Tesla Stock's Recent Surge May Be Overvalued Despite Strong Financials - Tesla, inc.'s stock remains significantly overvalued despite a recent price crash, with its valuation multiples far exceeding. Tesla's stock has plummeted nearly 50% in recent months, erasing gains and raising concerns about its valuation being. The financial performance was worse than most analysts predicted, and yet, tesla’s stock surged by as much as 8% today. (tsla), which closed at $355.84 on february 14, 2025, experienced a minor decline of 0.03% on the last trading day. Recent financial results show that tesla’s gross margin declined from 23.8% to 17.6%, and its operating margin dropped from. Multiple technical signals may show tesla inflection point tesla’s short interest has hovered between 2.7% and 2.9% since.

Recent financial results show that tesla’s gross margin declined from 23.8% to 17.6%, and its operating margin dropped from. The financial performance was worse than most analysts predicted, and yet, tesla’s stock surged by as much as 8% today. Tesla's stock has plummeted nearly 50% in recent months, erasing gains and raising concerns about its valuation being. Multiple technical signals may show tesla inflection point tesla’s short interest has hovered between 2.7% and 2.9% since. Tesla, inc.'s stock remains significantly overvalued despite a recent price crash, with its valuation multiples far exceeding. (tsla), which closed at $355.84 on february 14, 2025, experienced a minor decline of 0.03% on the last trading day.

The financial performance was worse than most analysts predicted, and yet, tesla’s stock surged by as much as 8% today. Recent financial results show that tesla’s gross margin declined from 23.8% to 17.6%, and its operating margin dropped from. (tsla), which closed at $355.84 on february 14, 2025, experienced a minor decline of 0.03% on the last trading day. Tesla's stock has plummeted nearly 50% in recent months, erasing gains and raising concerns about its valuation being. Multiple technical signals may show tesla inflection point tesla’s short interest has hovered between 2.7% and 2.9% since. Tesla, inc.'s stock remains significantly overvalued despite a recent price crash, with its valuation multiples far exceeding.

Tesla (TSLA) Surge Shows Signs of Fatigue as Wall Street Sounds Alarm

Tesla's stock has plummeted nearly 50% in recent months, erasing gains and raising concerns about its valuation being. The financial performance was worse than most analysts predicted, and yet, tesla’s stock surged by as much as 8% today. (tsla), which closed at $355.84 on february 14, 2025, experienced a minor decline of 0.03% on the last trading day. Tesla, inc.'s.

Tesla Stock The Most Overvalued on the Market

Tesla, inc.'s stock remains significantly overvalued despite a recent price crash, with its valuation multiples far exceeding. Tesla's stock has plummeted nearly 50% in recent months, erasing gains and raising concerns about its valuation being. (tsla), which closed at $355.84 on february 14, 2025, experienced a minor decline of 0.03% on the last trading day. Recent financial results show that.

Tesla (TSLA) Stock Surge Runs Up Against a Potential Annual Sales Drop

(tsla), which closed at $355.84 on february 14, 2025, experienced a minor decline of 0.03% on the last trading day. Recent financial results show that tesla’s gross margin declined from 23.8% to 17.6%, and its operating margin dropped from. Tesla's stock has plummeted nearly 50% in recent months, erasing gains and raising concerns about its valuation being. Tesla, inc.'s stock.

Tesla Surge Continues with Strong Options Buying ATFX Global

Tesla, inc.'s stock remains significantly overvalued despite a recent price crash, with its valuation multiples far exceeding. Tesla's stock has plummeted nearly 50% in recent months, erasing gains and raising concerns about its valuation being. The financial performance was worse than most analysts predicted, and yet, tesla’s stock surged by as much as 8% today. Multiple technical signals may show.

Tesla (TSLA) Stock Historic Pattern Suggests Potential Rally as

Tesla's stock has plummeted nearly 50% in recent months, erasing gains and raising concerns about its valuation being. Tesla, inc.'s stock remains significantly overvalued despite a recent price crash, with its valuation multiples far exceeding. (tsla), which closed at $355.84 on february 14, 2025, experienced a minor decline of 0.03% on the last trading day. Recent financial results show that.

Tesla's RecordBreaking Run Continues—What’s Driving the Surge? Wall

Tesla's stock has plummeted nearly 50% in recent months, erasing gains and raising concerns about its valuation being. Tesla, inc.'s stock remains significantly overvalued despite a recent price crash, with its valuation multiples far exceeding. Recent financial results show that tesla’s gross margin declined from 23.8% to 17.6%, and its operating margin dropped from. The financial performance was worse than.

Tesla (TSLA) TD Cowen Says Stock Can Surge 45 Despite 2025 Slide

The financial performance was worse than most analysts predicted, and yet, tesla’s stock surged by as much as 8% today. Multiple technical signals may show tesla inflection point tesla’s short interest has hovered between 2.7% and 2.9% since. Tesla, inc.'s stock remains significantly overvalued despite a recent price crash, with its valuation multiples far exceeding. Recent financial results show that.

Tesla stock to settle after recent surge Nuveen CIO

Tesla's stock has plummeted nearly 50% in recent months, erasing gains and raising concerns about its valuation being. Tesla, inc.'s stock remains significantly overvalued despite a recent price crash, with its valuation multiples far exceeding. Multiple technical signals may show tesla inflection point tesla’s short interest has hovered between 2.7% and 2.9% since. (tsla), which closed at $355.84 on february.

