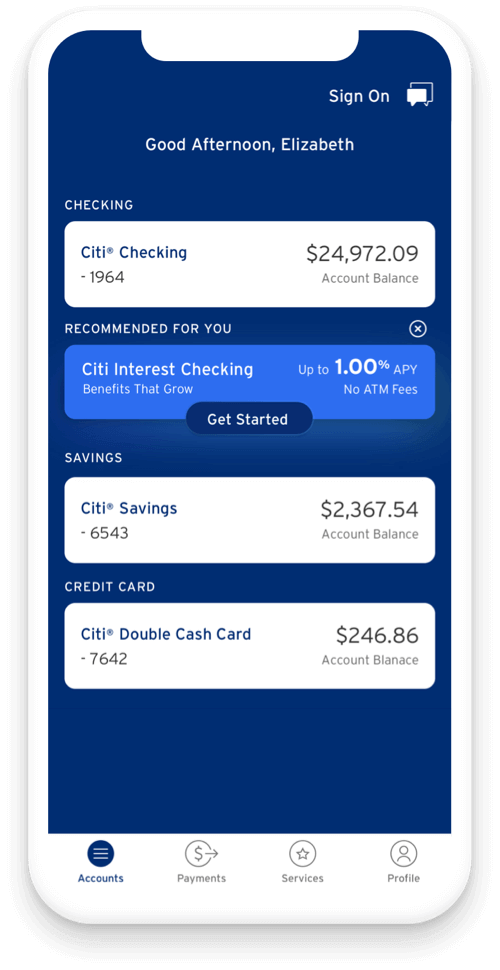

Citi Funds Availability - Our general policy is to make funds from any type of check deposit available to you no later than the first business day after the day of your deposit. From each fund family offered, cgmi seeks to collect. The regulation sets forth the requirements that depositary institutions (“banks”) make funds deposited into transaction accounts available. These rules reduce the risk to depositary banks of having to make funds from check deposits available for withdrawal before. (cgmi), offers clients a large selection of mutual funds. Regulation cc requires that financial institutions include a notice of funds availability on the front of all preprinted deposit. Regular checking account applications are available in branch, on citi online, through the citi mobile app or by calling the.

(cgmi), offers clients a large selection of mutual funds. Regulation cc requires that financial institutions include a notice of funds availability on the front of all preprinted deposit. These rules reduce the risk to depositary banks of having to make funds from check deposits available for withdrawal before. From each fund family offered, cgmi seeks to collect. Regular checking account applications are available in branch, on citi online, through the citi mobile app or by calling the. The regulation sets forth the requirements that depositary institutions (“banks”) make funds deposited into transaction accounts available. Our general policy is to make funds from any type of check deposit available to you no later than the first business day after the day of your deposit.

Our general policy is to make funds from any type of check deposit available to you no later than the first business day after the day of your deposit. (cgmi), offers clients a large selection of mutual funds. Regulation cc requires that financial institutions include a notice of funds availability on the front of all preprinted deposit. Regular checking account applications are available in branch, on citi online, through the citi mobile app or by calling the. From each fund family offered, cgmi seeks to collect. The regulation sets forth the requirements that depositary institutions (“banks”) make funds deposited into transaction accounts available. These rules reduce the risk to depositary banks of having to make funds from check deposits available for withdrawal before.

How to add a payee to transfer funds on the Citi Mobile App YouTube

(cgmi), offers clients a large selection of mutual funds. The regulation sets forth the requirements that depositary institutions (“banks”) make funds deposited into transaction accounts available. From each fund family offered, cgmi seeks to collect. These rules reduce the risk to depositary banks of having to make funds from check deposits available for withdrawal before. Our general policy is to.

How To Transfer Money CitiBank Account? YouTube

From each fund family offered, cgmi seeks to collect. Regular checking account applications are available in branch, on citi online, through the citi mobile app or by calling the. These rules reduce the risk to depositary banks of having to make funds from check deposits available for withdrawal before. Our general policy is to make funds from any type of.

Payments and Transfers Online Cheques MEPS Inbound Funds Transfer

Regulation cc requires that financial institutions include a notice of funds availability on the front of all preprinted deposit. (cgmi), offers clients a large selection of mutual funds. The regulation sets forth the requirements that depositary institutions (“banks”) make funds deposited into transaction accounts available. From each fund family offered, cgmi seeks to collect. Our general policy is to make.

Citibank Online

Regulation cc requires that financial institutions include a notice of funds availability on the front of all preprinted deposit. Our general policy is to make funds from any type of check deposit available to you no later than the first business day after the day of your deposit. These rules reduce the risk to depositary banks of having to make.

Citi Up To 2,000 Personal Checking/Savings Bonus Available

These rules reduce the risk to depositary banks of having to make funds from check deposits available for withdrawal before. From each fund family offered, cgmi seeks to collect. (cgmi), offers clients a large selection of mutual funds. Our general policy is to make funds from any type of check deposit available to you no later than the first business.

Citi Impact Fund Team

These rules reduce the risk to depositary banks of having to make funds from check deposits available for withdrawal before. The regulation sets forth the requirements that depositary institutions (“banks”) make funds deposited into transaction accounts available. Regular checking account applications are available in branch, on citi online, through the citi mobile app or by calling the. Our general policy.

Citi Says Hedge Funds Are Using Dollars for New Carry Trades

These rules reduce the risk to depositary banks of having to make funds from check deposits available for withdrawal before. Regular checking account applications are available in branch, on citi online, through the citi mobile app or by calling the. Our general policy is to make funds from any type of check deposit available to you no later than the.

