Deferred Gain On Balance Sheet - The internal revenue service allows taxes on gains from the sale of business. Asc 740 provides specific guidance for the balance sheet presentation of deferred tax accounts and any related valuation allowance. What is a deferred gain on a balance sheet?

Asc 740 provides specific guidance for the balance sheet presentation of deferred tax accounts and any related valuation allowance. What is a deferred gain on a balance sheet? The internal revenue service allows taxes on gains from the sale of business.

What is a deferred gain on a balance sheet? The internal revenue service allows taxes on gains from the sale of business. Asc 740 provides specific guidance for the balance sheet presentation of deferred tax accounts and any related valuation allowance.

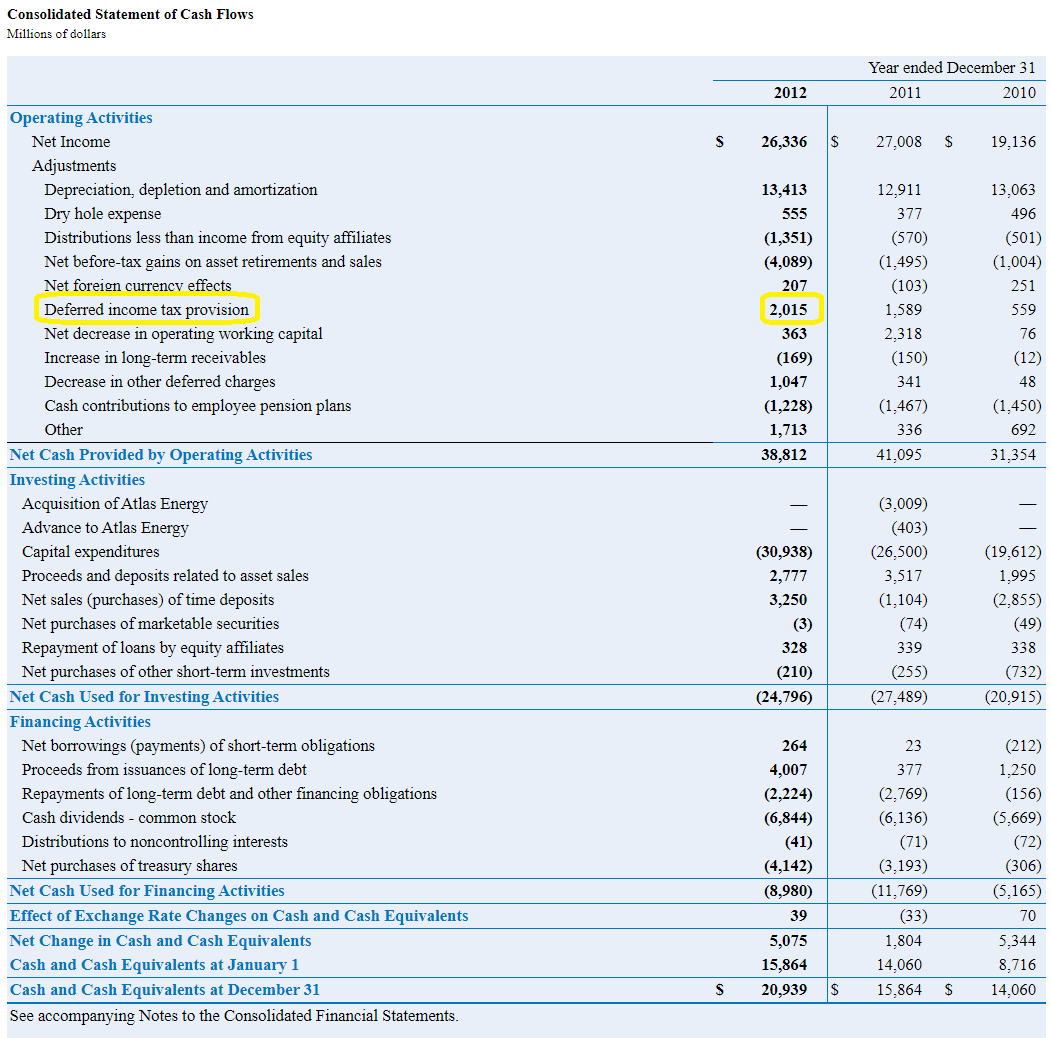

Net Operating Losses & Deferred Tax Assets Tutorial

The internal revenue service allows taxes on gains from the sale of business. Asc 740 provides specific guidance for the balance sheet presentation of deferred tax accounts and any related valuation allowance. What is a deferred gain on a balance sheet?

Ideal Withholding Tax Payable In Balance Sheet Gain And Loss

Asc 740 provides specific guidance for the balance sheet presentation of deferred tax accounts and any related valuation allowance. What is a deferred gain on a balance sheet? The internal revenue service allows taxes on gains from the sale of business.

What Is Deferred Revenue? Complete Guide Pareto Labs

The internal revenue service allows taxes on gains from the sale of business. Asc 740 provides specific guidance for the balance sheet presentation of deferred tax accounts and any related valuation allowance. What is a deferred gain on a balance sheet?

