Credit Suisse Leveraged Loan Index Fact Sheet - 3 credit suisse leveraged loan index is an unmanaged index that is designed to mirror the investable universe of the u.s. This index tracks the investable market of the u.s. 12 rows see all etfs tracking the credit suisse leveraged loan index, including the cheapest and the most popular among them. Dollar denominated leveraged loan market. The current distress ratios of 7 percent in the ice bofa high yield index and 11.5 percent in the credit suisse leveraged loan index are below. Loans denominated in us$ or western european currencies are eligible for inclusion in the index. Leverages database of 85,000+ loans drawn from both public and proprietary sources, bringing transparency to private loan market. Fitch ratings is pleased to announce that its ratings have been incorporated into the. The indices were incepted on january 1998 and.

The current distress ratios of 7 percent in the ice bofa high yield index and 11.5 percent in the credit suisse leveraged loan index are below. Loans denominated in us$ or western european currencies are eligible for inclusion in the index. 3 credit suisse leveraged loan index is an unmanaged index that is designed to mirror the investable universe of the u.s. Leverages database of 85,000+ loans drawn from both public and proprietary sources, bringing transparency to private loan market. Dollar denominated leveraged loan market. 12 rows see all etfs tracking the credit suisse leveraged loan index, including the cheapest and the most popular among them. This index tracks the investable market of the u.s. The indices were incepted on january 1998 and. Fitch ratings is pleased to announce that its ratings have been incorporated into the.

12 rows see all etfs tracking the credit suisse leveraged loan index, including the cheapest and the most popular among them. Fitch ratings is pleased to announce that its ratings have been incorporated into the. 3 credit suisse leveraged loan index is an unmanaged index that is designed to mirror the investable universe of the u.s. The current distress ratios of 7 percent in the ice bofa high yield index and 11.5 percent in the credit suisse leveraged loan index are below. Leverages database of 85,000+ loans drawn from both public and proprietary sources, bringing transparency to private loan market. This index tracks the investable market of the u.s. Loans denominated in us$ or western european currencies are eligible for inclusion in the index. The indices were incepted on january 1998 and. Dollar denominated leveraged loan market.

Collateralized Loan Obligations (CLOs) OFS Credit Company

Dollar denominated leveraged loan market. 3 credit suisse leveraged loan index is an unmanaged index that is designed to mirror the investable universe of the u.s. Leverages database of 85,000+ loans drawn from both public and proprietary sources, bringing transparency to private loan market. The indices were incepted on january 1998 and. 12 rows see all etfs tracking the credit.

S&P/LSTA Leveraged Loan Index Analysis August 2021 LSTA

Fitch ratings is pleased to announce that its ratings have been incorporated into the. The indices were incepted on january 1998 and. Leverages database of 85,000+ loans drawn from both public and proprietary sources, bringing transparency to private loan market. The current distress ratios of 7 percent in the ice bofa high yield index and 11.5 percent in the credit.

S&P/LSTA Leveraged Loan Index Analysis May 2022 LSTA

This index tracks the investable market of the u.s. Loans denominated in us$ or western european currencies are eligible for inclusion in the index. 12 rows see all etfs tracking the credit suisse leveraged loan index, including the cheapest and the most popular among them. 3 credit suisse leveraged loan index is an unmanaged index that is designed to mirror.

