A 55 Year Old Recently Received A 30 000 Distribution - A 55 year old recently received a $30,000 distribution from a previous employer's 401k plan, minus $6,000 for income tax. To determine the federal taxes that apply to the $30,000 distribution from the 401k plan, we need to consider that the $6,000 withholding has. A 55 year old recently receied a $30,000 distribution from a pervious employer's 401 k plan minus $6.006 wathholding. Since you took the withdrawal earlier than you reached age 59 1/2, unless you met one of the exceptions, you will need to pay. A 55 year old recently received a $30,000 distribution from a previous employer's 401k plan, minus $6,000 for income tax withholding. Study with quizlet and memorize flashcards containing terms like a 55 year old recently received a $30,000 distribution from a previous. If the individual took the.

A 55 year old recently received a $30,000 distribution from a previous employer's 401k plan, minus $6,000 for income tax. Since you took the withdrawal earlier than you reached age 59 1/2, unless you met one of the exceptions, you will need to pay. To determine the federal taxes that apply to the $30,000 distribution from the 401k plan, we need to consider that the $6,000 withholding has. A 55 year old recently received a $30,000 distribution from a previous employer's 401k plan, minus $6,000 for income tax withholding. Study with quizlet and memorize flashcards containing terms like a 55 year old recently received a $30,000 distribution from a previous. A 55 year old recently receied a $30,000 distribution from a pervious employer's 401 k plan minus $6.006 wathholding. If the individual took the.

Study with quizlet and memorize flashcards containing terms like a 55 year old recently received a $30,000 distribution from a previous. To determine the federal taxes that apply to the $30,000 distribution from the 401k plan, we need to consider that the $6,000 withholding has. A 55 year old recently received a $30,000 distribution from a previous employer's 401k plan, minus $6,000 for income tax withholding. Since you took the withdrawal earlier than you reached age 59 1/2, unless you met one of the exceptions, you will need to pay. A 55 year old recently receied a $30,000 distribution from a pervious employer's 401 k plan minus $6.006 wathholding. A 55 year old recently received a $30,000 distribution from a previous employer's 401k plan, minus $6,000 for income tax. If the individual took the.

Solved Activity 1 C Identifying Differences Between C vrogue.co

A 55 year old recently receied a $30,000 distribution from a pervious employer's 401 k plan minus $6.006 wathholding. Study with quizlet and memorize flashcards containing terms like a 55 year old recently received a $30,000 distribution from a previous. A 55 year old recently received a $30,000 distribution from a previous employer's 401k plan, minus $6,000 for income tax..

52525 Calvary Evening Worship Service Luke Hughes By Calvary

To determine the federal taxes that apply to the $30,000 distribution from the 401k plan, we need to consider that the $6,000 withholding has. A 55 year old recently receied a $30,000 distribution from a pervious employer's 401 k plan minus $6.006 wathholding. Since you took the withdrawal earlier than you reached age 59 1/2, unless you met one of.

[Solved] The following selected transactions were completed by

To determine the federal taxes that apply to the $30,000 distribution from the 401k plan, we need to consider that the $6,000 withholding has. Study with quizlet and memorize flashcards containing terms like a 55 year old recently received a $30,000 distribution from a previous. A 55 year old recently receied a $30,000 distribution from a pervious employer's 401 k.

Map Comparison Results On Yolov3 Using Each Method In vrogue.co

A 55 year old recently receied a $30,000 distribution from a pervious employer's 401 k plan minus $6.006 wathholding. To determine the federal taxes that apply to the $30,000 distribution from the 401k plan, we need to consider that the $6,000 withholding has. A 55 year old recently received a $30,000 distribution from a previous employer's 401k plan, minus $6,000.

[Solved] on january 1, 20x1 an entity issues a 3 year non interest

Since you took the withdrawal earlier than you reached age 59 1/2, unless you met one of the exceptions, you will need to pay. A 55 year old recently receied a $30,000 distribution from a pervious employer's 401 k plan minus $6.006 wathholding. A 55 year old recently received a $30,000 distribution from a previous employer's 401k plan, minus $6,000.