Deferred Tax Liabilities Explained (with RealLife Example in a

Asc 740 provides specific guidance for the balance sheet presentation of deferred tax accounts and any related valuation allowance. What is a deferred gain on a balance sheet? The internal revenue service allows taxes on gains from the sale of business.

What Is a Deferred Gain on a Balance Sheet? Bizfluent

The internal revenue service allows taxes on gains from the sale of business. Asc 740 provides specific guidance for the balance sheet presentation of deferred tax accounts and any related valuation allowance. What is a deferred gain on a balance sheet?

Understanding Negative Balances in Your Financial Statements Fortiviti

What is a deferred gain on a balance sheet? The internal revenue service allows taxes on gains from the sale of business. Asc 740 provides specific guidance for the balance sheet presentation of deferred tax accounts and any related valuation allowance.

Deferred Tax Liabilities Explained (with RealLife Example in a

The internal revenue service allows taxes on gains from the sale of business. Asc 740 provides specific guidance for the balance sheet presentation of deferred tax accounts and any related valuation allowance. What is a deferred gain on a balance sheet?

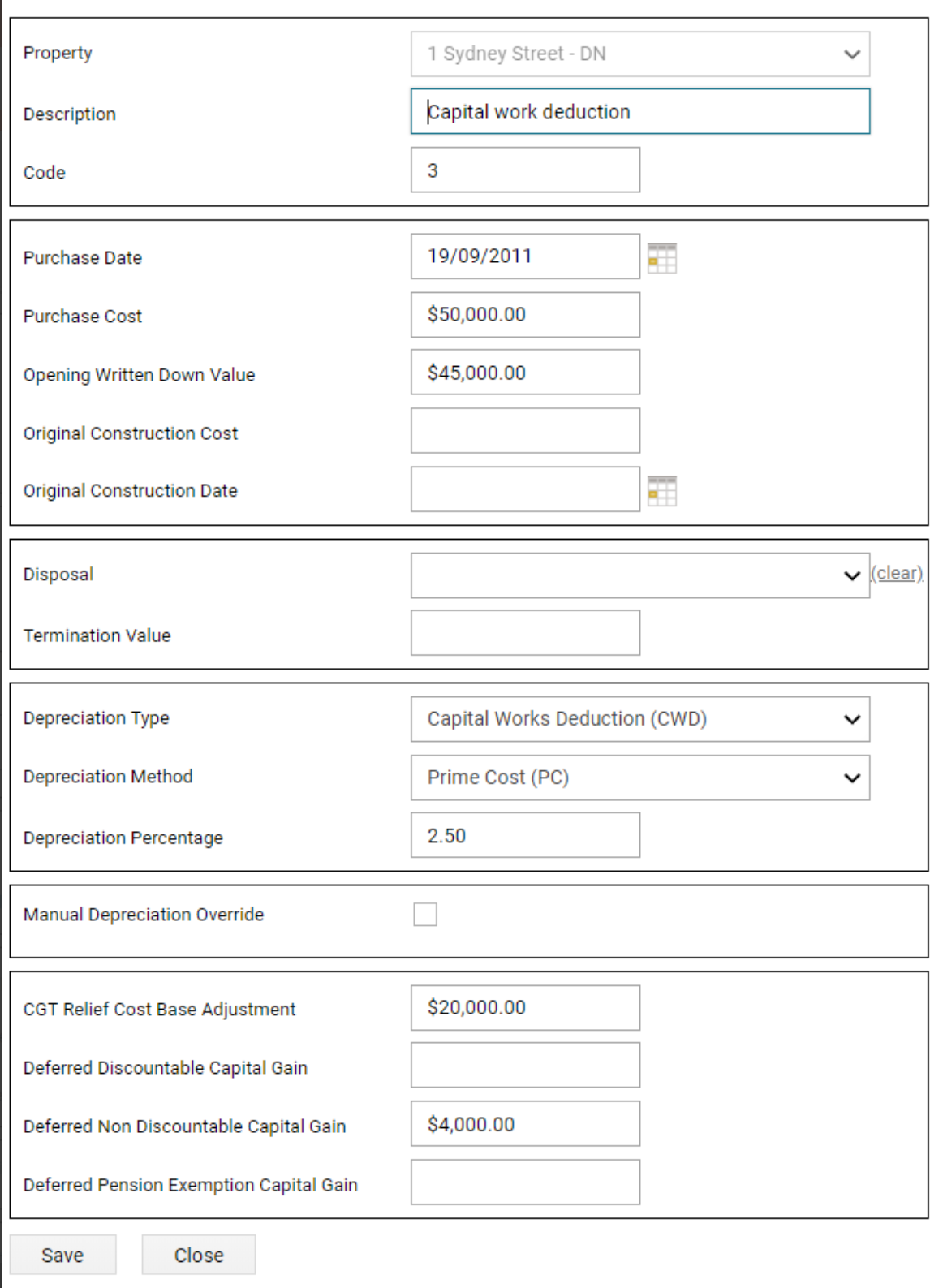

