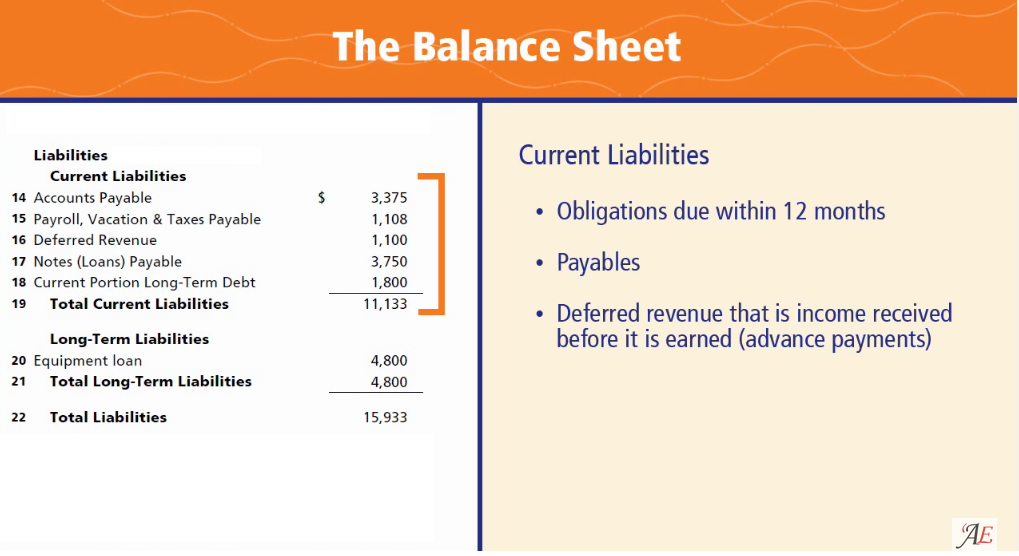

Current Liabilities In Balance Sheet - A liability occurs when a company has undergone a transaction. Each of these liabilities is current because it results from a. Current liabilities on the balance sheet impose restrictions on the cash flow of a company and have to be managed prudently to ensure that the company has enough current assets to. Current liabilities are financial obligations of a business entity that are due and payable within a year. Current liabilities are listed on a company’s balance sheet below its current assets and are calculated as a sum of different accounting heads. Current liabilities are listed on the balance sheet and are paid from the revenue generated by the operating activities of a company. Common current liabilities include accounts payable, unearned revenues, the current portion of a note payable, and taxes payable.

Each of these liabilities is current because it results from a. A liability occurs when a company has undergone a transaction. Current liabilities are listed on a company’s balance sheet below its current assets and are calculated as a sum of different accounting heads. Current liabilities are financial obligations of a business entity that are due and payable within a year. Current liabilities are listed on the balance sheet and are paid from the revenue generated by the operating activities of a company. Current liabilities on the balance sheet impose restrictions on the cash flow of a company and have to be managed prudently to ensure that the company has enough current assets to. Common current liabilities include accounts payable, unearned revenues, the current portion of a note payable, and taxes payable.

Current liabilities are financial obligations of a business entity that are due and payable within a year. Current liabilities are listed on a company’s balance sheet below its current assets and are calculated as a sum of different accounting heads. A liability occurs when a company has undergone a transaction. Each of these liabilities is current because it results from a. Current liabilities on the balance sheet impose restrictions on the cash flow of a company and have to be managed prudently to ensure that the company has enough current assets to. Current liabilities are listed on the balance sheet and are paid from the revenue generated by the operating activities of a company. Common current liabilities include accounts payable, unearned revenues, the current portion of a note payable, and taxes payable.

How to Read a Balance Sheet (Free Download) Poindexter Blog

Current liabilities are financial obligations of a business entity that are due and payable within a year. Each of these liabilities is current because it results from a. Current liabilities are listed on the balance sheet and are paid from the revenue generated by the operating activities of a company. Current liabilities on the balance sheet impose restrictions on the.

Understanding Liabilities Reading a Balance Sheet

Current liabilities are financial obligations of a business entity that are due and payable within a year. Each of these liabilities is current because it results from a. Current liabilities are listed on the balance sheet and are paid from the revenue generated by the operating activities of a company. Common current liabilities include accounts payable, unearned revenues, the current.

Balance Sheet Basics Accounting Education

Current liabilities are listed on a company’s balance sheet below its current assets and are calculated as a sum of different accounting heads. Each of these liabilities is current because it results from a. A liability occurs when a company has undergone a transaction. Current liabilities on the balance sheet impose restrictions on the cash flow of a company and.