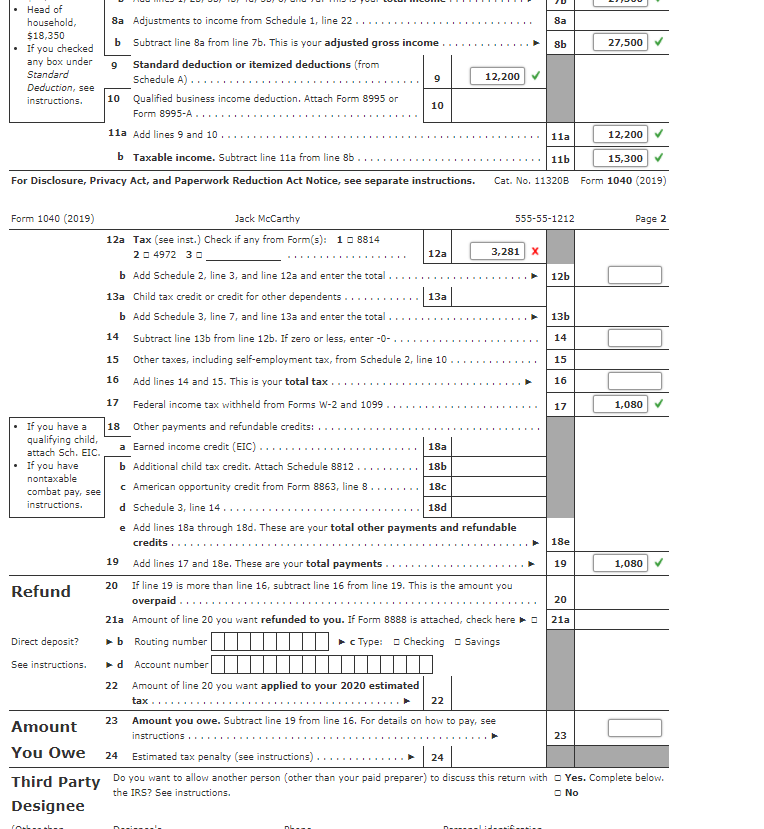

Comprehensive Problem 61 Richard and Christine

Study with quizlet and memorize flashcards containing terms like a 55 year old recently received a $30,000 distribution from a previous. A 55 year old recently receied a $30,000 distribution from a pervious employer's 401 k plan minus $6.006 wathholding. Since you took the withdrawal earlier than you reached age 59 1/2, unless you met one of the exceptions, you.