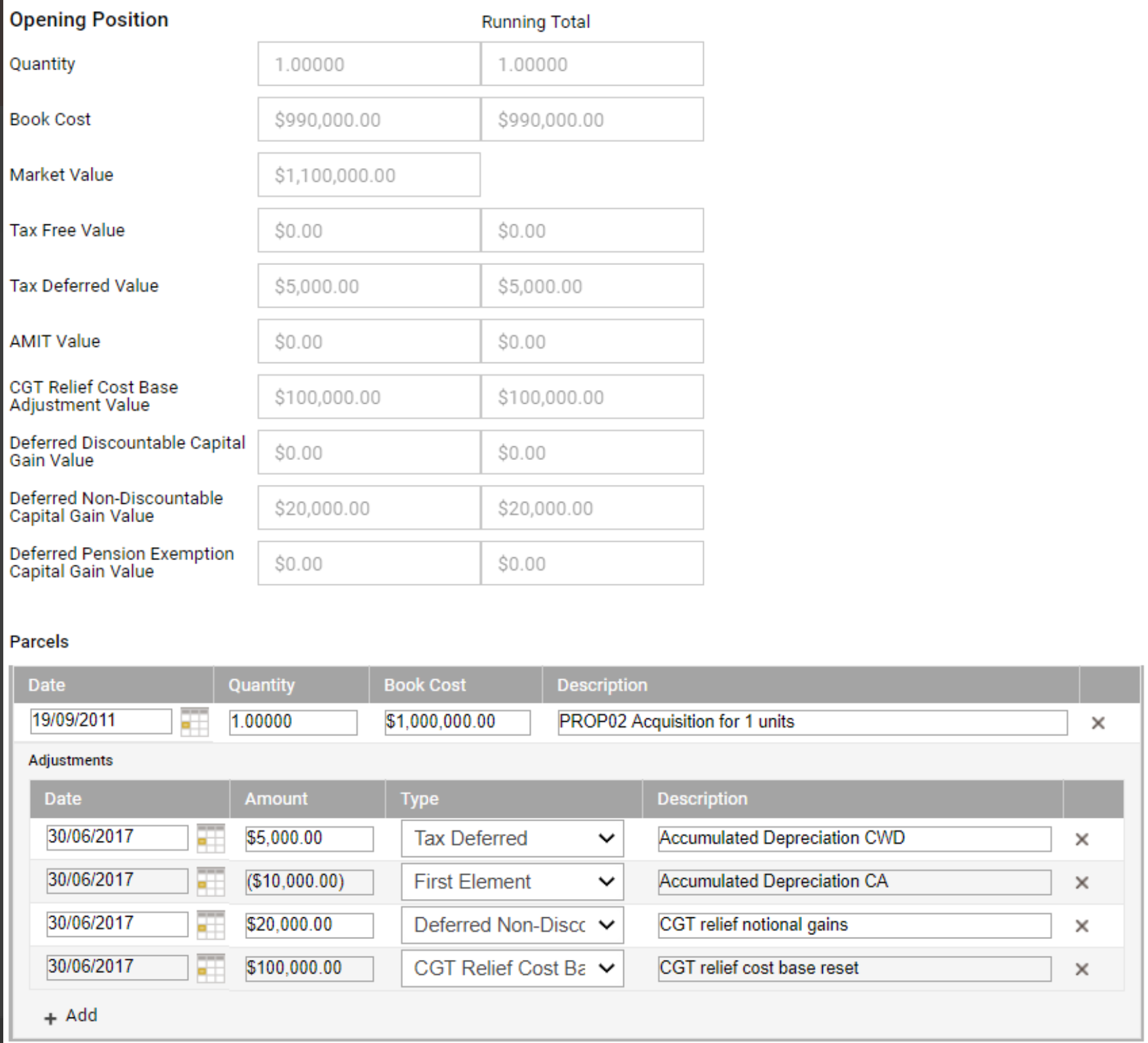

Worked example How to enter deferred notional gains and reset cost

What is a deferred gain on a balance sheet? Asc 740 provides specific guidance for the balance sheet presentation of deferred tax accounts and any related valuation allowance. The internal revenue service allows taxes on gains from the sale of business.

Worked example How to enter deferred notional gains and reset cost

The internal revenue service allows taxes on gains from the sale of business. What is a deferred gain on a balance sheet? Asc 740 provides specific guidance for the balance sheet presentation of deferred tax accounts and any related valuation allowance.

Deferred tax and temporary differences The Footnotes Analyst

Asc 740 provides specific guidance for the balance sheet presentation of deferred tax accounts and any related valuation allowance. The internal revenue service allows taxes on gains from the sale of business. What is a deferred gain on a balance sheet?

What Is A Deferred Gain On A Balance Sheet?

The internal revenue service allows taxes on gains from the sale of business. Asc 740 provides specific guidance for the balance sheet presentation of deferred tax accounts and any related valuation allowance.

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)