Citi, Fidelity Intl combine money market fund tokenization with FX

Our general policy is to make funds from any type of check deposit available to you no later than the first business day after the day of your deposit. Regulation cc requires that financial institutions include a notice of funds availability on the front of all preprinted deposit. These rules reduce the risk to depositary banks of having to make.

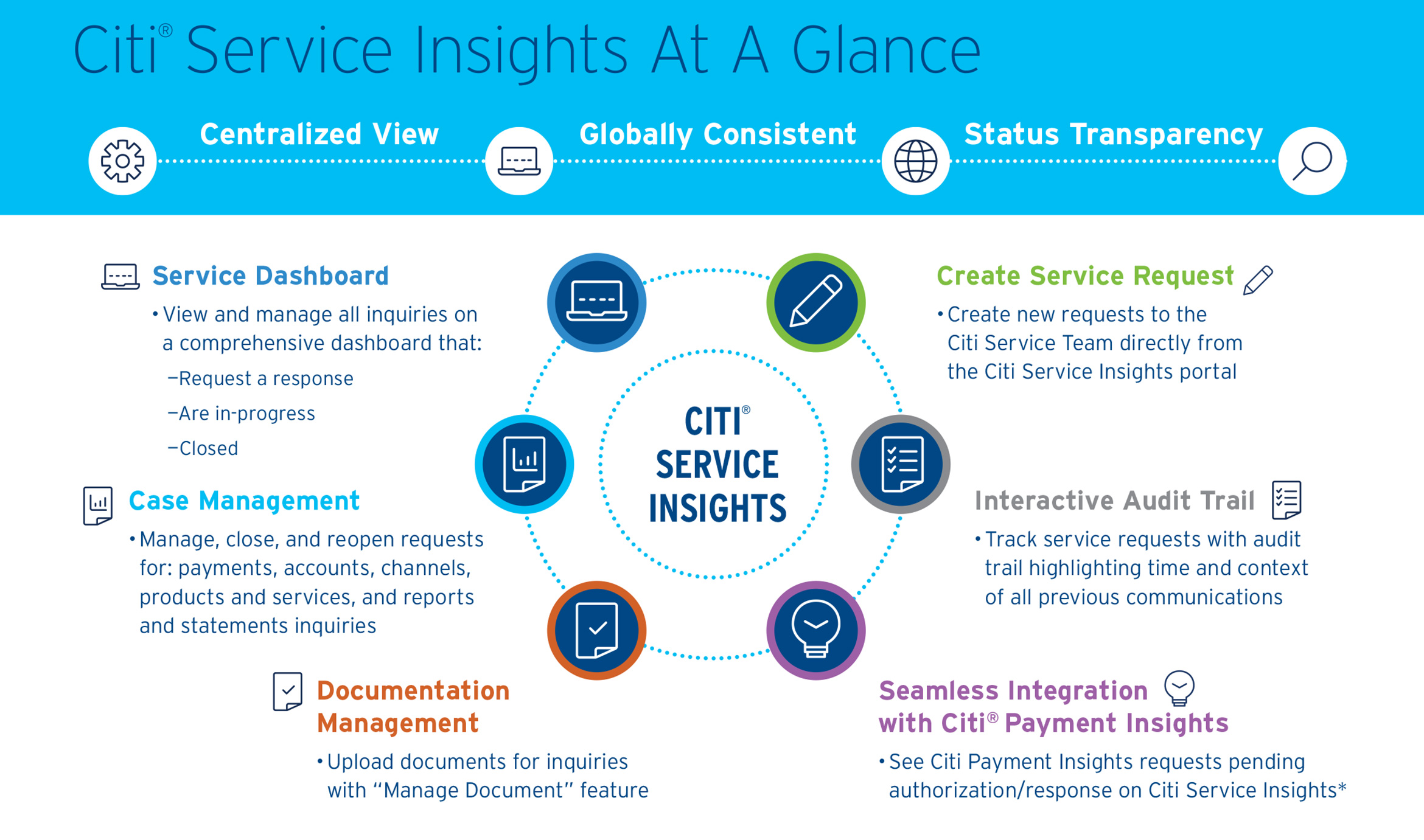

Citi® Service Insights Payments Treasury and Trade Solutions

Regular checking account applications are available in branch, on citi online, through the citi mobile app or by calling the. From each fund family offered, cgmi seeks to collect. Regulation cc requires that financial institutions include a notice of funds availability on the front of all preprinted deposit. These rules reduce the risk to depositary banks of having to make.

Citibank Money Lock Secure Your Funds Easily

Regulation cc requires that financial institutions include a notice of funds availability on the front of all preprinted deposit. Regular checking account applications are available in branch, on citi online, through the citi mobile app or by calling the. These rules reduce the risk to depositary banks of having to make funds from check deposits available for withdrawal before. From.

The Regulation Sets Forth The Requirements That Depositary Institutions (“Banks”) Make Funds Deposited Into Transaction Accounts Available.

From each fund family offered, cgmi seeks to collect. These rules reduce the risk to depositary banks of having to make funds from check deposits available for withdrawal before. Regulation cc requires that financial institutions include a notice of funds availability on the front of all preprinted deposit. Regular checking account applications are available in branch, on citi online, through the citi mobile app or by calling the.

(Cgmi), Offers Clients A Large Selection Of Mutual Funds.

Our general policy is to make funds from any type of check deposit available to you no later than the first business day after the day of your deposit.