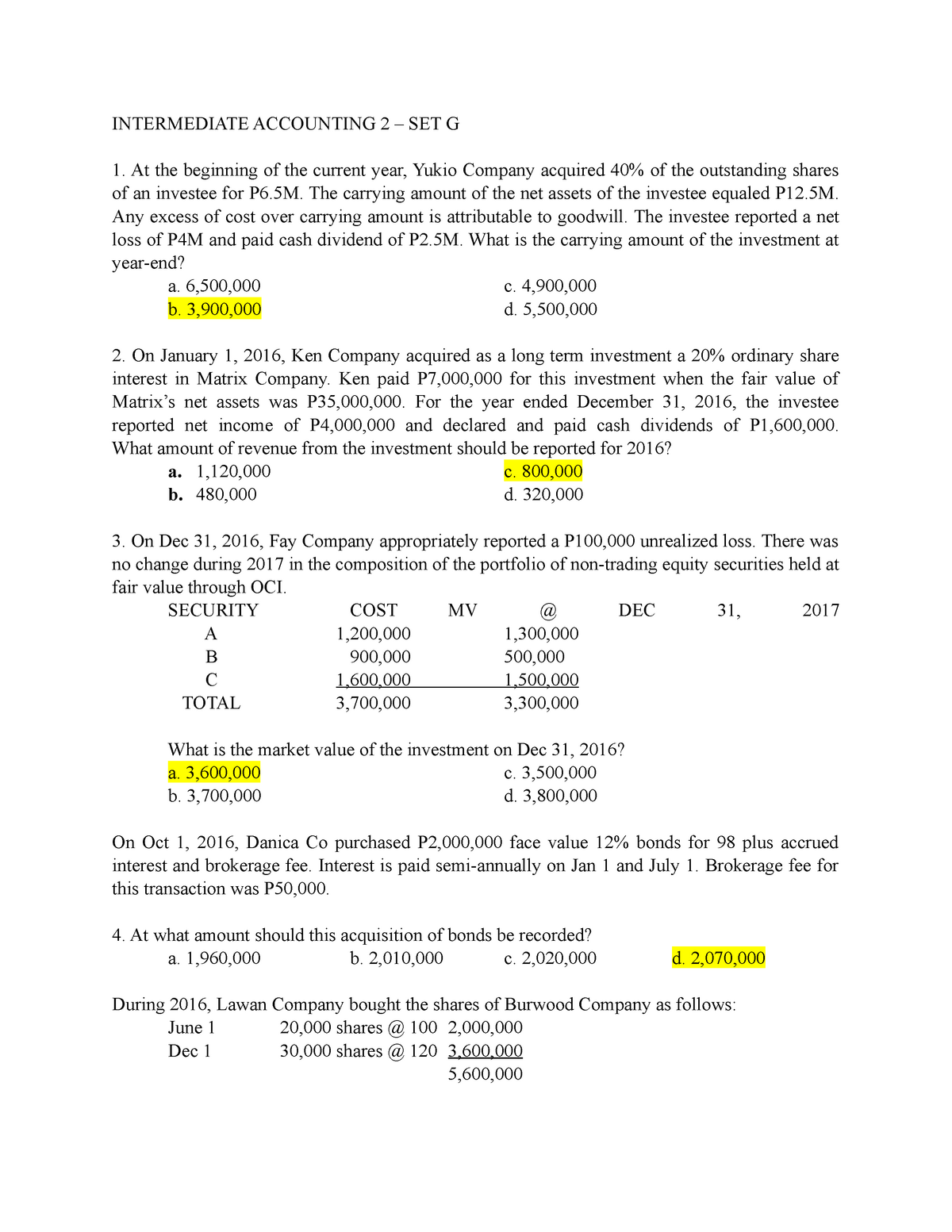

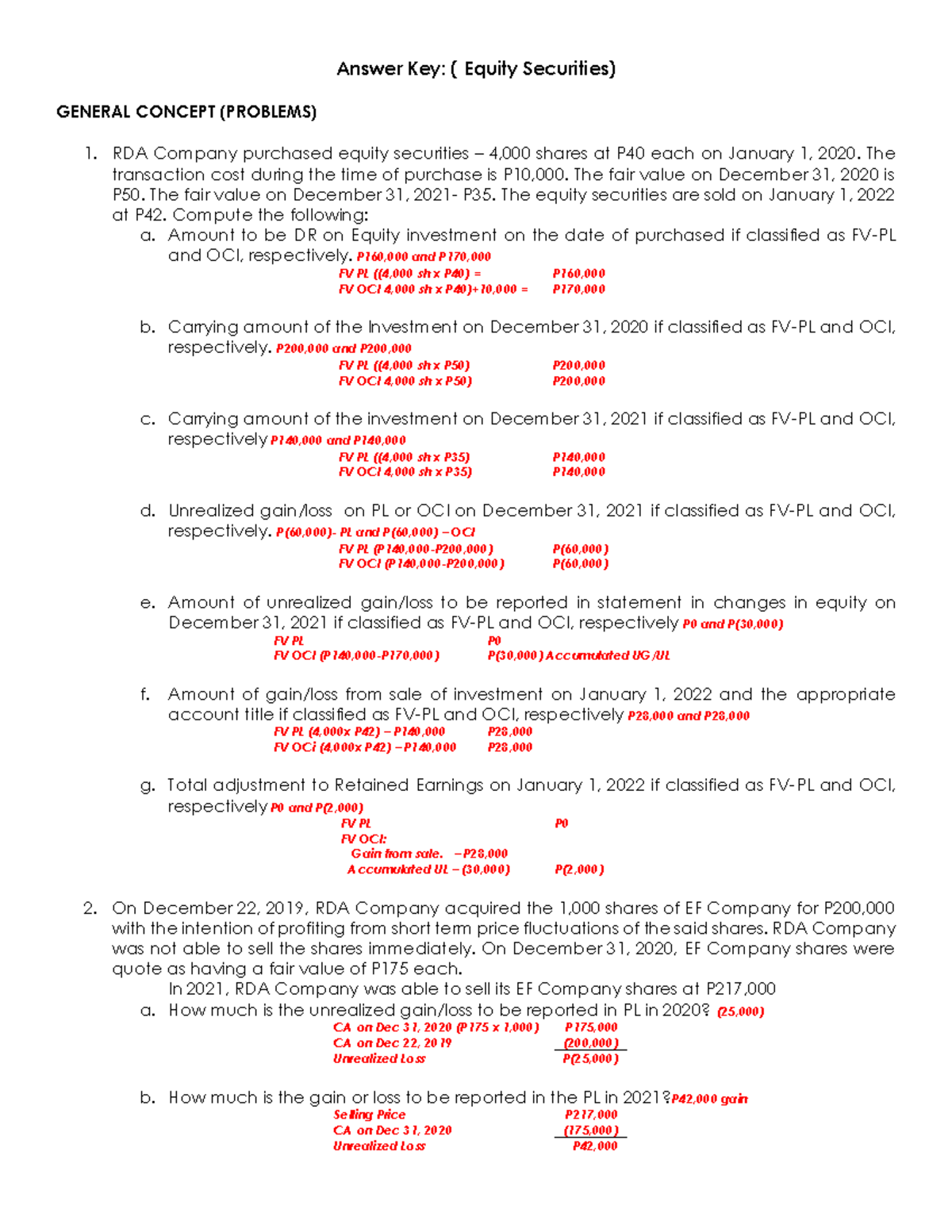

Answer Key Debt and Equity Securities1 Answer Key ( Equity

A 55 year old recently receied a $30,000 distribution from a pervious employer's 401 k plan minus $6.006 wathholding. A 55 year old recently received a $30,000 distribution from a previous employer's 401k plan, minus $6,000 for income tax. A 55 year old recently received a $30,000 distribution from a previous employer's 401k plan, minus $6,000 for income tax withholding..

