Cash Available To Trade Fidelity - If it runs into problem more than a few times, like. Fidelity has evaluated you as a customer and is willing to take the credit risk. If you plan to trade strictly on a cash basis, there are 3 types of potential violations you should aim to avoid: You can continue to buy without settled cash but you must hold until cash settles in, then you can sell. Cash available to trade is defined as the cash dollar amount available for trading in the core account without adding money to the account. Settled cash represents the amount of money in your fidelity account that’s entirely cleared and available for trading without any. Good faith violations, freeriding, and. It takes about 7 business days from the.

Cash available to trade is defined as the cash dollar amount available for trading in the core account without adding money to the account. You can continue to buy without settled cash but you must hold until cash settles in, then you can sell. Good faith violations, freeriding, and. If you plan to trade strictly on a cash basis, there are 3 types of potential violations you should aim to avoid: Fidelity has evaluated you as a customer and is willing to take the credit risk. It takes about 7 business days from the. If it runs into problem more than a few times, like. Settled cash represents the amount of money in your fidelity account that’s entirely cleared and available for trading without any.

If you plan to trade strictly on a cash basis, there are 3 types of potential violations you should aim to avoid: Fidelity has evaluated you as a customer and is willing to take the credit risk. You can continue to buy without settled cash but you must hold until cash settles in, then you can sell. Good faith violations, freeriding, and. If it runs into problem more than a few times, like. Cash available to trade is defined as the cash dollar amount available for trading in the core account without adding money to the account. Settled cash represents the amount of money in your fidelity account that’s entirely cleared and available for trading without any. It takes about 7 business days from the.

FZFXX is currently 104.07. Cash core is 104.07 yet cash available to

Good faith violations, freeriding, and. If it runs into problem more than a few times, like. Cash available to trade is defined as the cash dollar amount available for trading in the core account without adding money to the account. If you plan to trade strictly on a cash basis, there are 3 types of potential violations you should aim.

Got this warning but I have more than enough "cash available to trade

Settled cash represents the amount of money in your fidelity account that’s entirely cleared and available for trading without any. You can continue to buy without settled cash but you must hold until cash settles in, then you can sell. If it runs into problem more than a few times, like. If you plan to trade strictly on a cash.

Cash available to trade vs Settled Cash r/Fidelity

Cash available to trade is defined as the cash dollar amount available for trading in the core account without adding money to the account. It takes about 7 business days from the. If you plan to trade strictly on a cash basis, there are 3 types of potential violations you should aim to avoid: If it runs into problem more.