How to Read & Prepare a Balance Sheet QuickBooks

A liability occurs when a company has undergone a transaction. Current liabilities are listed on a company’s balance sheet below its current assets and are calculated as a sum of different accounting heads. Current liabilities are financial obligations of a business entity that are due and payable within a year. Current liabilities on the balance sheet impose restrictions on the.

Current Liabilities Examples Accounting Education

Current liabilities are financial obligations of a business entity that are due and payable within a year. Common current liabilities include accounts payable, unearned revenues, the current portion of a note payable, and taxes payable. Each of these liabilities is current because it results from a. Current liabilities on the balance sheet impose restrictions on the cash flow of a.

A Guide To Current Liabilities On The Balance Sheet

Common current liabilities include accounts payable, unearned revenues, the current portion of a note payable, and taxes payable. Current liabilities are financial obligations of a business entity that are due and payable within a year. A liability occurs when a company has undergone a transaction. Each of these liabilities is current because it results from a. Current liabilities are listed.

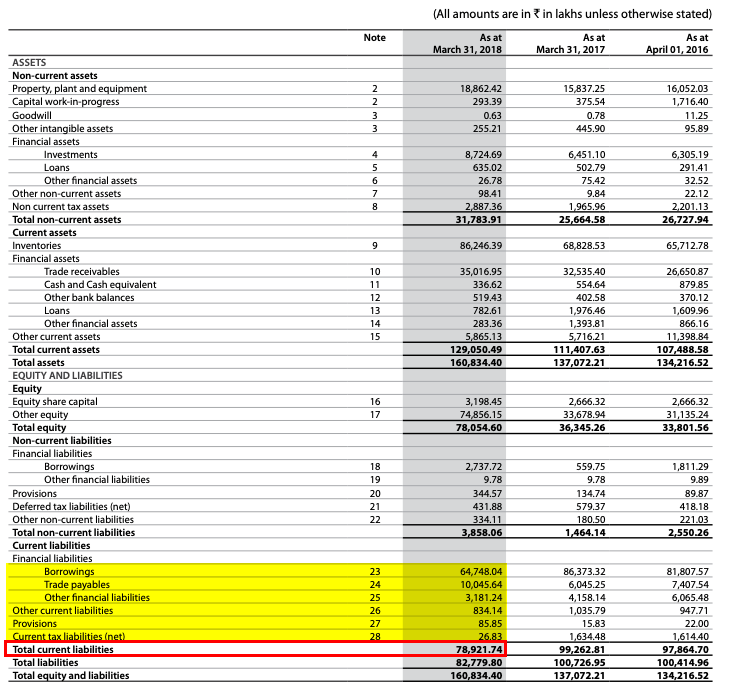

Liabilities Side of Balance Sheet

Current liabilities on the balance sheet impose restrictions on the cash flow of a company and have to be managed prudently to ensure that the company has enough current assets to. Common current liabilities include accounts payable, unearned revenues, the current portion of a note payable, and taxes payable. A liability occurs when a company has undergone a transaction. Current.

Current Liabilities List

A liability occurs when a company has undergone a transaction. Each of these liabilities is current because it results from a. Current liabilities on the balance sheet impose restrictions on the cash flow of a company and have to be managed prudently to ensure that the company has enough current assets to. Current liabilities are financial obligations of a business.

Assets And Liabilities Examples

Common current liabilities include accounts payable, unearned revenues, the current portion of a note payable, and taxes payable. Each of these liabilities is current because it results from a. Current liabilities are financial obligations of a business entity that are due and payable within a year. A liability occurs when a company has undergone a transaction. Current liabilities are listed.

Current Liabilities Formula How To Calculate Current Liabilities?

Common current liabilities include accounts payable, unearned revenues, the current portion of a note payable, and taxes payable. Current liabilities are listed on a company’s balance sheet below its current assets and are calculated as a sum of different accounting heads. A liability occurs when a company has undergone a transaction. Current liabilities are listed on the balance sheet and.

Current Liabilities Are Listed On The Balance Sheet And Are Paid From The Revenue Generated By The Operating Activities Of A Company.

Current liabilities are listed on a company’s balance sheet below its current assets and are calculated as a sum of different accounting heads. A liability occurs when a company has undergone a transaction. Each of these liabilities is current because it results from a. Current liabilities on the balance sheet impose restrictions on the cash flow of a company and have to be managed prudently to ensure that the company has enough current assets to.

Current Liabilities Are Financial Obligations Of A Business Entity That Are Due And Payable Within A Year.

Common current liabilities include accounts payable, unearned revenues, the current portion of a note payable, and taxes payable.

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Liabilities_Sep_2020-01-6515e265cfd34787ae2b0a30e9f1ccc8.jpg)