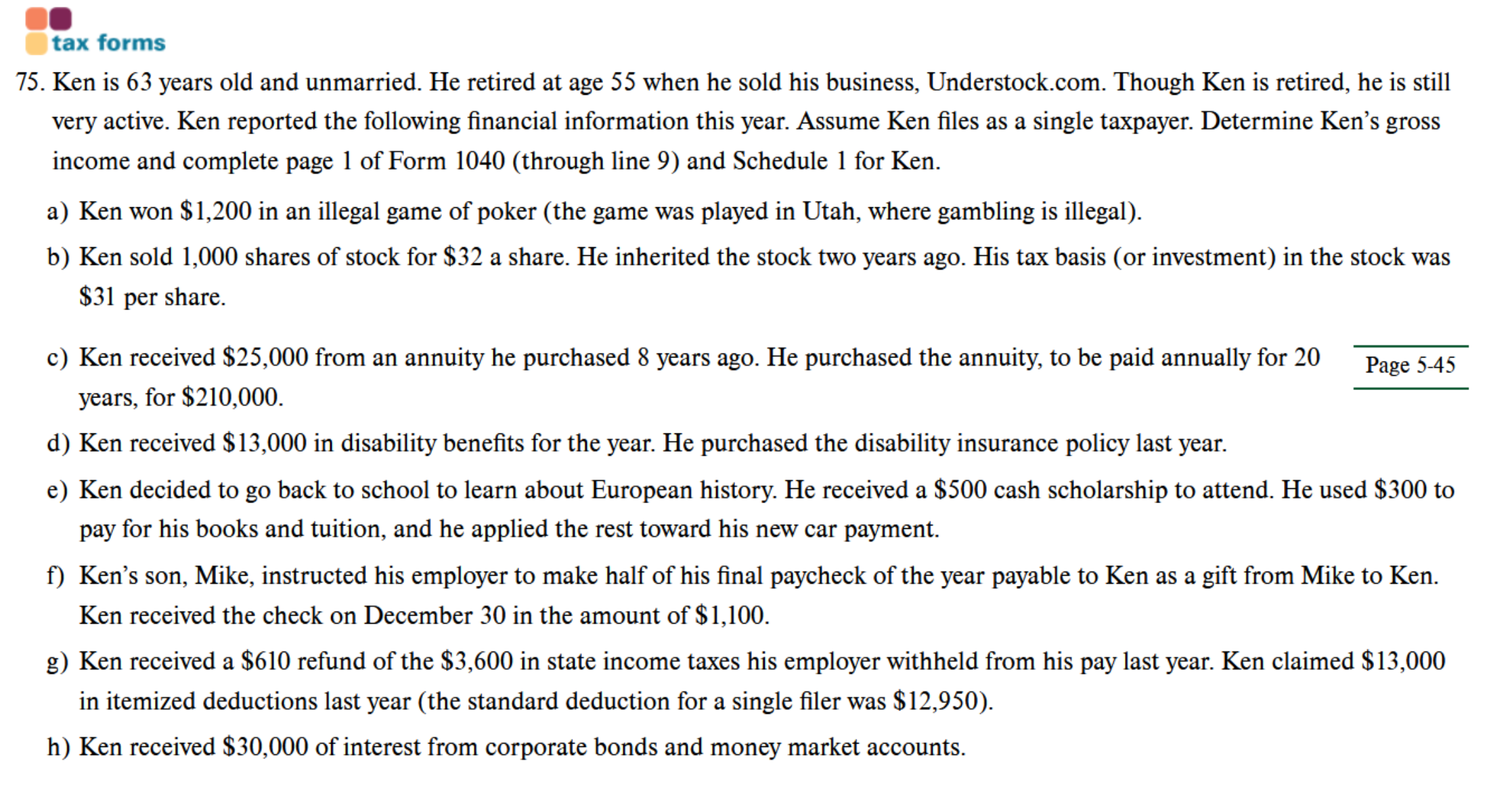

75. Ken is 63 years old and unmarried. He retired at

A 55 year old recently receied a $30,000 distribution from a pervious employer's 401 k plan minus $6.006 wathholding. To determine the federal taxes that apply to the $30,000 distribution from the 401k plan, we need to consider that the $6,000 withholding has. If the individual took the. A 55 year old recently received a $30,000 distribution from a previous.