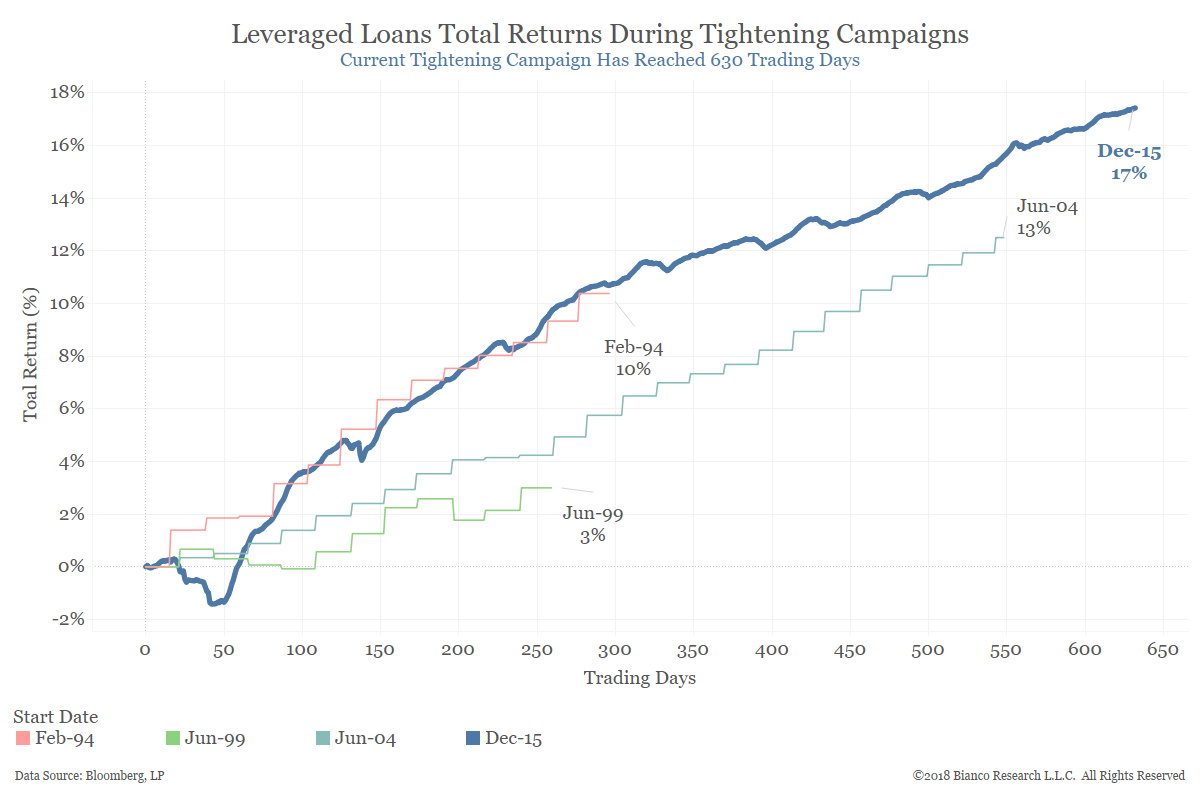

Can Leveraged Loans Keep Up the Pace? Bianco Research

Dollar denominated leveraged loan market. Loans denominated in us$ or western european currencies are eligible for inclusion in the index. 3 credit suisse leveraged loan index is an unmanaged index that is designed to mirror the investable universe of the u.s. Fitch ratings is pleased to announce that its ratings have been incorporated into the. This index tracks the investable.

S&P/LSTA Leveraged Loan Index Analysis January 2021 LSTA

Loans denominated in us$ or western european currencies are eligible for inclusion in the index. 12 rows see all etfs tracking the credit suisse leveraged loan index, including the cheapest and the most popular among them. This index tracks the investable market of the u.s. The indices were incepted on january 1998 and. Leverages database of 85,000+ loans drawn from.

S&P/LSTA Leveraged Loan Index Analysis March 2022 LSTA

Leverages database of 85,000+ loans drawn from both public and proprietary sources, bringing transparency to private loan market. Fitch ratings is pleased to announce that its ratings have been incorporated into the. 12 rows see all etfs tracking the credit suisse leveraged loan index, including the cheapest and the most popular among them. 3 credit suisse leveraged loan index is.

Increasing Speed

Loans denominated in us$ or western european currencies are eligible for inclusion in the index. The indices were incepted on january 1998 and. This index tracks the investable market of the u.s. The current distress ratios of 7 percent in the ice bofa high yield index and 11.5 percent in the credit suisse leveraged loan index are below. Leverages database.

Range Bound

The indices were incepted on january 1998 and. Dollar denominated leveraged loan market. 3 credit suisse leveraged loan index is an unmanaged index that is designed to mirror the investable universe of the u.s. 12 rows see all etfs tracking the credit suisse leveraged loan index, including the cheapest and the most popular among them. Loans denominated in us$ or.