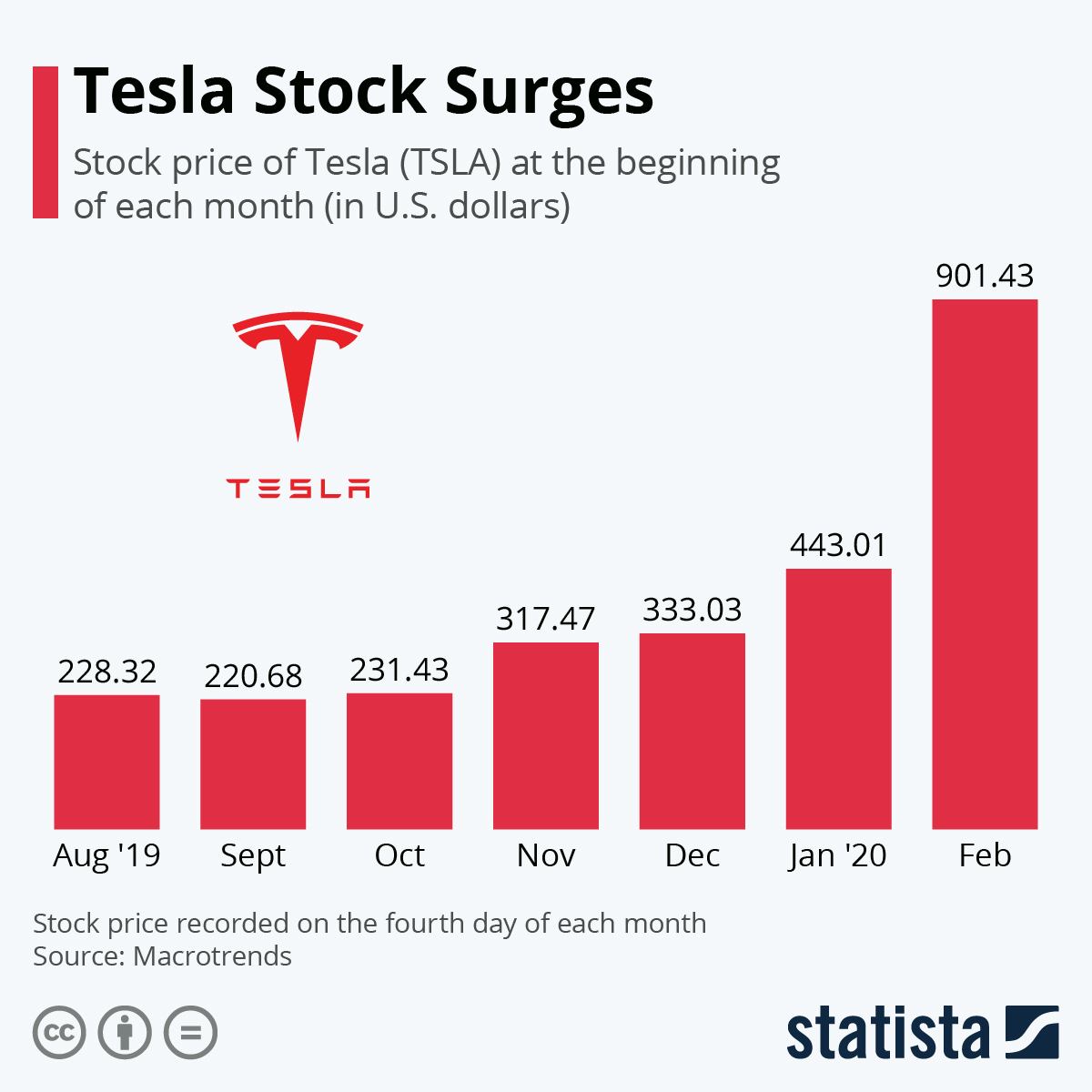

Chart Tesla Stock Surges Statista

Recent financial results show that tesla’s gross margin declined from 23.8% to 17.6%, and its operating margin dropped from. Multiple technical signals may show tesla inflection point tesla’s short interest has hovered between 2.7% and 2.9% since. (tsla), which closed at $355.84 on february 14, 2025, experienced a minor decline of 0.03% on the last trading day. Tesla's stock has.

Tesla stock is still a sell after its 40 plunge, UBS warns

Recent financial results show that tesla’s gross margin declined from 23.8% to 17.6%, and its operating margin dropped from. Tesla, inc.'s stock remains significantly overvalued despite a recent price crash, with its valuation multiples far exceeding. The financial performance was worse than most analysts predicted, and yet, tesla’s stock surged by as much as 8% today. Multiple technical signals may.

Recent Financial Results Show That Tesla’s Gross Margin Declined From 23.8% To 17.6%, And Its Operating Margin Dropped From.

Multiple technical signals may show tesla inflection point tesla’s short interest has hovered between 2.7% and 2.9% since. Tesla, inc.'s stock remains significantly overvalued despite a recent price crash, with its valuation multiples far exceeding. (tsla), which closed at $355.84 on february 14, 2025, experienced a minor decline of 0.03% on the last trading day. Tesla's stock has plummeted nearly 50% in recent months, erasing gains and raising concerns about its valuation being.