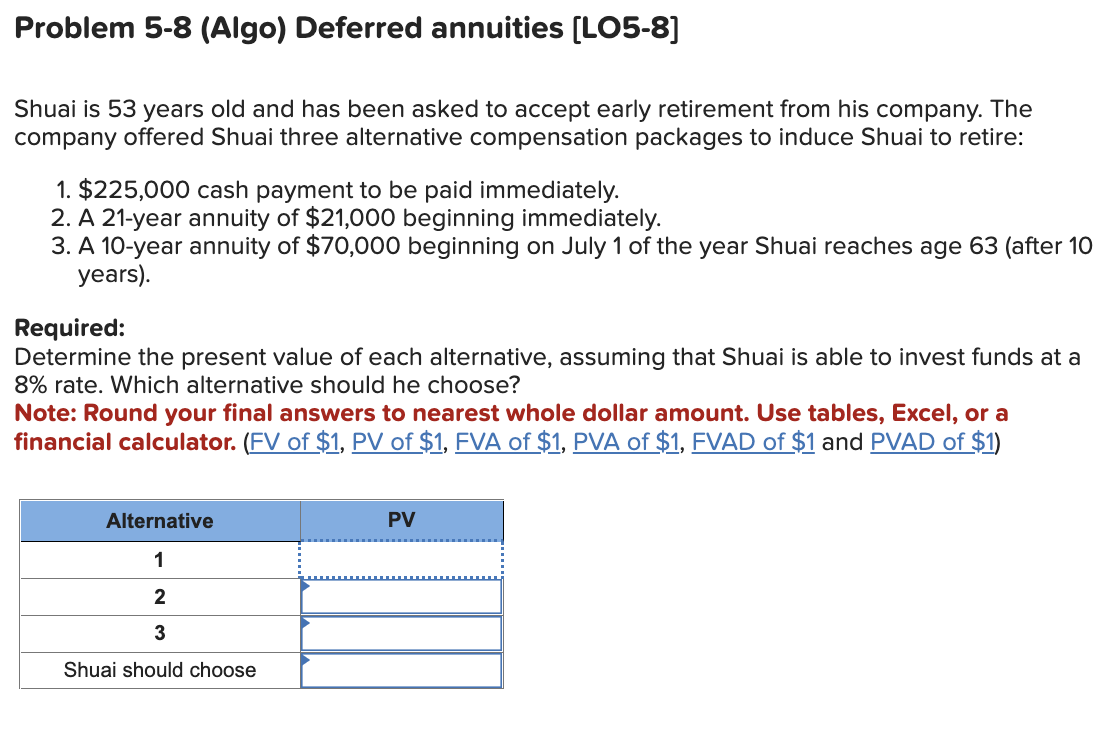

Solved Shuai is 53 years old and has been asked to accept

A 55 year old recently received a $30,000 distribution from a previous employer's 401k plan, minus $6,000 for income tax. To determine the federal taxes that apply to the $30,000 distribution from the 401k plan, we need to consider that the $6,000 withholding has. Since you took the withdrawal earlier than you reached age 59 1/2, unless you met one.

Standard Deduction For 2024 Head Of Household Salary Janel Lezlie

A 55 year old recently received a $30,000 distribution from a previous employer's 401k plan, minus $6,000 for income tax. A 55 year old recently received a $30,000 distribution from a previous employer's 401k plan, minus $6,000 for income tax withholding. To determine the federal taxes that apply to the $30,000 distribution from the 401k plan, we need to consider.

A 55 Year Old Recently Received A $30,000 Distribution From A Previous Employer's 401K Plan, Minus $6,000 For Income Tax Withholding.

Since you took the withdrawal earlier than you reached age 59 1/2, unless you met one of the exceptions, you will need to pay. A 55 year old recently receied a $30,000 distribution from a pervious employer's 401 k plan minus $6.006 wathholding. To determine the federal taxes that apply to the $30,000 distribution from the 401k plan, we need to consider that the $6,000 withholding has. A 55 year old recently received a $30,000 distribution from a previous employer's 401k plan, minus $6,000 for income tax.

If The Individual Took The.

Study with quizlet and memorize flashcards containing terms like a 55 year old recently received a $30,000 distribution from a previous.