferred revenue helps. When a customer prepays for goods or services, the business must record the receipt of cash as deferred revenue on the balance sheet and only recognize the revenue on the income. You record deferred revenue as a short term or current liability on the balance sheet. Deferred revenue (also called unearned revenue) is generated.

41 Balance Sheet Deferred Tax Expense

When a customer prepays for goods or services, the business must record the receipt of cash as deferred revenue on the balance sheet and only recognize the revenue on the income. You record deferred revenue as a short term or current liability on the balance sheet. Deferred revenue is recorded as a liability on the balance sheet, since the company.

Deferred Tax Liabilities Explained (with RealLife Example in a

You record deferred revenue as a short term or current liability on the balance sheet. Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until the product or service is delivered. When a customer prepays for goods or services, the business must record the receipt of cash as.

Deferred Revenue Balance Sheet Ppt Powerpoint Presentation Visual Aids

When a customer prepays for goods or services, the business must record the receipt of cash as deferred revenue on the balance sheet and only recognize the revenue on the income. You record deferred revenue as a short term or current liability on the balance sheet. Deferred revenue (also called unearned revenue) is generated when a company receives payment for.

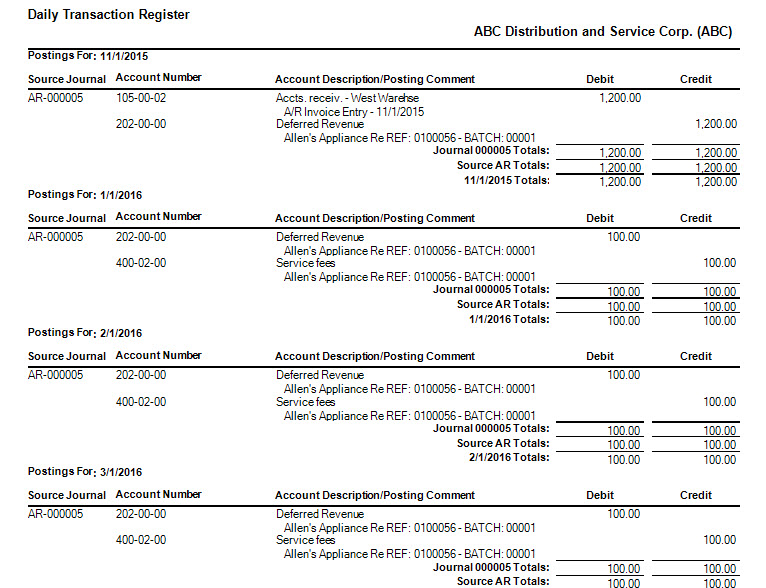

Sage 100 Accounts Receivable Deferred Revenue Posting

Deferred revenue (also called unearned revenue) is generated when a company receives payment for goods and/or services that have not been delivered or. You record deferred revenue as a short term or current liability on the balance sheet. Proper accounting for deferred revenue helps. Deferred revenue is an advance payment received for goods or services to be delivered in the.

Proper Accounting For Deferred Revenue Helps.

When a customer prepays for goods or services, the business must record the receipt of cash as deferred revenue on the balance sheet and only recognize the revenue on the income. Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until the product or service is delivered. Deferred revenue (also called unearned revenue) is generated when a company receives payment for goods and/or services that have not been delivered or. Current liabilities are expected to be repaid within one year unlike long term liabilities which are.

You Record Deferred Revenue As A Short Term Or Current Liability On The Balance Sheet.

Deferred revenue is an advance payment received for goods or services to be delivered in the future, recorded as a liability until earned.