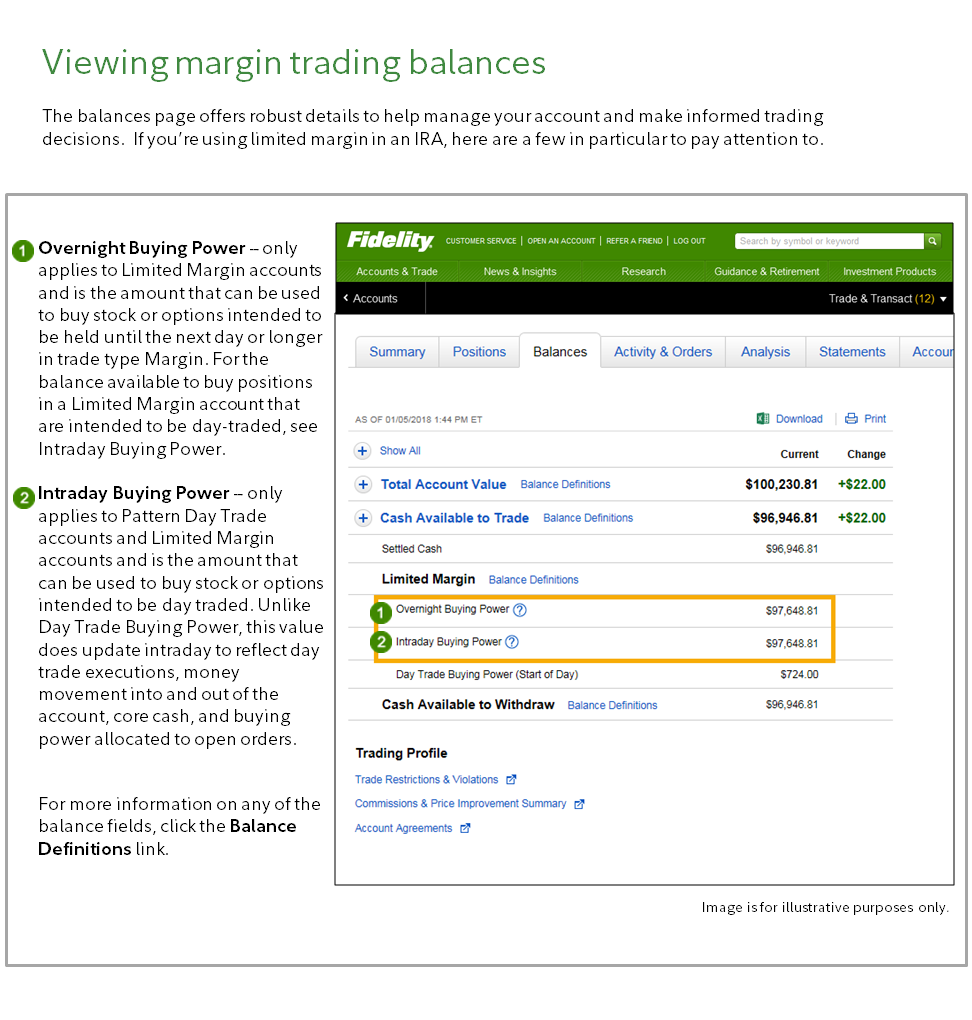

What Is Limited Margin Trading? Fidelity

Good faith violations, freeriding, and. Fidelity has evaluated you as a customer and is willing to take the credit risk. If it runs into problem more than a few times, like. It takes about 7 business days from the. You can continue to buy without settled cash but you must hold until cash settles in, then you can sell.

Cash Available To Trade Fidelity Exceeds Needed Ammount Stock Machine

It takes about 7 business days from the. If you plan to trade strictly on a cash basis, there are 3 types of potential violations you should aim to avoid: Cash available to trade is defined as the cash dollar amount available for trading in the core account without adding money to the account. Settled cash represents the amount of.

Fidelity Investments 101 Buying and Selling Stock To Transfer Cash

Cash available to trade is defined as the cash dollar amount available for trading in the core account without adding money to the account. Good faith violations, freeriding, and. It takes about 7 business days from the. Settled cash represents the amount of money in your fidelity account that’s entirely cleared and available for trading without any. You can continue.

Fidelity Settled Cash Vs Cash Available To Withdraw NetworkBuildz

Cash available to trade is defined as the cash dollar amount available for trading in the core account without adding money to the account. Settled cash represents the amount of money in your fidelity account that’s entirely cleared and available for trading without any. If you plan to trade strictly on a cash basis, there are 3 types of potential.

Trading FAQs Margin Fidelity

Cash available to trade is defined as the cash dollar amount available for trading in the core account without adding money to the account. You can continue to buy without settled cash but you must hold until cash settles in, then you can sell. If you plan to trade strictly on a cash basis, there are 3 types of potential.

Cash available to trade vs Settled Cash r/Fidelity

Settled cash represents the amount of money in your fidelity account that’s entirely cleared and available for trading without any. Fidelity has evaluated you as a customer and is willing to take the credit risk. If you plan to trade strictly on a cash basis, there are 3 types of potential violations you should aim to avoid: It takes about.

How to Invest in the Stock Market on a Budget Wander Onwards

Cash available to trade is defined as the cash dollar amount available for trading in the core account without adding money to the account. Settled cash represents the amount of money in your fidelity account that’s entirely cleared and available for trading without any. Fidelity has evaluated you as a customer and is willing to take the credit risk. If.

Fidelity Has Evaluated You As A Customer And Is Willing To Take The Credit Risk.

You can continue to buy without settled cash but you must hold until cash settles in, then you can sell. It takes about 7 business days from the. Cash available to trade is defined as the cash dollar amount available for trading in the core account without adding money to the account. Settled cash represents the amount of money in your fidelity account that’s entirely cleared and available for trading without any.

If You Plan To Trade Strictly On A Cash Basis, There Are 3 Types Of Potential Violations You Should Aim To Avoid:

If it runs into problem more than a few times, like. Good faith violations, freeriding, and.