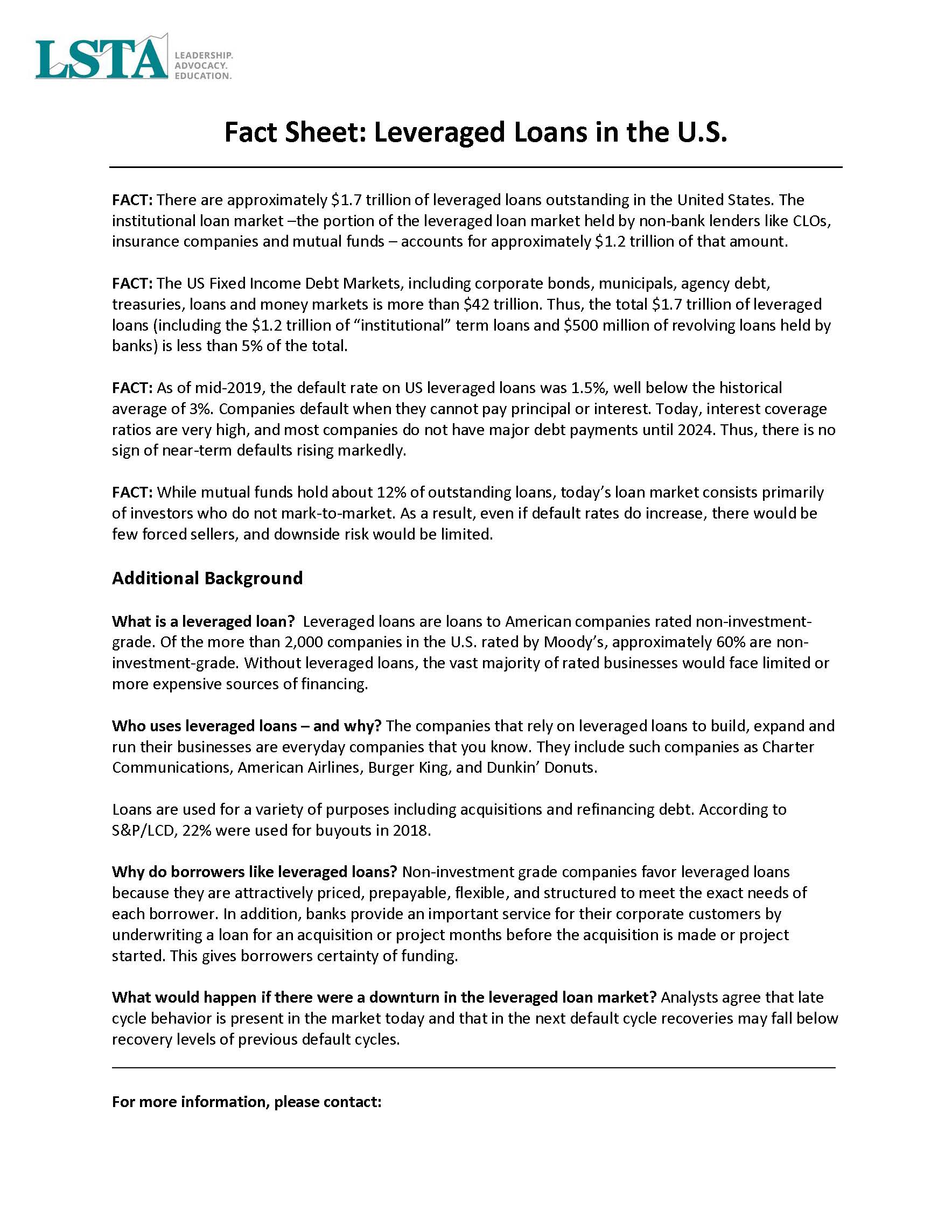

Leveraged Loan Fact Sheet LSTA

3 credit suisse leveraged loan index is an unmanaged index that is designed to mirror the investable universe of the u.s. The indices were incepted on january 1998 and. The current distress ratios of 7 percent in the ice bofa high yield index and 11.5 percent in the credit suisse leveraged loan index are below. Leverages database of 85,000+ loans.

The Market Grinds Higher Following Record Year for Loans and CLOs

12 rows see all etfs tracking the credit suisse leveraged loan index, including the cheapest and the most popular among them. This index tracks the investable market of the u.s. Leverages database of 85,000+ loans drawn from both public and proprietary sources, bringing transparency to private loan market. Loans denominated in us$ or western european currencies are eligible for inclusion.

The Indices Were Incepted On January 1998 And.

12 rows see all etfs tracking the credit suisse leveraged loan index, including the cheapest and the most popular among them. 3 credit suisse leveraged loan index is an unmanaged index that is designed to mirror the investable universe of the u.s. The current distress ratios of 7 percent in the ice bofa high yield index and 11.5 percent in the credit suisse leveraged loan index are below. Fitch ratings is pleased to announce that its ratings have been incorporated into the.

Dollar Denominated Leveraged Loan Market.

Loans denominated in us$ or western european currencies are eligible for inclusion in the index. This index tracks the investable market of the u.s. Leverages database of 85,000+ loans drawn from both public and proprietary sources, bringing transparency to private loan market.